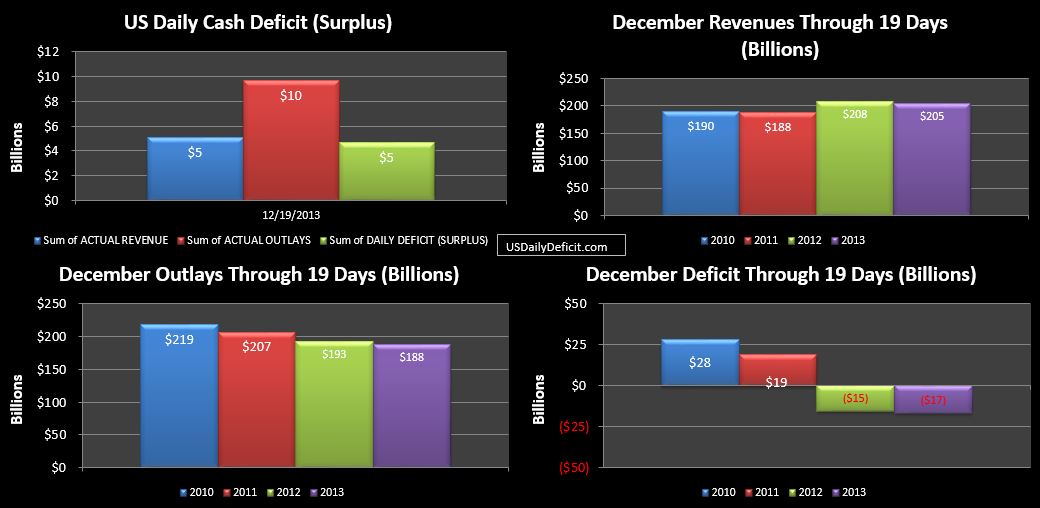

The US Daily Cash Deficit for 12/19/2013 was $4.7B bringing the December 2013 surplus through 19 days to $17B.

The main story continues to be that revenues look low….here in 2013, we have come to expect revenue gains of 10%+ each month…yet here we are with only 7 business days left sitting at -2% vs 2012. What I suspect is happening is a preview of what we may see all of next year…You see, looking back a year, everybody was running around worried about the fiscal cliff…a part of which was taxes being raised effective 1/1/2013. So of course…tax accountants were working into the wee hours of the night in excel trying to figure out the optimum year end tax moves. For many…generally corporations (remember those “special” dividends) and the wealthy…it made a lot of sense to take gains in 2012…and therefore paying taxes in either late 2012 or early 2013. This created a “surge” in revenues that started in 12/2012.

Now…that’s a good thing…but the problem is…it’s one thing to post +10% YOY gains once due to a one time event or change in tax rates ect….you get that one time boost to a higher steady state. But then…12 months later…it becomes very difficult to get another 10% gain on top of the first 10%. It’s kind of like getting a promotion in corporate America….you get that nice one time boost…but come Jan 1, you’re back to that same o’l 1% raise everybody else gets. This is more or less what I am expecting for 2014…somewhere around 4-6% growth, though it wouldn’t surprise me if it comes in lower.

Back to December…every day that passes without closing the gap makes it less likely that it will happen. I still expect revenues to end up YOY positive, we do have an extra day after all, but the window for a late month surge is shrinking….