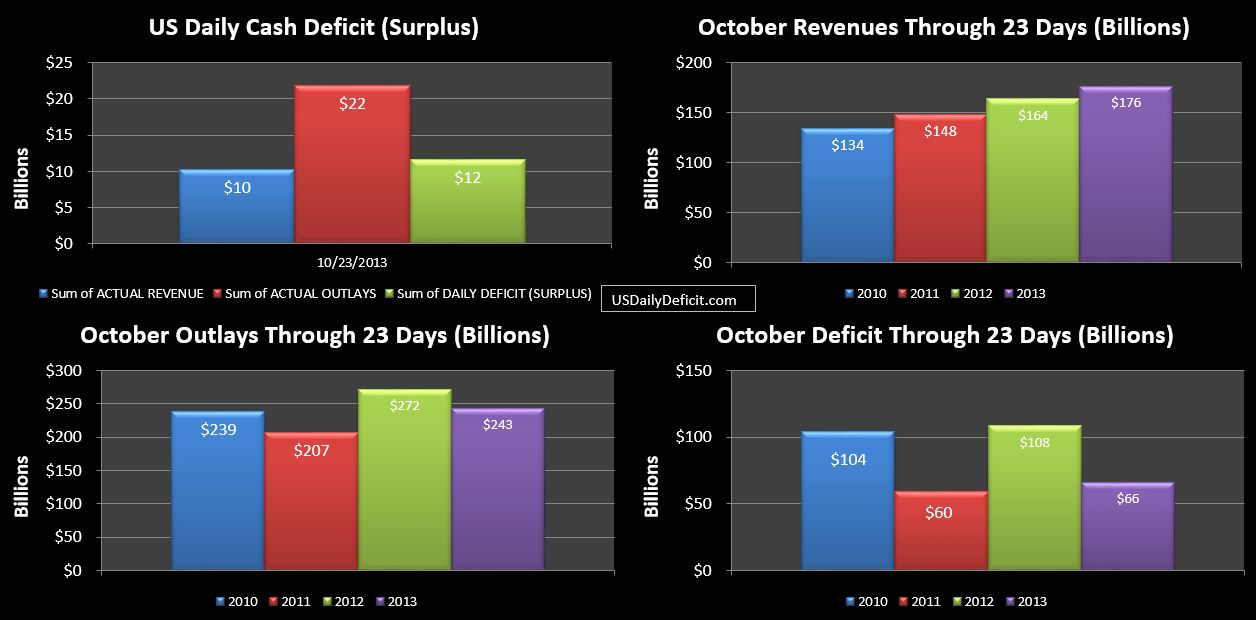

The US Daily Cash deficit for 10/23/2013 was $11.6B as the final SS checks of the month went out totaling $12.3B. This brings the October 2013 deficit through 23 days to $66B. We did see a small trickle of those delayed payments start going out today starting with 2.6B of tax refunds and $0.5B for the Commodity Credit Corporation….whatever the heck that is.

Revenues continue to make small gains vs. 2012 and are now at +$12B. If they continue at this pace, hitting +10% seems likely, which will be good for a symbolic win if nothing else. For the rest of the month, I’ll be keeping my eyes on revenues.

Perhaps of note…though it’s not set in stone, the vast majority of SS payments have gone out, and for the second month in a row it is looking like outlays were pretty much flat. August ended up at $61.632B…October is sitting at $61.671B…only $39M higher. For reference, in a typical month, we’ve been seeing about +$300M, with some seasonal variation. Quick math tells us that +100k people at $1163 per month would add about $125M to the baseline. Very interesting…. I have SS projected to grow at about 5% per year due to COLA increases and increased enrollment at higher monthly benefits. If we see a few more months like this, I may have to think about adjusting my forecast down a bit even though I had expected this to be a bit conservative. Oh well…when the facts change…so must the forecast….fingers crossed!! For what it’s worth…last October was at $56.949B…8.3% lower, so these last 3 months might just be an aberration. COLA increases go out in December, which should be good for a $1B bump at least, so one way or another, this won’t last more than another month or two.