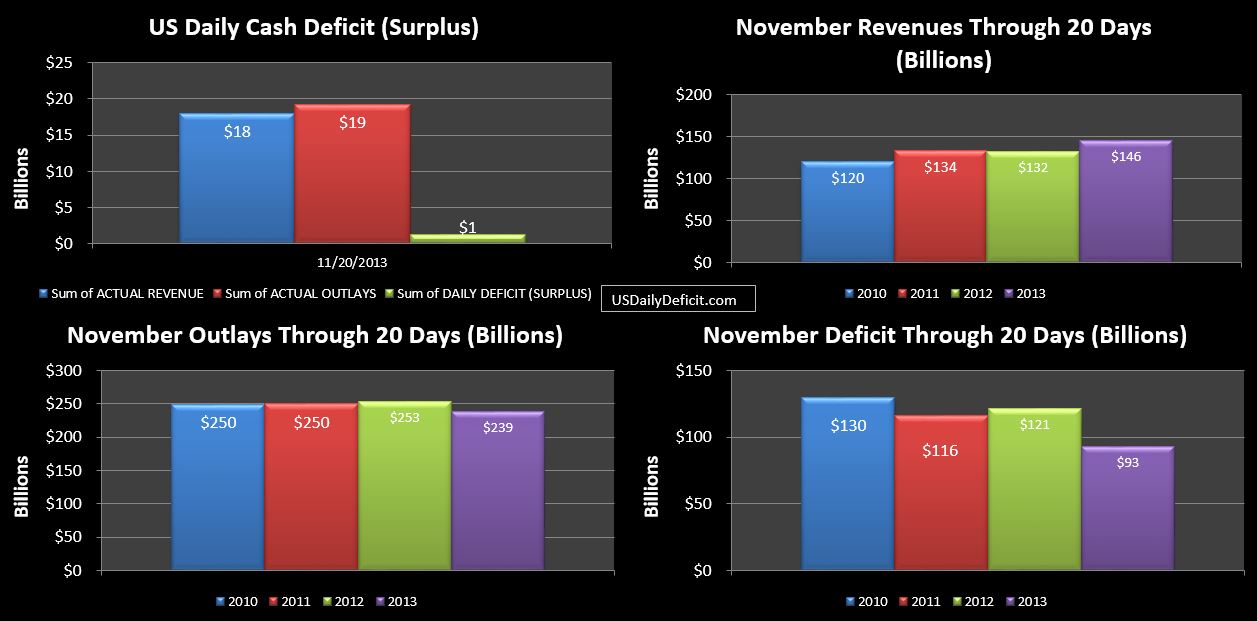

The US Daily Cash Deficit for Wednesday 11/20/2013 was $1.2B as strong SS outlays were offset by a surprise (to me) cash infusion from TARP in the amount of $6.1B. TARP assets still on the books as of the beginning of the month were about $22B and are being slowly liquidated (for cash) at a rate of about $2B per month lately…which is what my estimate was. So….I’ll go back to the drawing board…this will result in $6B of revenues I clearly was not anticipating, which will reduce the current period cash deficit accordingly. However…in the big scheme of things, all this does is pull forward “revenue” that I had expected in future months….so it basically nets to zero.

Still…thanks to that $6B, we got pretty close to posting a surplus on a day we typically would expect have a $5-10B deficit….so clearly more good news. While this is not a sustainable source of revenues (the $14B remaining balance will be exhausted before too long), we are now at +14B and +10% on revenues YOY with six business days remaining. If we stay on trend (anything but certain) it would appear that we could end the month with a deficit under $150B vs the $160B I had initially predicted, but you never really know until the books are closed.