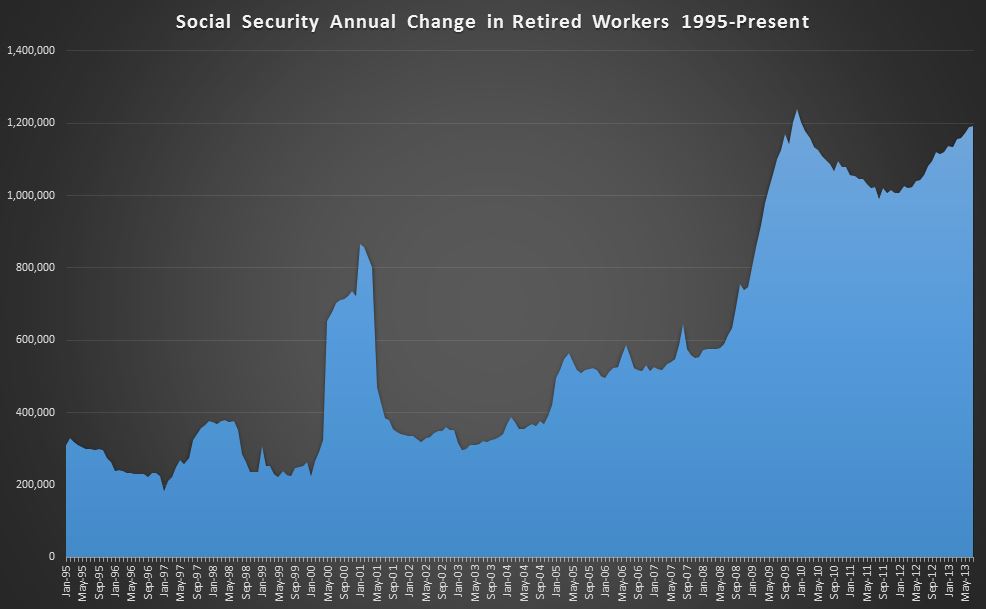

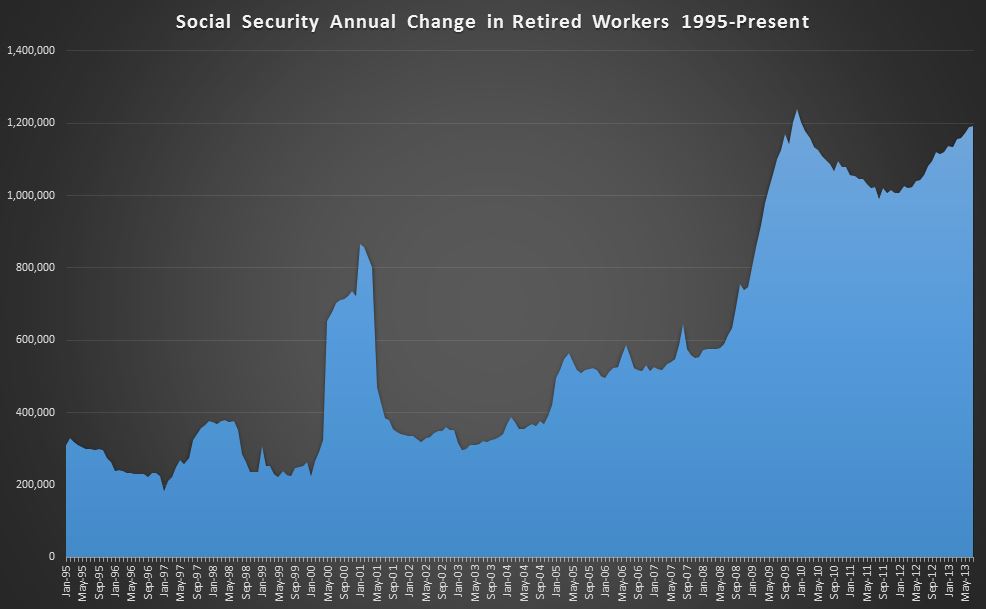

The Official July Social Security update was released this morning so I thought I’d take a look and give an update…here is my June update if you missed it.

The chart is largely unchanged. For July, we added 112k new retired workers to the population…I don’t have the data to confirm this, but generally…you are looking at about 300k new enrollees, being offset by ~200k deaths. Also note that additions seem to be driven seasonally with Jan being the highest month at +171k this year, and December being the lowest…59k in 12/2012. I don’t know if this is driven by retirement patterns or death rate patterns, I suppose it doesn’t really matter.

What we are really looking at then…is to compare July 2013 to July 2012. It turns out they are nearly identical…July 2012 had 110k of additions, so less than a 2% increase. This very may well be an anomaly…the last 4 months have averaged almost 17% YOY gains. With minimal YOY change…our TTM…charted above rises the 2k…from an annual rate of +1.190M to +1.192M

The average benefit rose $0.86 from $1269.38 to 1268.52. This sounds inconsequential, but it suggests to me that new retirees are on average coming in with higher monthly benefits, as much as $300 higher than the beneficiaries that are passing away. This could be driven largely by narrowing of the gender gap…both in labor force participation and pay. So just imagine that in a given month, a 95 year old female beneficiary passes, and a 65 year old female applies for benefits. With 30 years between them….they likely have very different work histories….and very different $ benefits. In this scenario, even though the count stays the same, the average could go up quite a bit. In the long run, we can likely expect the current $300 gender gap ($1425-male $1111-female) to close, and perhaps even reverse itself…and while this may be a good thing for society….it will add additional strain to social security. If the gap were eliminated today….monthly benefits would jump nearly$6B…$70B per year (or $700B over ten….which is how congress likes to digest it’s data)…all of course added directly to the deficit.

So bottom line, we are currently adding a net of nearly 1.2M people to the social security retirement rolls per year, a trend that should start ramping up over the next five years as we get into the meat of the boomers. This may be a slow motion trainwreck, but the end result is going to be just as ugly.