The August Social Security monthly update came out last week, but I am just now getting a chance to look at the latest results. If you aren’t familiar with the report, basically, it gives us the number of participants in the Social Security program, both the Old Age and Disability portions of the program. It also gives us average monthly payouts per category, and some demographic male/female breakout.

So…in a given month, the given population changes in two ways. First, new people reach retirement age or become disabled, adding to the population. Second, retired workers pass away, or disabled workers recover and join the workforce. Just to frame it, the current population on Social Security is 57.554M or 18% of the total US population and the average monthly payout is $1,162 per month.

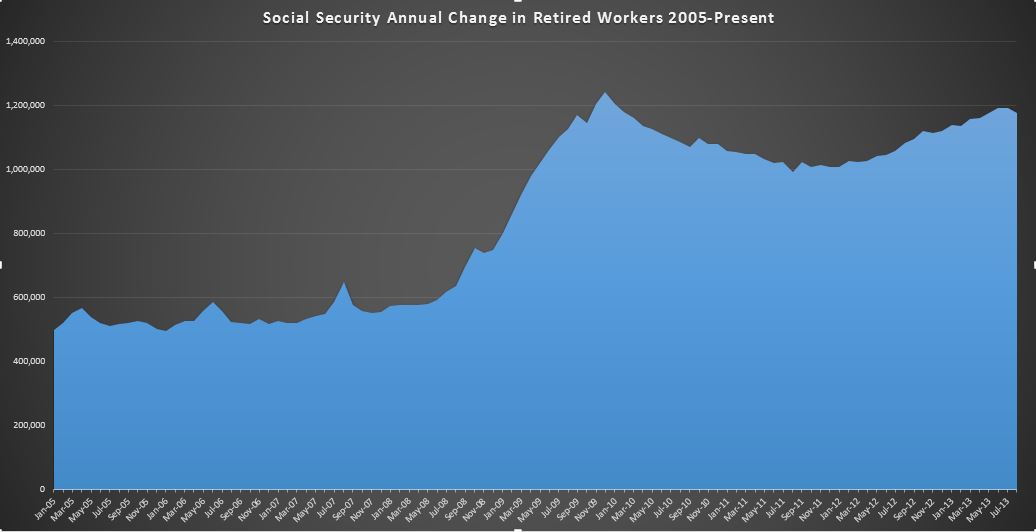

In my prior two posts on June and July, I focused primarily on the retired worker population…by far the largest at ~37M. To continue that analysis for August, the monthly change was an increase of 71k over the prior month ending up at 37.575M people compared to last months increase of 112k people. So great news right? Well…not exactly. See, there is a lot of seasonality involved, driven by retirement and death patterns that cause a lot of variation in rates over the year. December is generally the lowest, at 59k in 12/2012. January is typically the highest at 171k of additions in 1/2013. The rest of the months fall somewhere in between. So…rather than comparing the monthly change to the prior month…it is best to compare to the year ago delta.

August 2012 had an increase of 85k, so this is an actual improvement, bringing the TTM change down a hair from 1.191M to 1.177M, still within a stones throw of the December 2009 1.240M record. So despite the small improvement, we are still adding people to the program at nearly a record rate and this rate will almost certainly continue to trend up over the next decade as we get into the meat of the Boomer retirements.

This is the same chart we’ve seen in prior posts, but I’ve narrowed the range only showing 2005 to present. You can clearly see the 2005-2008 average of about 500k doubling during the great recession to the 12/2009 peak, trending down, and then back up to the current peak just under 1.2M per year rate. You can see the small dip at the end….I wouldn’t get excited about that yet…but we will keep an eye on it.

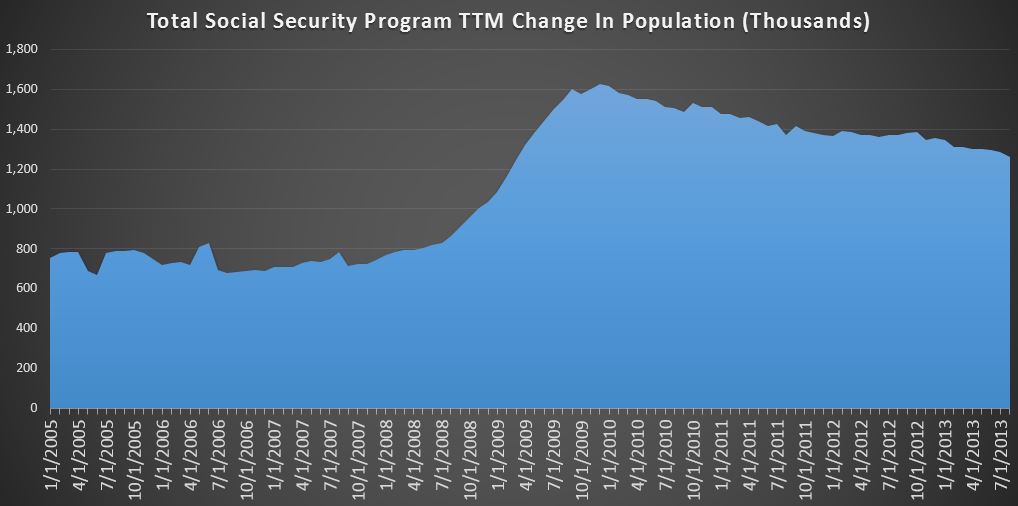

Now, lets take a step back and look at the entire population. It includes disability, currently at 8.9M and growing at about 12k per month over the last year, as well as various subcategories of spouses, widows, and children. The entire population grew 82k to 57.554M, down from the year ago increase of 103k. Lets take a look at the chart:

This chart looks a bit less menacing. After following the same trend up to 1.6M per year the rate is has steadily declined to around 1.26M per year. As it turns out…most of the other categories seem to have more or less stabilized, with retired workers, and to a lesser degree disabled workers being the only materially changing categories. Still… 3 years past the great recession, we are nowhere near to the normalized rates we saw leading up to 2008. Bottom line, the TTM cash cost of SS related programs was $710B over the last 12 months, and is growing at an annual rate of $60B. By the time the next president takes office in Jan. 2017, that annual rate will be around $922B. By Jan. 2021…it will be closer to $1.2T.

So…to wrap it all up, 85k added to the welfare rolls in August 2013. The overall rate slowly is declining…for now, but the annual add is still nearly twice the pre-recession rate, and likely to turn back up before too long as the Boomers keep retiring in droves. There is no happy ending here…it will just get worse and worse and worse until it is ultimately defaulted on with the rest of the debt.