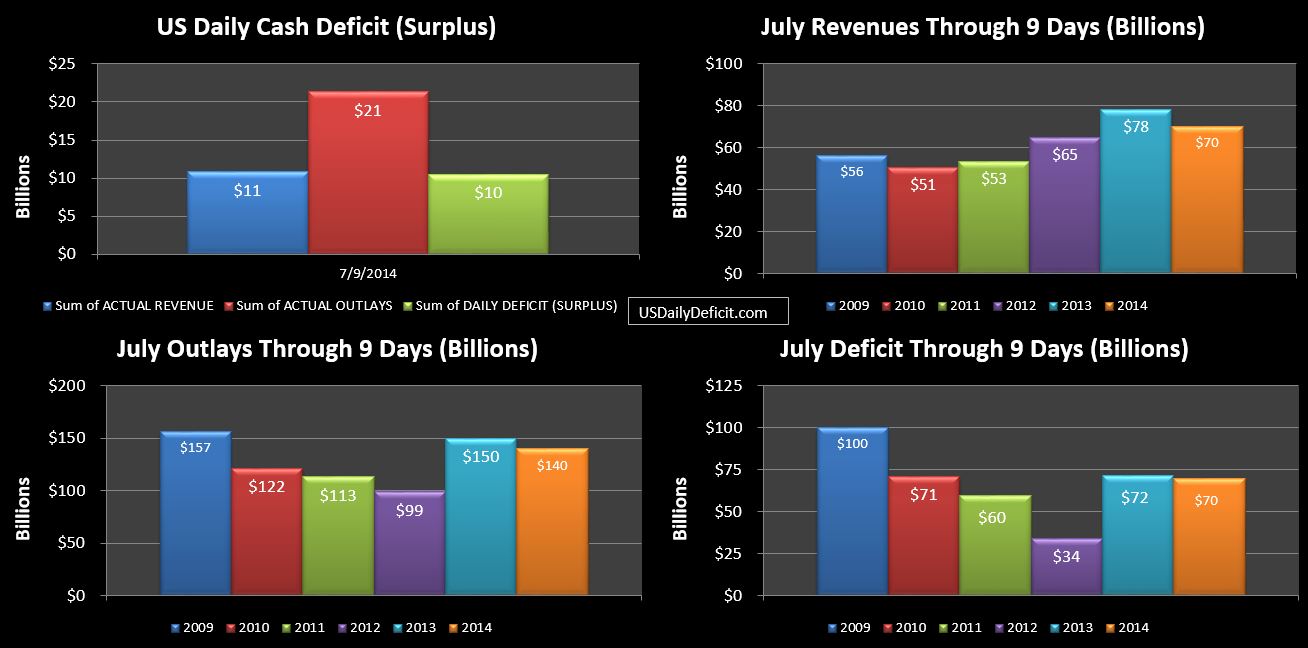

The Us Daily Cash Deficit for Wednesday 7/9/2014 was $10.5B, following Tuesday’s $6.5B deficit, bringing the July 2014 Deficit through 9 days to $70B.

Revenues have gained a bit since the last report and now stand at $-8B vs 2013. Outlays have also gained a bit, leaving the deficit at $70B. We’ll get some corporate taxes in next week…probably $5-10B, but other than that no big revenue events on the July calendar….To hit that magic +5%, all we need is to get to +$11B for the month, which is certainly achievable given that 2014 as presented in the analysis above has an extra business day remaining over 2013. Back of the envelope…$1B per day ought to get us there…stay tuned.