The news of the day is that Treasury Secretary Lew has announced 10/17 as his latest greatest estimate of when we will “for real” become unable to cover outlays with incoming cash. Remember….hitting the debt limit isn’t the problem(that happened back in May and was a completely voluntary event)…running out of cash to pay bills is the problem.

Looking at a partial month is problematic, so for simplicity, let’s just assume we run out of cash at the end of October. What would November look like?

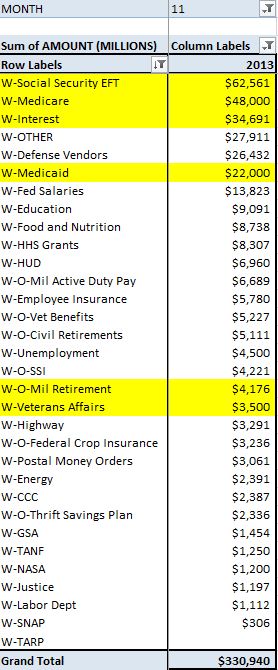

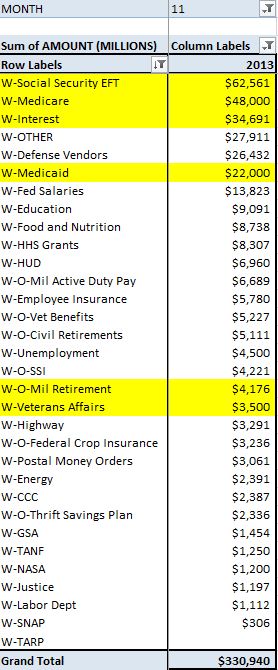

Over the full month, per my current forecast, November should see about $202B of cash revenues, offset by about $331B of outlays, good for a $129B deficit. But the good news is….we can still pay for $202B of those expenditures. But how to decide what to pay…and what not to pay?(Normally…they would issue $129B of debt in exchange for cash…that will cease to be possible) That is the problem. $35B or so of interest is due…probably want to pay that. Rolling expiring debt isn’t a problem…..If I pay off $1B of expiring notes….then replace it with a new $1B issue…debt outstanding remains constant. Not paying Social Security, Medicaid or Medicare would save $133B, which is enough, but that probably wouldn’t end well. Active duty military pay??? Nope. below is my forecasted outlays….what would you cut?

And this is the dilemma our poor…poor politicians find themselves in…both Republicans and Democrats. The government spends about $3.8T per year, but only manages to bring in $3.0T of revenues. The plug is debt…..$800B. So now here we are….right at the debt limit. If it isn’t raised, all else equal…..we have to cut $800B of spending. But unfortunately…all else is not equal. If you cut $800B of spending….by definition that cuts GDP by $800B directly, and who knows how much indirectly. This in turn, cuts revenues, which cuts spending….it’s either a terrible or wonderful circle, depending on who you are. Just for reference $800B is equal to about 16M 50k per year jobs….perhaps 8M (or less)government jobs I suppose 🙂

That’s what it would take to balance the budget. Is that what you really want? Look folks…it’s simply not politically possible….therefore it will not be done. Oh sure….they may reach the limit for a few days or even a week….maybe “slow paying” some bills (trust me…the checks in the mail) but not for long and I doubt it even gets that far. The debt limit will be raised…not because it’s the right thing to do…but because it is the easiest thing to do.

Don’t get me wrong…I’m not endorsing this….it’s not what I think should happen, rather, it’s what I think will happen. Honestly, it’s almost certainly too late….this cycle will continue until it collapses on itself and all of this debt (on and off balance sheet) is simply defaulted on, probably by inflating it away.

Not that anyone has asked, but my solution would be over say a 10 year period (wish we could have started 10 years ago) simply cut all non-essential and unconstitutional expenditures (including social security, Medicaid and medicare) 10% per year until they are zero….reducing taxes along the way. I would also default immediately on all $16.7T of debt outstanding….if you were dumb enough to lend money to Uncle Sam…..aka our congress with a single digit approval rating…. well…you deserve to lose your $16.7T.

Finally, when it was all said and done I would cut taxes to put them in line with the new expenditure requirements…probably somewhere between $500B and $1T per year. Yes…there are a lot of details to work out, and it would never actually happen, but the short term pain would be made up by long term prosperity…which is why it will never happen….it’s been a long time since anybody told the American people no, and I see no indication anybody is going to start now. The majority has found it’s way into the nation’s pocket book demanding pensions, schools, food stamps and infinite government paid medical care far beyond the nation’s willingness, or even ability to pay. No…there is no political solution here…the game will continue until it all crashes and burns. That day will come soon enough, but I doubt it is 10/17/2013.

Stay tuned….we look to be in for an interesting month.