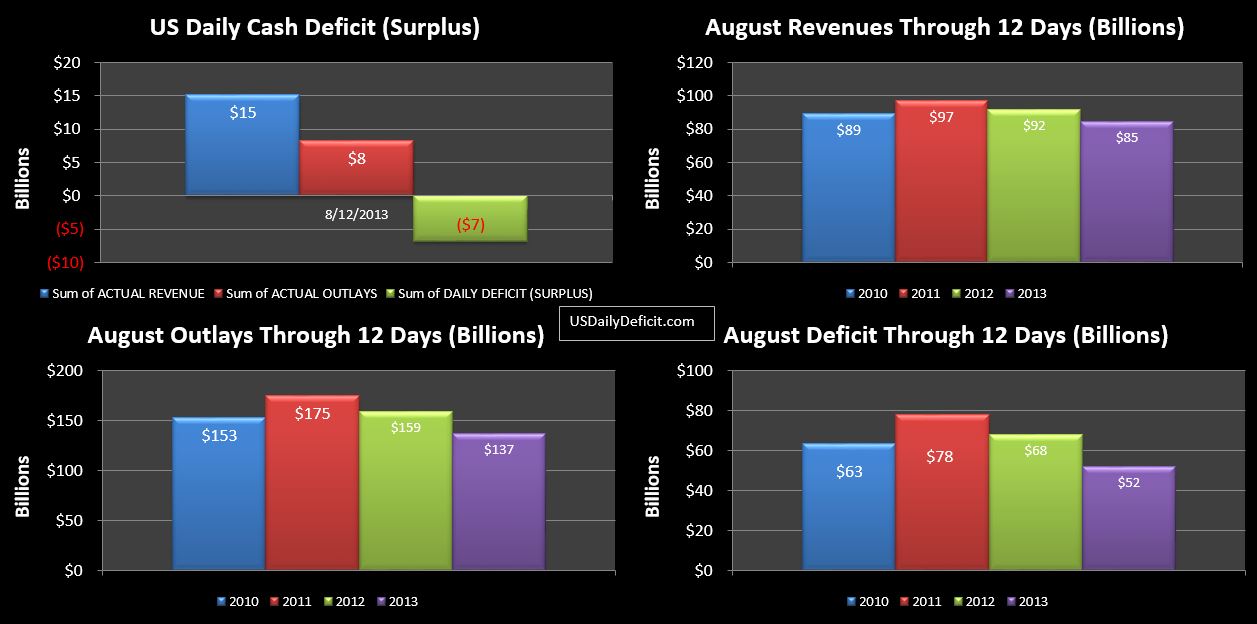

The US Cash Surplus for 8/12/2013 was $6.8B on typically strong Monday revenues including a $2B cash inflow from the IMF. No clue what that was for, but it helped the monthly revenues increase from $10B down to $7B down(vs Aug-2012)…with 14 business days to go. Just yesterday I said we needed to average $2B per day from here out to hit the +10%…so there you go. We’re saved right 🙂 $3B down, $27B to go.

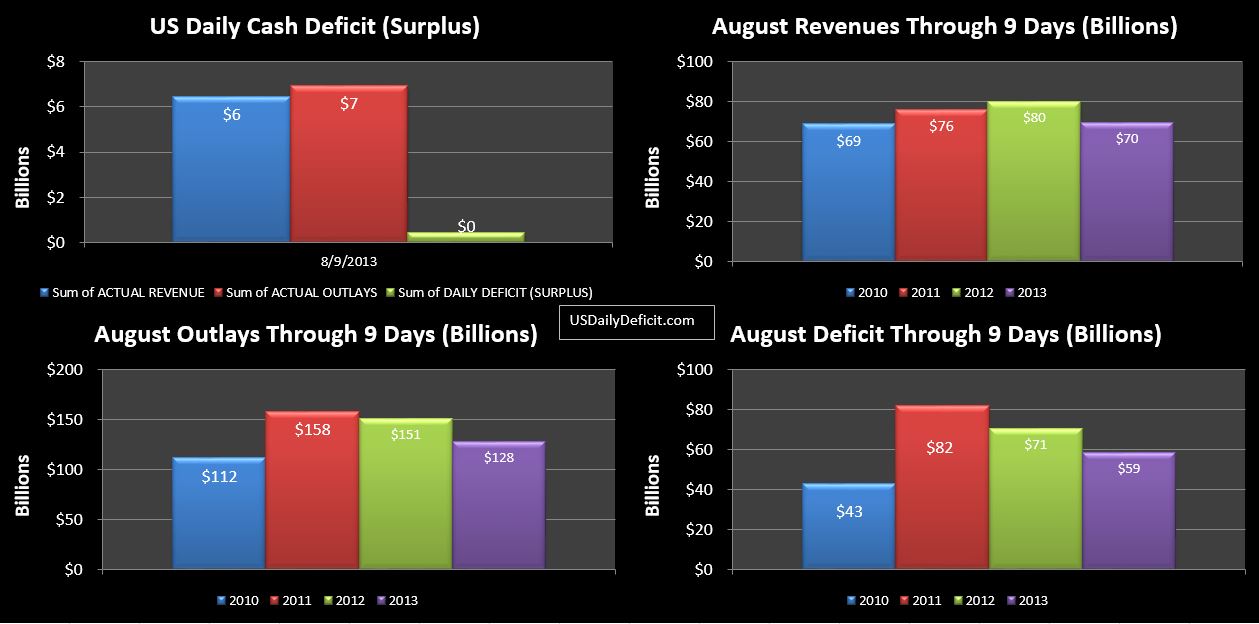

The US Cash Deficit for Friday 8/9/2013 was $0.5B bringing the August 2013 Cash Deficit through 9 days to $59B. With 15 business days remaining, we are $10B under where revenue was last year and need to get to +$20B to hit our 10% growth target….so $2B per day gain… I suppose it is possible, but looking less likely…stay tuned. So far this month no real surprises other than revenues being a bit weaker and outlays being a bit lighter than expected. I see no reason yet to alter my outlook for a $155B cash deficit to end the month.

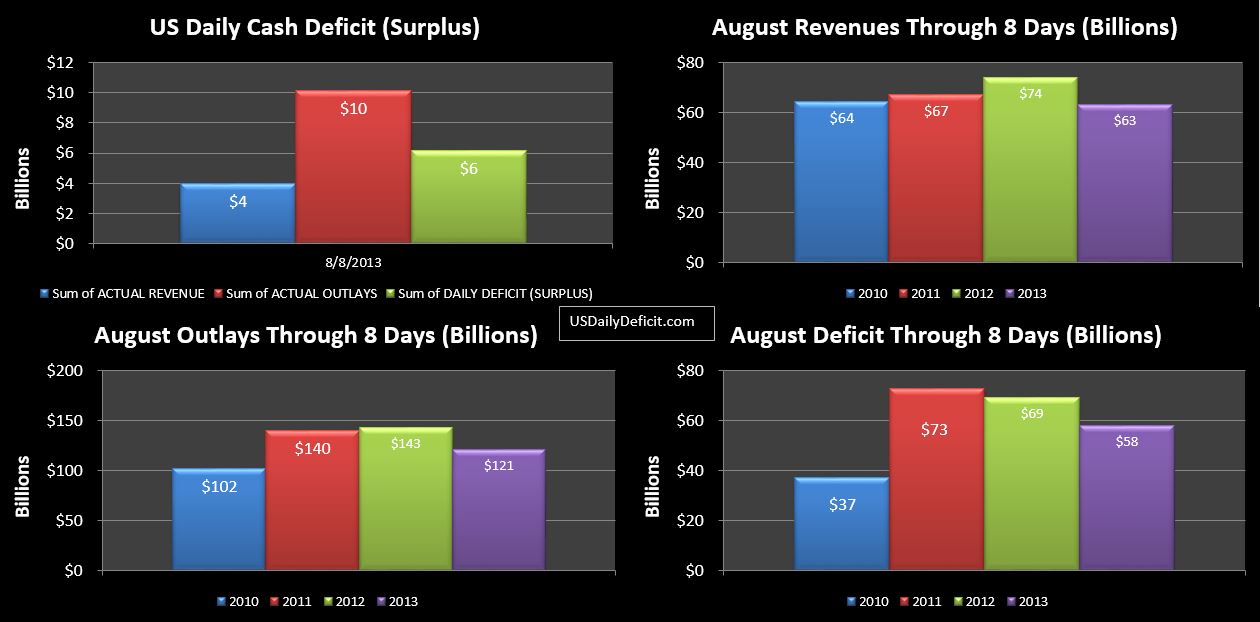

The US Cash Deficit for 8/8/2013 was $6.2 bringing the August 2013 deficit through 8 days to $58B. Nothing out of the ordinary here…stay tuned for next week when we should receive a few small revenue bumps on corporate and excise taxes, and large outlays with ~$30B of interest expense and the second round of social security. After almost no deficit this week, we will probably end next week around to $100B for the month with 2 weeks remaining.

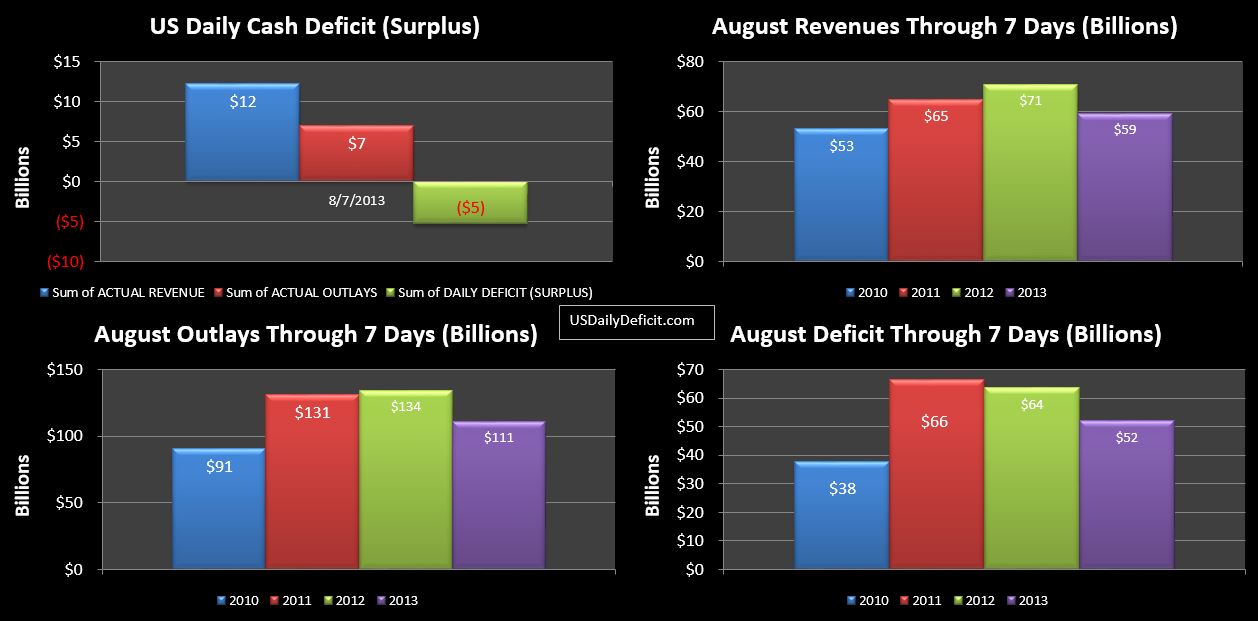

The Daily Cash Surplus for 8/7/2013 was $5.3B pushing the August 2013 deficit through one full week down to $52B.

Revenues lost a bit of ground today…last August about $9B of revenues came from TARP payoffs….we’ve been averaging only $2B per month in 2013, and it won’t be long before that gets down to zero. We are back to -$12B…we need to be at +$20B by the end of the month. We could get there…I haven’t crunched the numbers, but it does seem like compared to last year, the month’s seem to start out weak and end strong. I don’t know what could be behind the evolving pattern, but it is definitely something to keep in mind this early in the month.

Outlays appear to be down quite a bit, but $12B of that is related to the timing of SS payments…2013’s round two won’t go out until next Wednesday 8/14…last years went out 8/8 (which is included…as discussed in the 8/1 USDD). Other than that…there is one less day, and given the end of month timing, outlays for August 2013 should come in $40B or more under last year

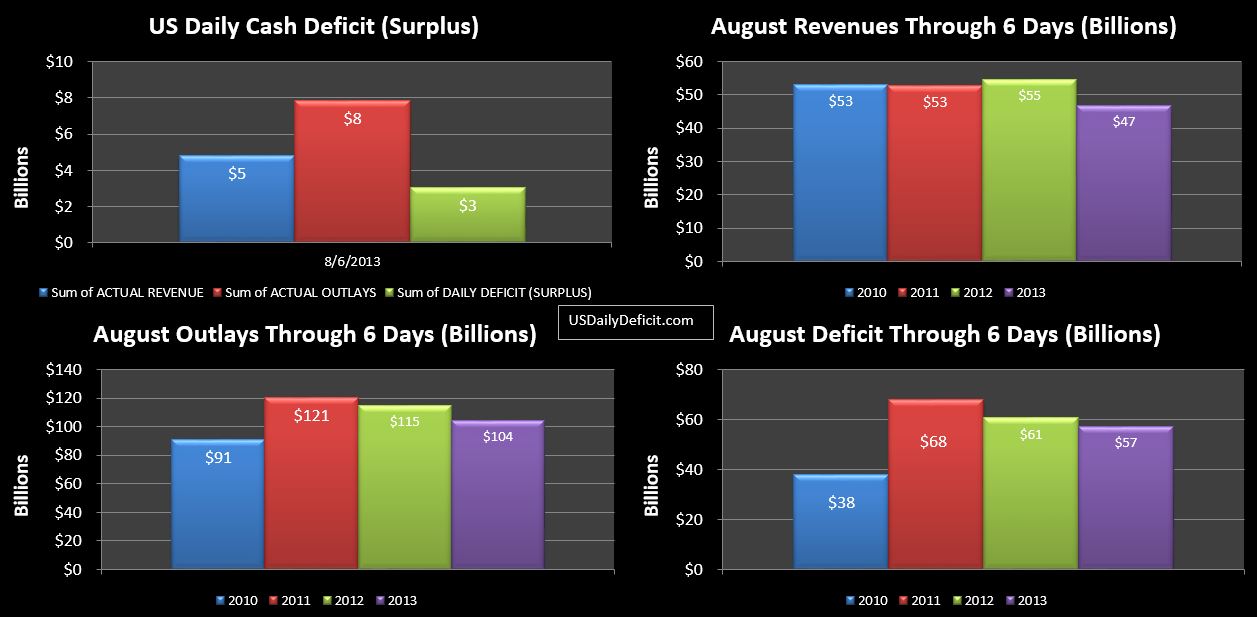

The Daily Cash Deficit for 8/6/2013 was $3.0B pushing the August 2013 deficit through 6 days to $57B. Nothing out of the ordinary…typically low cash revenues…like we usually see on Tuesdays and Thursdays with moderate outlays.

Compared to last year…the deficit is a bit lower and I expect it to stay that way. Aug 2012 went on to post a $211B deficit…I am only projecting $155B for this month on higher revenues, lower outlays, and timing.