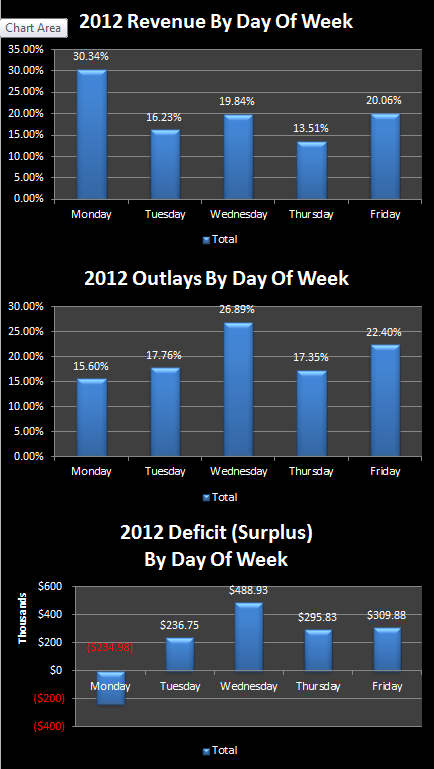

There is no Daily Treasury Statement today due to the holiday/inauguration. Instead, I decided to take a look at some daily trends. First off, one thing you immediately notice is that Mondays are typically the strongest days for revenues, which makes sense. They (Treasury Employees) come in Monday morning, and process all those checks, wire transfers ect. that came in over the weekend, plus Monday activity, so it is like 3 days in one, except that weekend activity is obviously lighter. Of course, even flows would be 20% each, but we clearly see Monday on top at 30%, with Wednesday and Friday at ~20%, trailed by Tuesday and Thursday.

Outlays on the other hand are dominated by Wednesdays, which is when most of Social Security payments go out, with the rest going out on the third…whatever day that happens to be. The difference, of course gives us our deficit. In 2012, we actually ran a surplus…. but only on Mondays. Nearly $500B of deficit was incurred on Wednesdays due to heavy outlays, with Tuesday, Thursday, and Friday all around $200-$300B.

According to The Hill

House Republican leaders on Friday announced a plan to condition a three-month increase in the debt limit on the Senate committing to pass a budget by the April 15 statutory deadline.