I’m on vacation starting now returning 9/13/2013….yes Friday the 13th. As I mentioned in the 9/4/2013 Daily Deficit…it’s probably going to be a slow week…at least in regards to the cash deficit, and I’ll be back just in time to watch the quarterly tax receipts start pouring in…giving us one last hurrah before finally bumping up against the real debt limit of 16.699B(+$300B of governmental accounting shenanigans) in October.

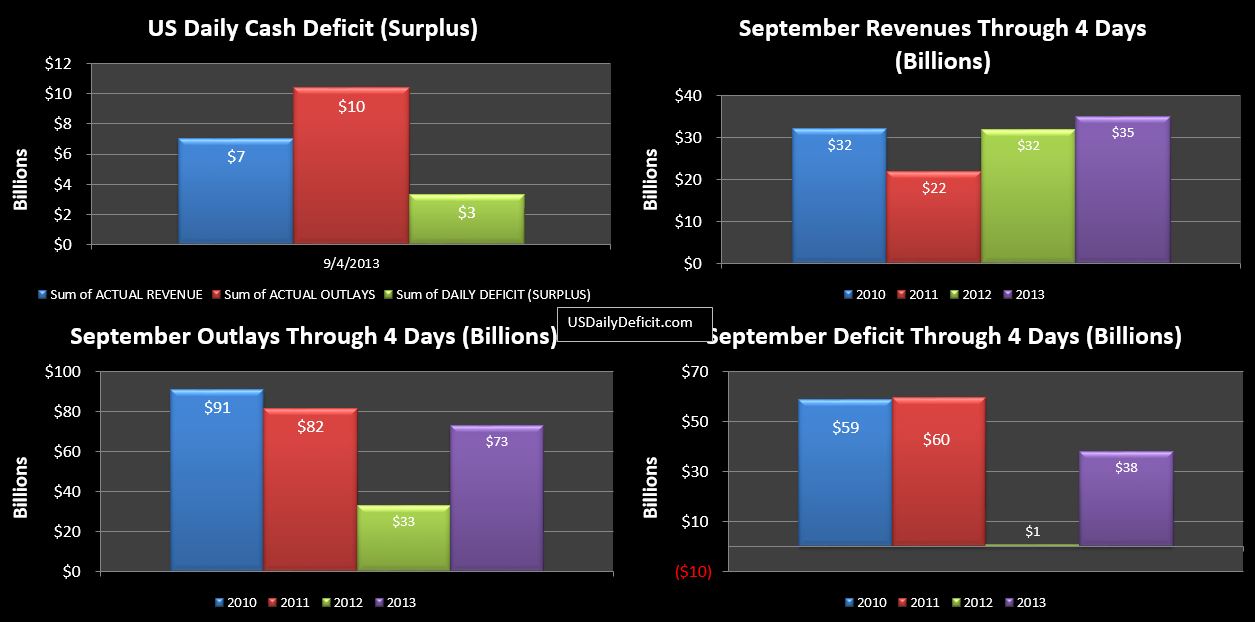

The US Daily Cash Deficit for 9/4/2013 was $3.3B pushing the September 2013 deficit through 4 days to $38B compared to just $3B over the comparable period in 2012. Revenues…up $4B yesterday YOY lose a bit of ground…are now at $+3B, a 10% YOY increase, but honestly, this early, there isn’t much predictive value with only 2 data points.

There really shouldn’t be much action over the next week…just moderate daily deficits with the occasional moderate surplus. We’ll probably hit next Thursday with an additional $15-20B of deficit, just say $55B. Then, Friday 9/14 and especially Monday 9/17, tax revenues will start pouring in. Last year over the similar 2 day period, we ran an 84B cash surplus …it will be very interesting to see how this year turns out.

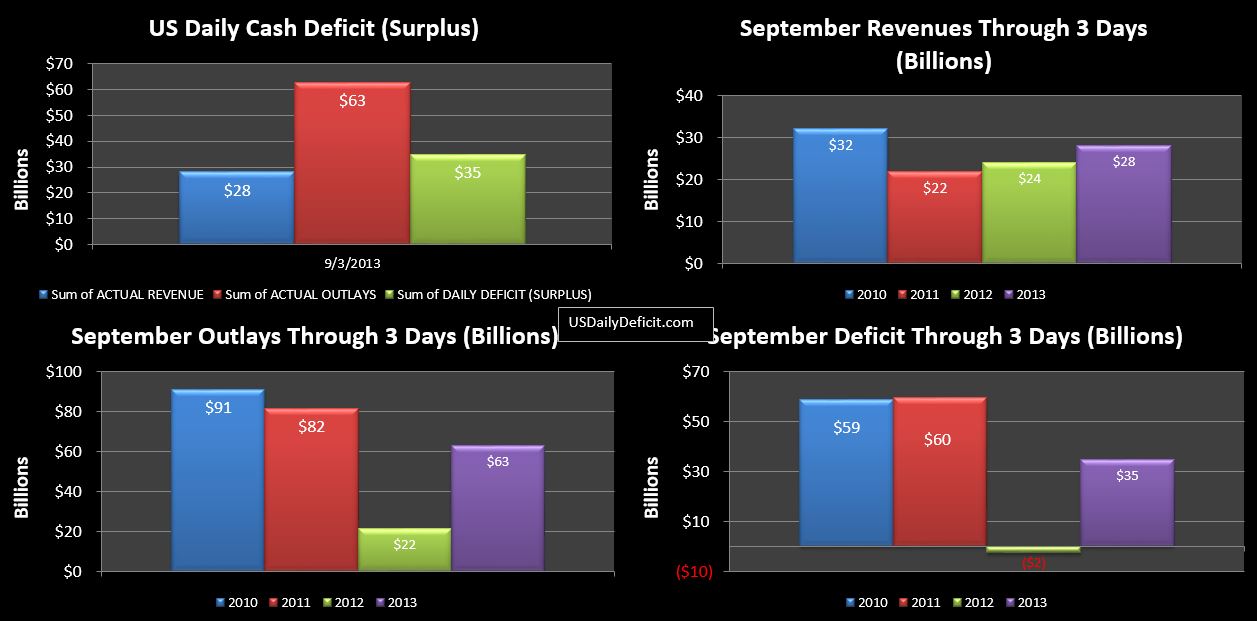

The US Daily Cash Deficit for 9/3/2013 was $34.7B starting off the month with a bang. The first round of SS payments went out at $24B, as did $6B of interest payments. This is all more or less in line with expectations…one down, 19 business days to go.

Revenues are a bright spot…kicking off the month at $+4B already, but honestly it is way too early to read too much into this.

The US Daily Cash deficit for 8/30/2013 was $36.5B bringing the August 2013 Cash deficit to $173B over the full month. This is a $38B improvement over last August at $211B, but after adjusting for about $25B of timing, it reflects a only moderate $13B improvement.

The story is all in revenues…up a meager $1B…less than 1% in a year that averaged 18% YOY increase over the first 6 months thanks to tax increases, moderate increases in employment, and of course, a $60B payday loan from Fannie Mae. Digging into the details…it wasn’t all gloom, tax deposits were actually up $8B…offset by an $8B decrease in TARP Receipts…an issue I detailed 9 months ago in We Won’t Miss TARP, But Uncle Sam Will. We’ll see this again in September as last year’s $23B of TARP revenue is likely to fall down to $1-2B or so.

Overall, I have to say this was clearly a disappointing month, but I’m not sure yet if the revenue slide is just an anomaly, or a bona fide shift in the trend. September should give us a pretty good idea which…especially the corporate tax deposits and the “taxes not withheld”. I’ll try to do a more detailed write up later in the month, but this will have to do for now…

While we await the August final deficit numbers, I thought it would be a good time to take a look at what September has in store for us.

As a quarter end month, we should see some strong revenues around the middle of the month as corporate taxes and taxes not withheld from paychecks are remitted to Treasury. All in, we will likely see about $100B more revenue in September than we did in August, resulting in a monthly surplus of about $70B, though this is still using some pretty healthy YOY revenue assumptions more in line with what we saw in the first half of the year. Given that the last two months have shown a marked decline from those initial rates, this $70B surplus could be a bit optimistic if we continue to see sub 10% YOY revenue growth.

On the outlays side, against the backdrop of sequestration, we would typically expect a 2% or so decrease in outlays…primarily from defense vendors. However, September 2012 managed to push $25B of SS outlays into late August…September 2013 will not have this benefit, and thus, we will probably end up seeing higher YOY outlays over the month as reductions in outlays will not be large enough to offset the timing issues.

For reference, September 2012 posted a $58B surplus, so within the margin of error of what I am projecting for September 2013. The key here, as it has been for most of the year is to keep our eyes on revenues, which could range from +5 to +20%. Outlays are far more stable (and predictable)…adjusting for timing, they will probably be down a few%. We should know by about 9/21 how the revenue story is shaping up… Stay tuned!!