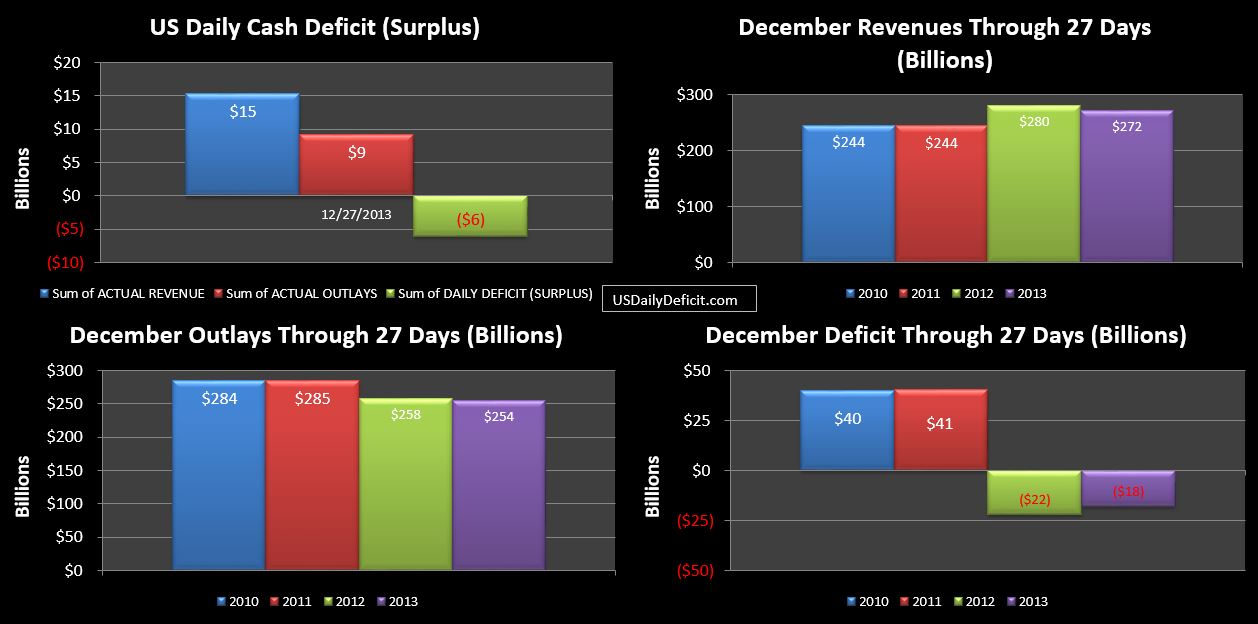

The US Daily Cash Surplus for Friday 11/27/2013 was $6.1B bringing the December 2013 surplus through 27 days to $18B and likely headed to $50B+ once Freddie Mac’s $30B New Year’s present is delivered tomorrow afternoon.

Taxes withheld are up 2% YOY, taxes non withheld are up 4%, and corporate taxes are up 4%. Not terrible numbers, but not good enough if your expectation is +10%. Overall revenues are down 3%….a number that will no doubt reverse once the Freddie check clears….which is fine, but don’t expect a repeat next year…or the next…or the next. Between Fannie and Freddie, we are looking at about $75B of phantom 2013 revenues…and that’s just related to the write up of their faux tax assets.

It looks like 2013 cash revenues are likely to come in at around $3.150T…inclusive of the $75B from Fannie/Freddie write up of deferred tax assets. I’m assuming that wad is spent….and will not repeat in 2014. Now…just for revenue to get back to break even for 2014, you need 2.4% across the board growth….which is more or less what the economy is supposedly growing at. Clearly…anything is possible, and I missed this by about $200B last year, but I’m quite skeptical we get anywhere close to 10% YOY revenue growth in 2014.