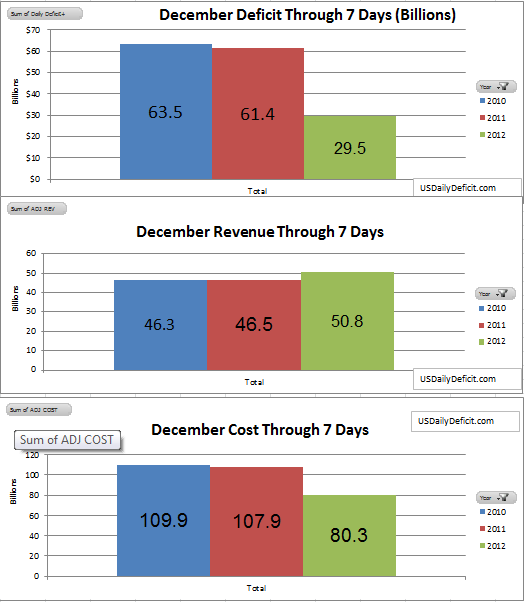

The Daily Deficit for 12/7 was $3.9B bringing the deficit through 7 days to $29.5B….still trailing 2011 and 2010 by over $30B (That’s a good thing!!). Unfortunately, at this point it seems to primarily be a timing issue related to December cost getting pulled into November rather than any real improvement. Revenue shows marginal improvement, but nothing to get excited about yet.

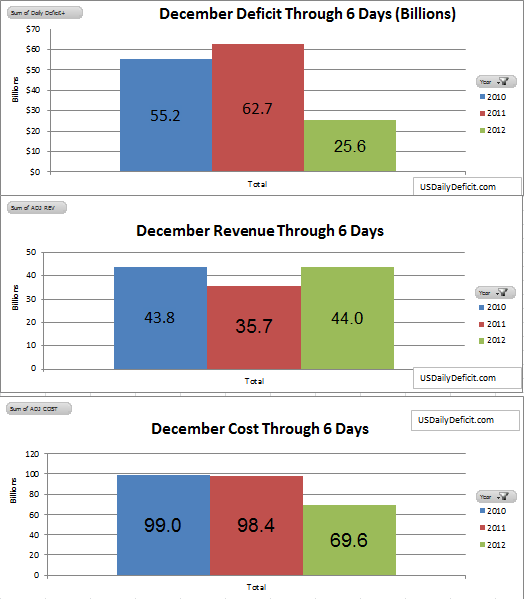

The Daily Deficit for 12/6 was $4.3B bringing the deficit through 6 days to $25.6B…$37B under last year’s deficit at this point. There are still a lot of days left, but just looking at the timing of payments this year and last, I’m going to guess at least some of this “improvement” sticks. Last year’s December deficit was $59B..I’ll throw my dart and say a 30B deficit for 12/2012. I will be paying special attention to Revenue, which was down a bit last month, to see if it could have been a timing issue, or the start of a trend?