I’ve been digging into the April “Surge” in revenues, and while unfortunately we won’t know if I am right until next April, here is my working thesis….

I probably said it a dozen times during April….the surge was primarily in the category “Tax deposits not withheld”, and this is likely the key to understanding what happened. I don’t have the numbers in front of me to prove this, but I think it is a pretty safe assumption that most of these tax deposits are made by the wealthy…let’s say top 5%. Most of the population…myself included, pay almost all our taxes through payroll withholding. Throughout the year, using IRS tables and information provided by the employee, a certain amount is withheld by the employer for FICA and income taxes. Then, after the year end, you plug your actuals into turbo tax, and probably get a refund of a few thousand bucks. These fall into “taxes withheld”…obviously because they are withheld by your employer and remitted to Uncle Sam on your behalf.

Taxes not withheld are a completely different animal. Say you own a small business, or daytrade, or own some timberland. You don’t have an employer to withhold your taxes….in fact, depending on your quarter, maybe you have a ton of income, or no income at all. So…your accountant will instead, about every quarter take a look at your books, and send enough $ to Uncle Sam to keep him off of your back until the next quarter. In one quarter, maybe you sell $1M of timber that took 30 years to grow….your accountant better send in a few hundred thousand. Unless…that is you had some day trades go bad, and also lost $500k.

So back to my hypothesis. There was a lot of speculation running up to the end of 2012 that people would be making a lot of year end tax moves to shift income into 2012 before tax rates went up in 2013. There are a lot of ways to do this, but the simplest one looks to me like the capital gains tax…which went from 15% to 23.8% (includes a new medicare surcharge of 3.8%) for those making over $400k per year.

So imagine you fall into this category, and had purchased a lot of stocks near the bottoms in 2009. It is near the end of 2012, and those gains of ~100% or so are sitting on your books…untaxed. Taxes are going to jump from 15% to 23.8% in a few days…what do you do? Simple….you sell them all…take your 15% lump….realizing that’s the best it’s probably ever going to get, and it could very well get a lot worse from here… You set aside enough to pay your taxes…then the very next day, if you are so inclined, you buy them all back.

Thus….you recognize all of your gains to date in 2012 at the 15% rate, and establish a new basis in your stocks at much higher 2012 prices. Then, as April 2013 rolls around, your accountant sends a very large check to Uncle Sam, who books it as Tax Deposits not withheld. YOY, we saw this category increase by about $56B…let’s divide that by the rate-15%, and we can see that perhaps as much as $375B of capital gains were taken in Q4-2012 to take advantage of the expiring 15% rates.

Obviously, this resulted in a blowout month.. good for us.. (bad for my forecasting record) But, if this is indeed what happened, we should then be extremely cautious about working this one month anomaly into our 10 year forecast because not only will it not repeat itself, we could actually witness a decline in revenues next year (April)…not cool if you were expecting exponential growth in the 11-12% range like the CBO.

So for now, it’s just a matter of sitting back and watching the daily numbers roll in. June and September are the next two months with material “not withheld” revenues…each should be in the $60B range, compared to April’s $196B. What we are looking for is YOY growth. 10-15% or so would be more or less in line with a surging stock market and higher tax rates. Anything close to the 40% YOY growth we saw in April would send me back to the drawing board, and possibly making some large revisions to my own 10 year forecast.

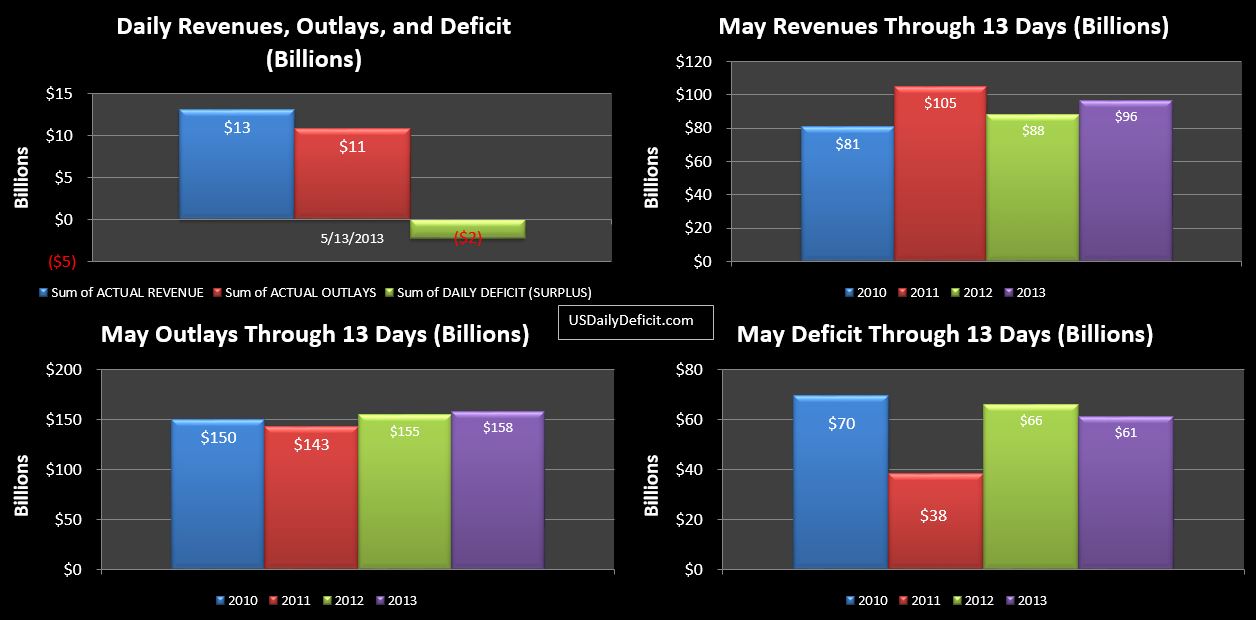

The US Cash Deficit for Friday 5/10/2013 was $4.3B bringing the May deficit through 10 days to $63B. May 2013 vs 2012 still look more or less the same on all fronts, though some of this is timing related. We’ll get another more or less synchronized snapshot this Wednesday, then on Thursday we get to see a ~30B interest payment and some corporate taxes…small, but worth taking a look at.

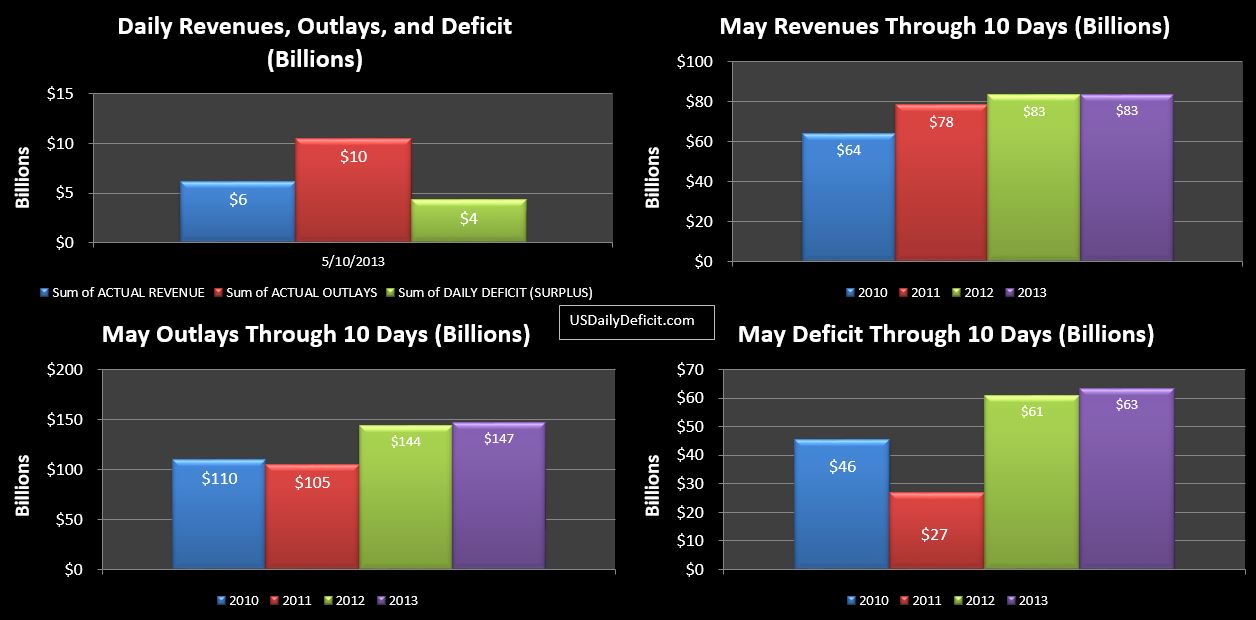

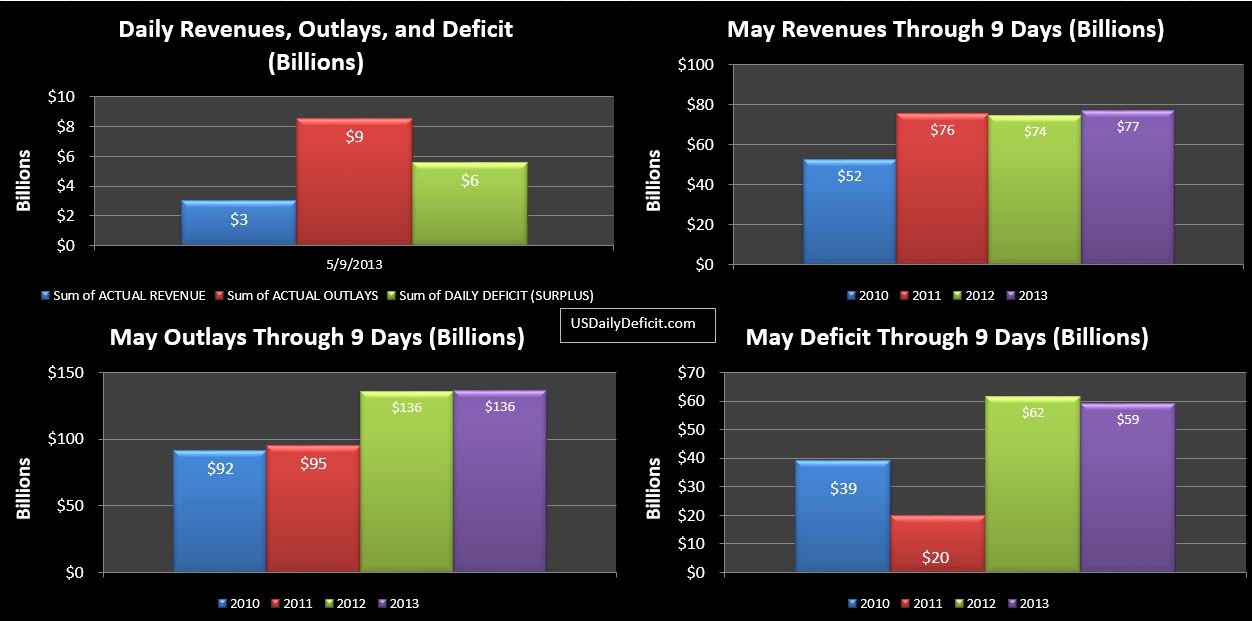

The US Daily Cash Deficit for 5/9/2013 was $5.6B bringing the May 2013 deficit through 9 days to $59B.

May 2012 and May 2013 are essentially the same YOY… a $6B increase in taxes withheld is being offset by decreases in taxes not withheld, unemployment deposits from the states, and federal reserve “earnings”.

A few weeks ago, I mentioned here that it looked like Treasury was stockpiling cash in preparation for the upcoming debt limit showdown…they had issued debt despite the huge April surplus, accumulating nearly $214B in cash as of 4/30….a two year high. Since then…cash has dwindled back down to $97B due to the cash deficit over that time, and a net paydown of external debt of $56B..including $31B yesterday. So…whatever the reason…it no longer appears like they are going to try and hit 5/19…the day the current infinite limit expires with a huge cash balance in the $200-$300B range…though if they are going to, they still have a week to make it happen.

Finally…just for fun since I completely missed last month…I’m going to guess the May deficit comes in at $140B…just topping last year’s May deficit of $136B. Revenue will be up 10% or so, but with 6/1 on a weekend, we’ll see $20B or so of extra cost hit 5/31 pushing the deficit up for May, but being offset in June, which very well could post a surplus.

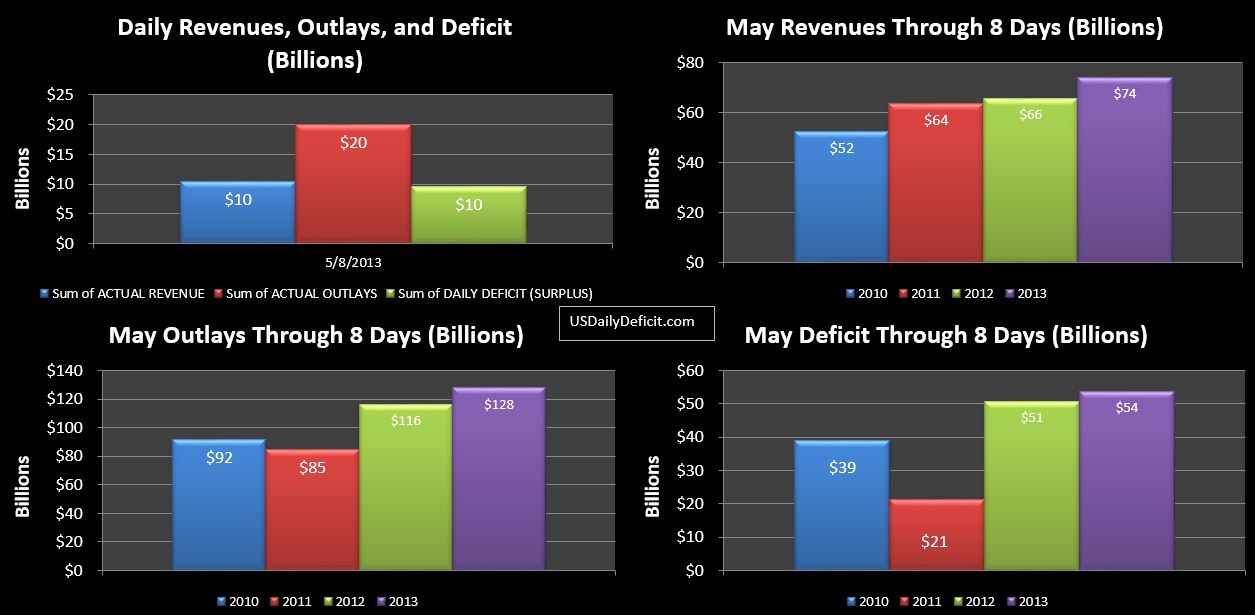

The US Daily Cash Deficit for 5/8/2013 was $9.6B bringing the deficit through 8 days to $54B…edging ahead of last year…primarily related to timing….2012 is a day behind….lacking both strong Wednesday revenues and the Wednesday Social Security payment now included in the May 2013 population.