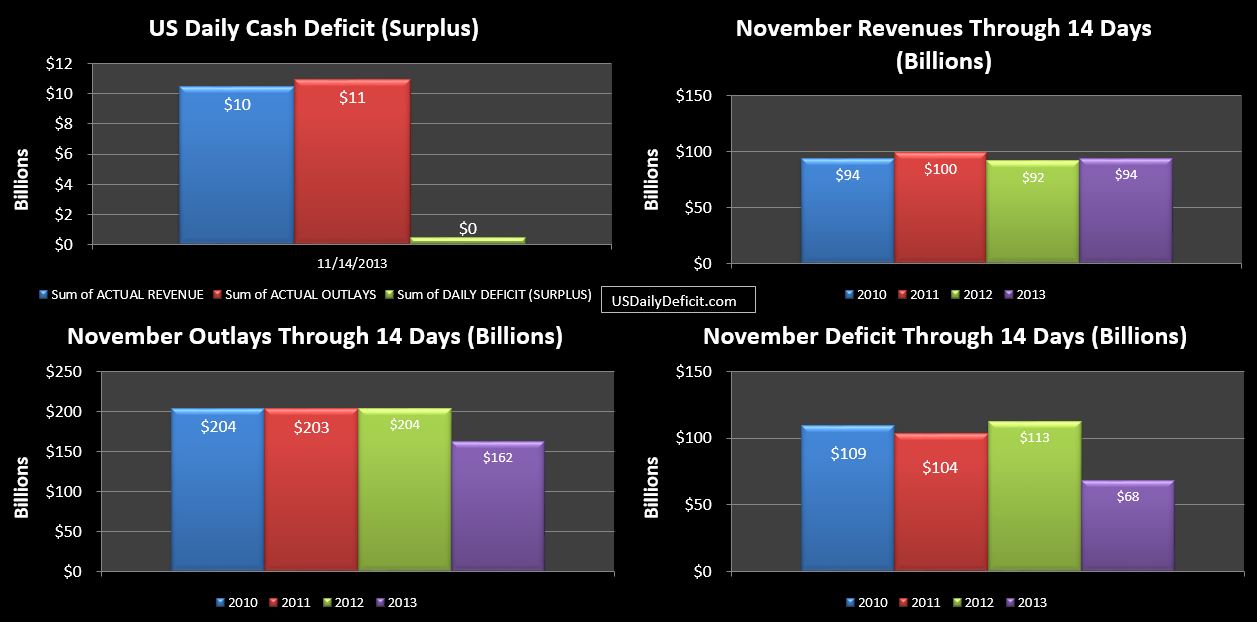

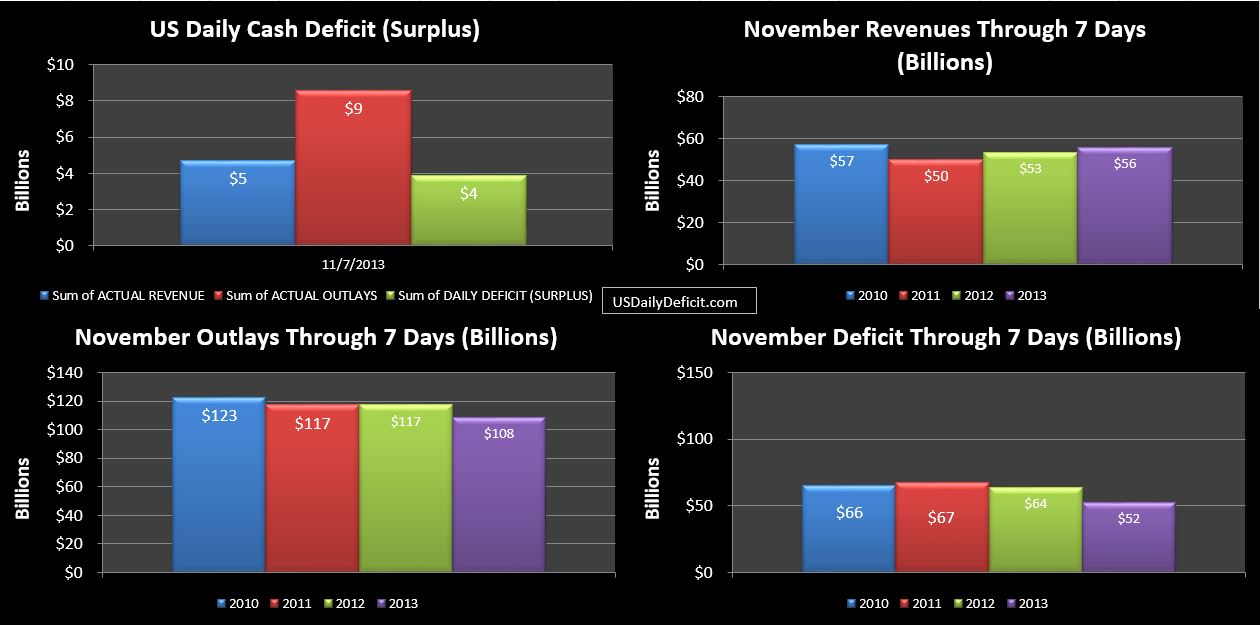

The US Daily Cash deficit for Thursday 11/14/2014 was $0.5B leaving the November 2013 cash deficit through 14 days virtually unchanged at $68B.

For the second day in a row revenues pull back a bit and are now only $2B ahead of 2013. We do still have a bit of timing, but that doesn’t explain away all of it. We did receive the $2B of excise taxes discussed yesterday, but it was replaced by a ~3B corporate income tax timing issue that should resolve with the next report. Most of the miss was actually in withheld tax deposits….perhaps another timing issue I am simply not aware of?? Let’s hope so. As it stands, revenues are up ~3% YOY, but we’ve seen a string of months that started weak but finished strong, so there is no reason at this point to think that +10% is out of reach by month end, but we will certainly be watching it.

Outlays have a big timing issue…with prior years already showing the mid month ~$30B interest payments that won’t show up in 2013 until Monday’s 11/15 report…bringing everything back into alignment for the most part.