With November in the bag…it’s time to pull out the old dart board and take a swing at December. But first…lets take a look at November. My forecast was $160B…actuals came in at $142B, good for an $18B miss…tying my largest miss in the last 6 months I’ve been doing this. The average is a $12B miss, with my best being October with a $4B miss. Clearly there exists some randomness with revenues and outlays that will never be able to proactively forecast, but all together, an $18B miss isn’t that bad given that there were $349B of outlays and $206B of revenues.

The model I am using splits revenues into 21 independent sources and forecasts each stream independently. Outlays are split into 36 sources…also with a cash forecast for each. That’s a hell of a lot of moving parts, but it works surprisingly well. So bottom line…the forecast is not perfect, and never will be, but it does seem to be doing a fairly good job at this point, though I do have some concern about the 2014 forecast….especially on the revenue side. Basically, it may take a few months in early 2014 to re-calibrate the revenue growth I am expecting ~5% (wild a** guess) with what we actually see come January 2014.

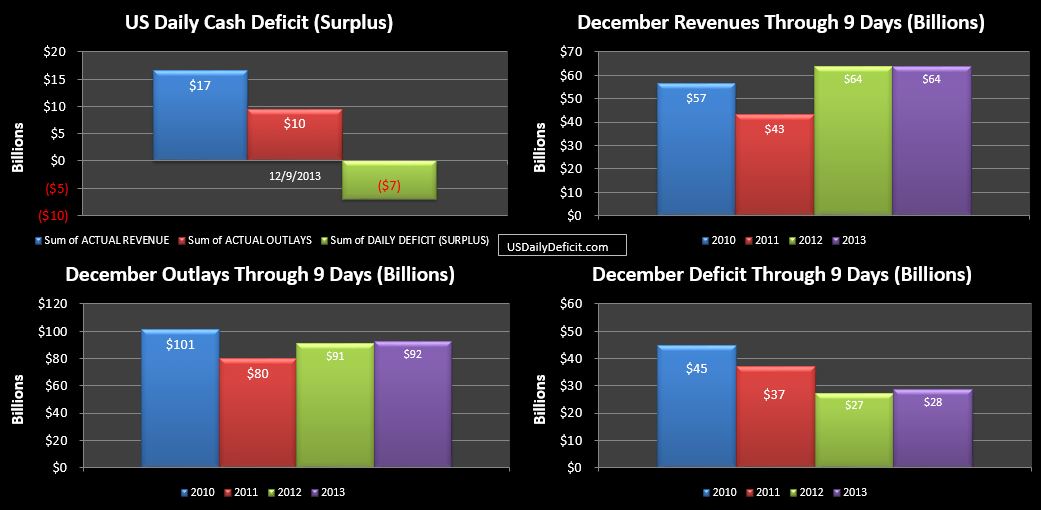

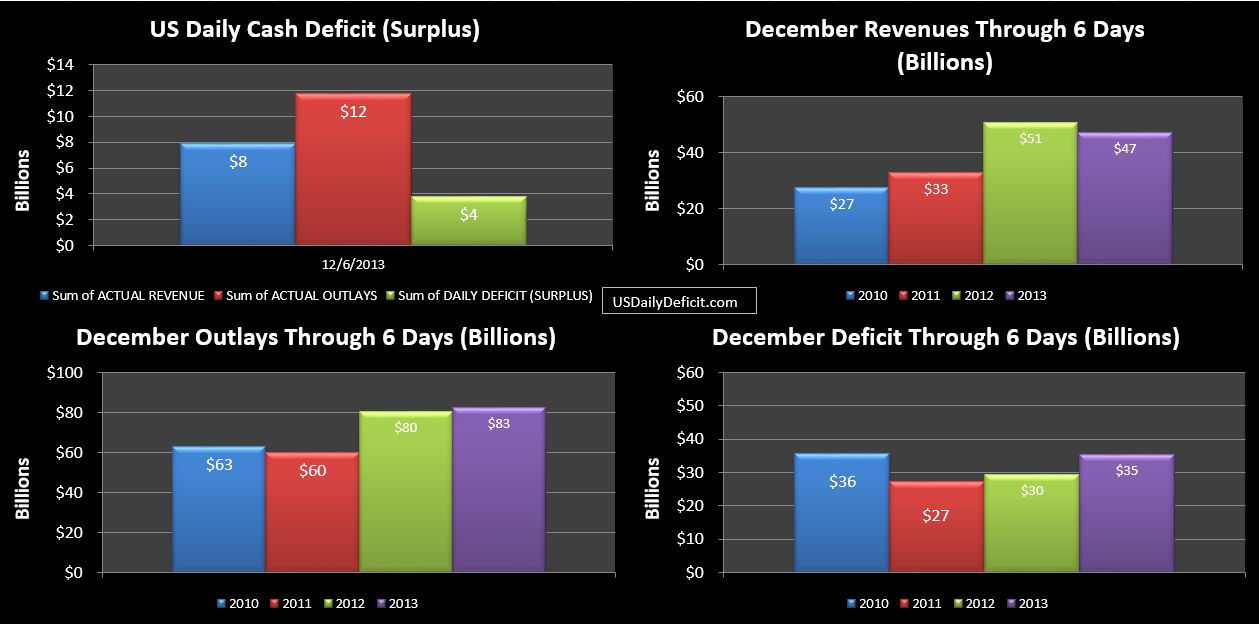

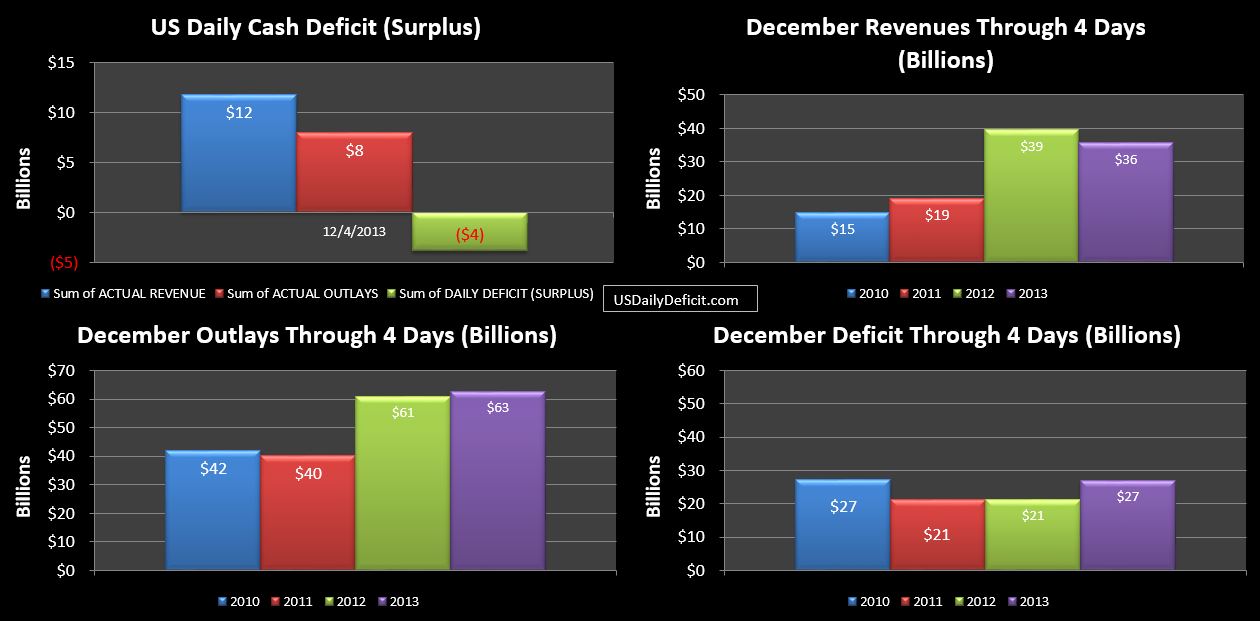

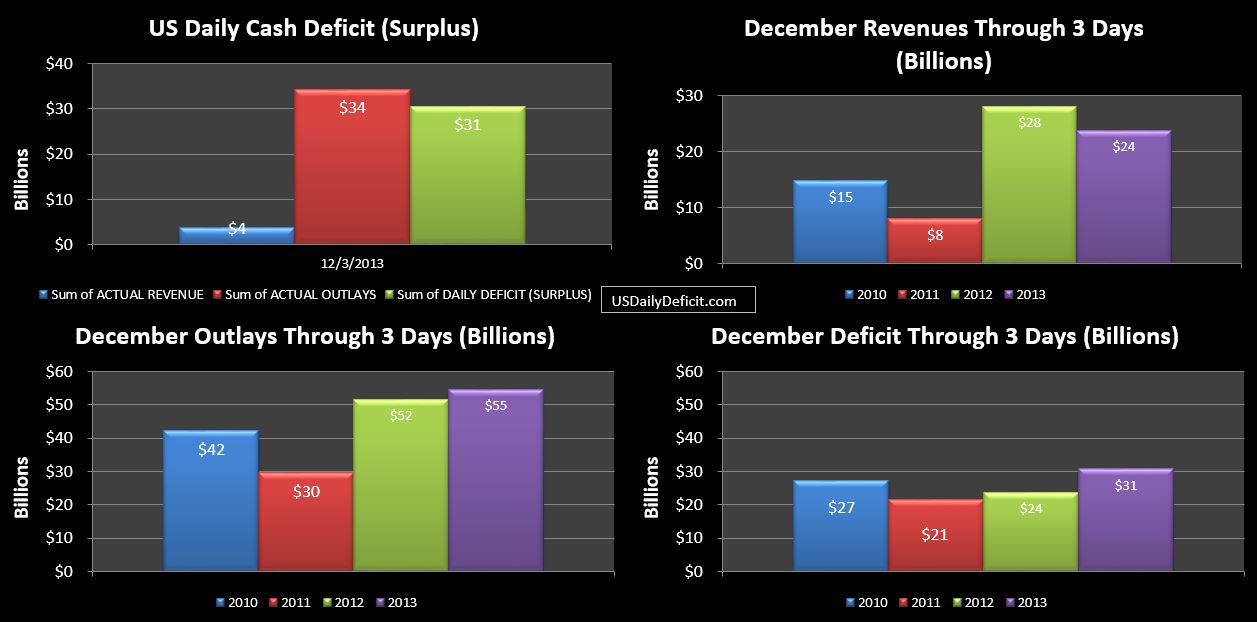

Ok…looking forward. December is a quarter close, so we should see a big increase in revenues over November…from $206B to ~$342B as tax payments are made by individuals and corporations, including some cash from our good buddies and Fannie/Freddie. This will be about a 10% gain over last December’s $310B.

For outlays, I have them pegged at $291B….just $2B over last year’s $289B. Clearly it would be nice if we saw outlays down 5% again, but I’m not so sure….at least not yet. Add it all up, and we have a $51B surplus on deck for December….which would leave the year at $663B vs 2012’s $1.096T