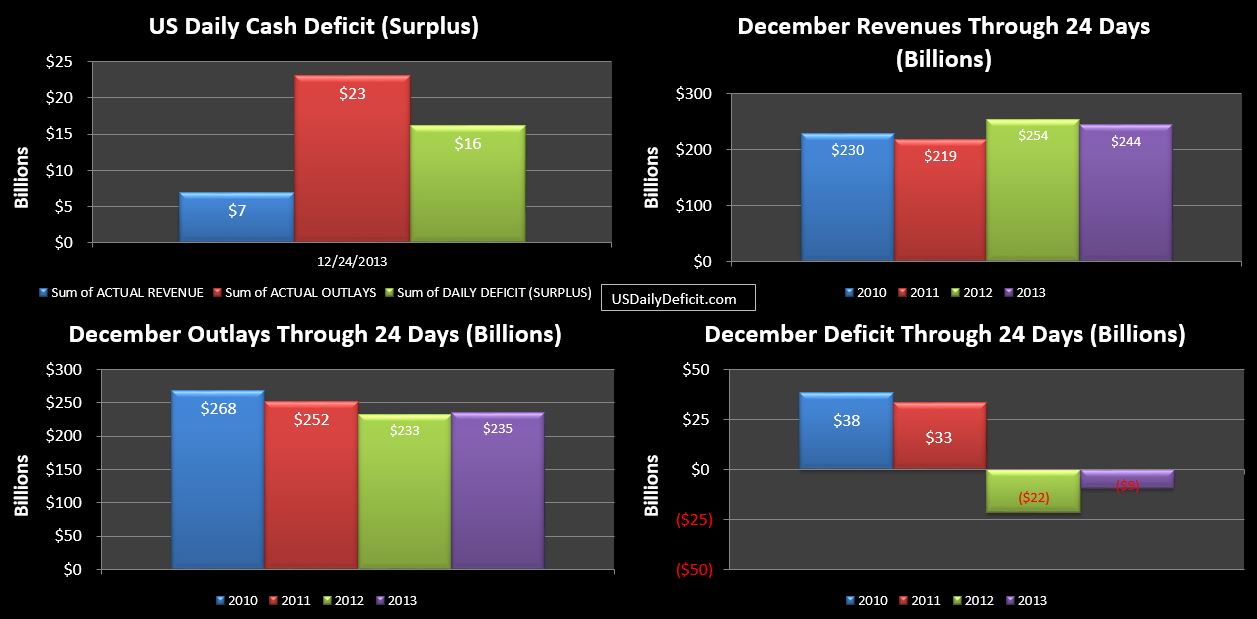

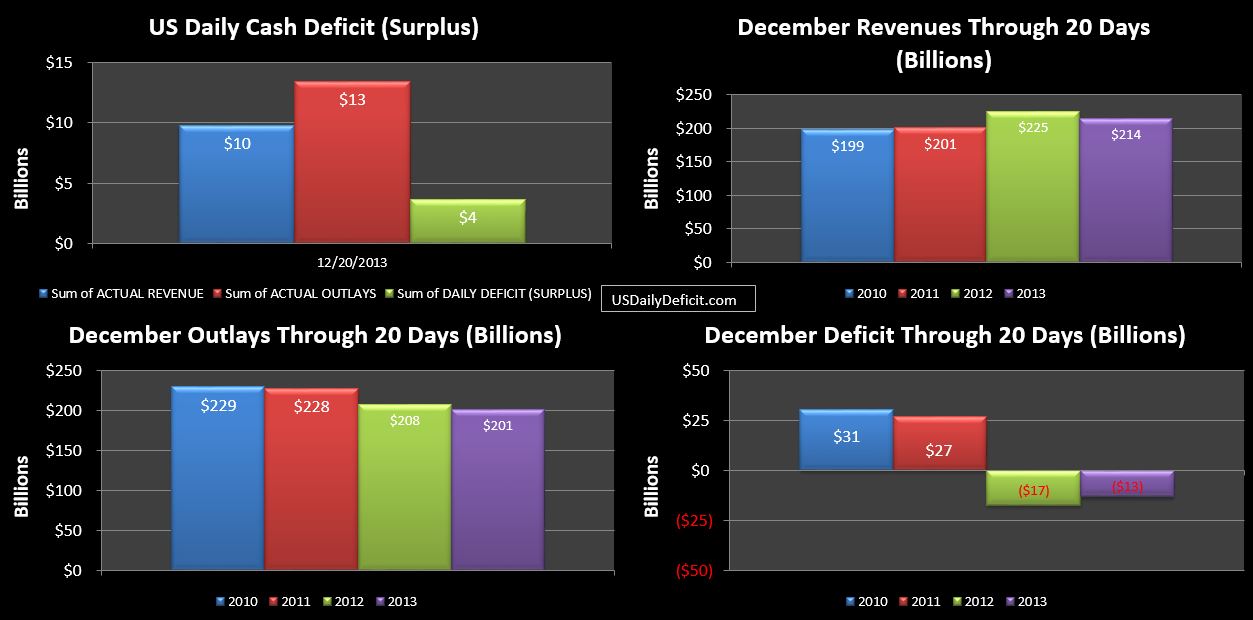

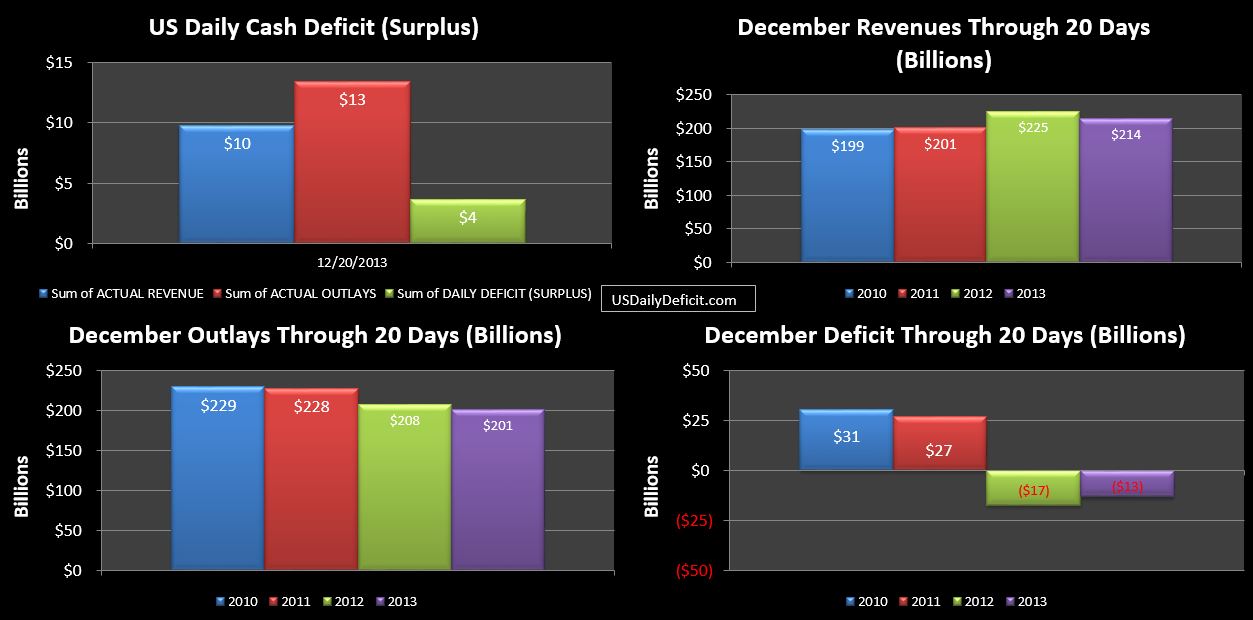

The US Daily Cash Deficit for Friday 12/20/2013 was $3.6B bringing the December 2013 surplus through 20 days to $13B with 6 business days remaining.

Revenues take a big hit today…$-7B vs last year…now down $11B YOY…almost 5%. While most of that can be attributed to a $6B TARP repayment received last year…that’s not really a surprise. Excluding TARP…tax deposits are just about flat at +1%…including corporate taxes which are up 3%.

So…while December is looking like a pretty miserable month on the revenue side…I just stumbled upon a nice little news story from back in November that looks like it will save the day. Over at The Street they reported that Freddie will be making a $30B payment to treasury. This is pretty much identical to what happened with Fannie Mae back in June as I documented here. Accountants at Freddie wrote back up previously written off tax assets…creating an accounting gain of $24B. Then…they go out and get a $24B loan….and use that to pay uncle Sam his due. Sounds great right??

Well…you see the thing is…Freddie is essentially a government owned entity….and since these fictitious “tax assets” only value is in reducing future taxes owed….the entire thing is essentially a huge circle j***. The US government is using Freddie and Fannie to get a payday loan….in this case cashing out $24B today….but reducing future revenues by the same…plus whatever interest Freddie has to pay…

At risk of putting some to sleep, I feel a need to proceed. Let’s just say in a given quarter Fannie and Freddie together post a $10B before tax profit….which they are obligated to turn over to treasury per the bailout terms. Now…if they were a normal corporation….they would pay about 35% of income tax….$3.5B…then the remaining $6.5B would then be turned over to Treasury (as the owner). Net to treasury….$10B. Now….let’s let them use their pretend tax assets to reduce income tax to zero. They still have $10B but no income tax….so all $10B is handed over to treasury. So…Treasury gets $10B regardless of what kind of nonsense the accountants come up with. However…now Freddie has an additional $24B of completely unsecured debt on it’s books. The interest on that…though probably not much, will directly reduce future earnings handed over to the treasury….and of course…the debt itself will ultimately have to be repaid. Even if Treasury ever sells Freddie, or lets it go public again….the entities value to a suitor has been reduced directly by the $24B of cash pulled out….a haul old school corporate raider Mitt Romney could only ever dream about.

So…the net impact of all this is that the December Surplus will be $24B higher than it otherwise would have been….and future deficits will be $24B+ or so higher. To my knowledge…the Fannie/Freddie bag-o-tricks is now just about empty… after buying us a whole…maybe 2 weeks of time. Yep…we’re still doomed 🙂