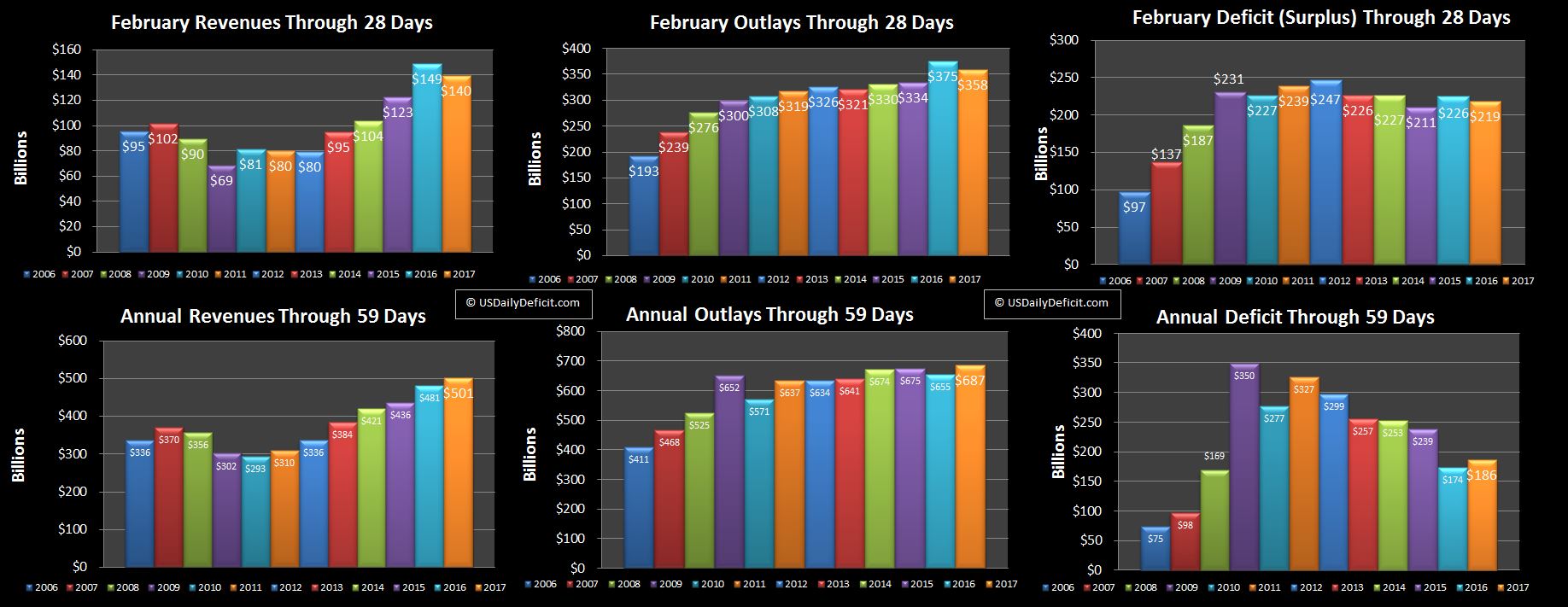

The US Cash Deficit for February 2017 came in at $219B wiping out January’s small surplus and bringing the YTD cash deficit through 2 months to $186B.

Revenue:

Revenue was down 9B from last year which in itself isn’t surprising given that last February had an extra day and favorable timing. What is surprising is that the year over year was down despite refunds being down by $20B. Taking a step back February is generally the largest month for refunds in the year, and I account for refunds as a reduction in revenue rather than an expense/outlay. So looking at February 2016, traditional revenues were $283B, but were reduced to $149B by $134B of refunds. February 2017 posted only $253B of traditional revenues but refunds were only 113B, so total revenue came in at $140B….a $9B miss rather than a $30B miss. So the big question is…will tax refunds be lower this year…or were they simply delayed…and we will see a ~$20B increase in March. From what I have read there was a ~2 week delay in the earned income tax credit processing this year, so there is good reason to believe that this is primarily just timing…. we should have a better idea in a few weeks.

Either way revenue for February looks weak and the YTD $20B lead 2017 has over 2016 may be attributable to the timing of tax refunds….meaning that we could be looking at flat YOY revenue numbers by the end of March. That reminds me…I really need to start working on my taxes!!

Outlays:

Outlays were down $17B compared to last February with most of the reduction coming in the “other” category which was pretty high at $31B last year compared to only $16B in 2017. It looks like there was a $15B payment to the IMF last year that spiked “other” that did not repeat in 2017….so hooray for that!!! Still, looking at the YTD, outlays are up 5% over last year…running strong but still looking better than last month when some timing issues went against us. With any luck we will be trending down to the 3%-4% range as we get further into the year and the one time issues become a smaller % of the population and the overall trends start to show themselves.

Deficit:

The monthly deficit of $219B was a slight improvement over last year’s $226B, but as noted it looks like this is only because of the delay in tax refunds. For the year the deficit is at $186B, $12B over 2016 through 2 months.

Forecast:

Last March ran a $100B deficit, and that’s about the ballpark we would probably be this year, but we need to make a few adjustments to account for timing. First, I am going to assume the $20B of tax refunds we didn’t see in February simply slide right into March. Second, April 1 is on a Saturday, which means a lot of outlays due on the first are going to get paid a day early, on 3/31…which is going to add around $40B. There is one “good guy”…seems like Fannie/Freddie dividends may be as high a $10B this quarter compared to less than $3B last March.Add it all up and I have the March 2017 cash deficit forecast at $144B with most of the variance being due to timing. Of course March’s loss is April’s gain…April would have posted a large surplus anyway, but by dumping $40B of cost into March, we may see a $200B cash surplus come April…

Summary:

The year is early and the data is noisy, but with 2 months in the bank revenues are up 4% and outlays are up 5%. I don’t think either of those numbers will hold, but either way it is looking like the deficit is headed back up in 2017…and this before any material policy change by the new administration. Forecasting any of that would be a fools errand, so for now I am holding everything steady…the 2017 deficit looks to be on a trajectory to surpass 2016, but it is a bit early to give up all hope. For now, I’m staying focused on refunds…if there is anything interesting I’ll try to get in a mid month update…my first in quite a while.