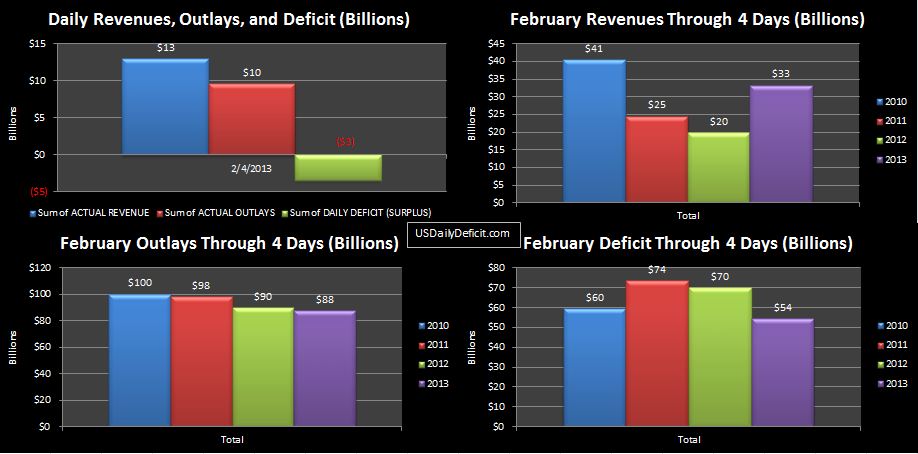

The US Daily Deficit for 2/6/2013 was $2.6B bringing the total deficit through 6 days to $66B, $14B under last year, primarily due to refunds running $12B under last year. I’m not sure yet how this is going to all play out. One possibility is that everybody who usually filed in the middle of January simply filed 1/30, and that we will see a spike in about a week and 2013 will start to catch back up to 2012. The other possibility is that there are system processing constraints that will simply push back everything, meaning that February would never catch up…refunds would just get pushed into March, skewing our monthly profiles and making next year that much more difficult to forecast:) There were $53B of refunds issued in the last 8 calendar days of February 2012, so all else equal, that would put the 2013 deficit ending at around “only” $200B. I’m pulling for the IRS’s refund department to power through so my charts don’t get screwed up for the next 2 years!!

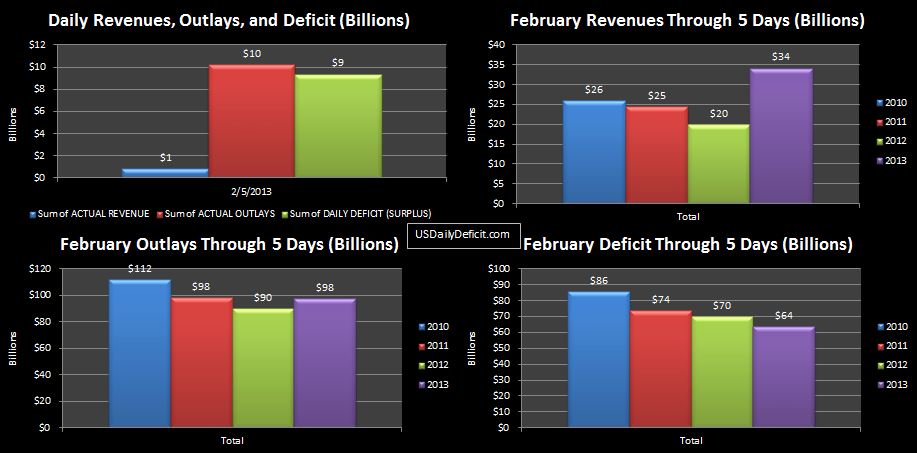

The US Daily Deficit for 2/5/2013 was $9.4B bringing the February total through 5 days to $64B. Refunds are running $8B below last year, so they really haven’t ramped up yet…give that another week or two. Keep in mind that as part of the methodology, tax refunds are subtracted from revenues. So while a typical month may average around $250B per month in revenues, February usually comes in around $80B. It’s not perfect, but it does all work out in the end. Think of it this way…all year long, true revenue is being overstated as people pay in more than they should be (usually). Then, every February-April everyone pays their taxes and trues up their balance…getting a refund if it is due, or writing a check if necesary. That’s just how the cash flows, so it’s how I report it. Anyway…hopefully that preempts a lot of questions on why “revenue” is so low this month. I will also take a look at unadjusted revenues to see how it compares to year ago to see if we can still see that $20B or so increase. Charts are below…don’t read too much into them this early in the month, but the deficit is pretty much in line with last year and ignoring the delayed refunds, revenue is too.

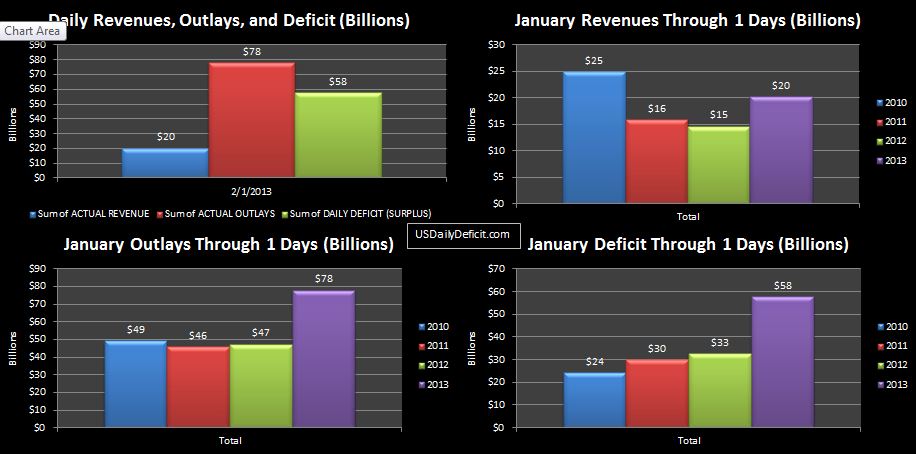

The US Daily Surplus for 2/1/2013 was $3.4B, bringing the monthly deficit down to $54B after last Friday’s $58B blowout. The charts look a little screwey today, but it is early and there are too many timing issues to count battling it out. Perhaps most interesting is that as of yesterday, we have no debt limit… at least until May 19th. I expected a flood of debt to flow back onto the balance sheet…around $100B or so, but debt only increased $41B. I’ll chalk it up to timing for now…we shall see.

In other news, the CBO released an updated 10 year budget outlook today projecting an $845B deficit for fiscal 2013. I have to assume they have much better information and more time than I do. It’s not a crazy number, but it does seem a bit optimistic. With 4 months in the books, we are averaging a $4B per month improvement over last fiscal year’s $1.092T cash deficit. At this pace, they won’t make it, but admittedly, the tax increases that kicked in last month should help. I believe that for the calendar year, I projected $1T, +/- $100B. Just for fun, let’s see who is better at this…a bureaucracy with a huge staff, or a guy with a ruler. I haven’t done a formal fiscal year forecast, but I don’t mind throwing a dart. There are 8 months left, so lets just assume that revenues increase $20B per month and outlays increase $10B over last year. That would give us a $10B pickup per month and land us right under $1T. For what it’s worth, I’m rooting for the CBO.

The US Daily Deficit for 2/1/2013 was $57.7B…off to a roaring start due to the timing of outlays and the start of tax refund season. In all of January a mere $672M of refunds were issued to individuals, compared to $3.973B last Friday alone. If this February is similar to last, we can expect another $130B of refunds to go out over the next 18 business days. As usual, it is going to take a few weeks for the timing issues to work their way out of the data, so hang on!! **Chart Titles should read February** Whoops!!

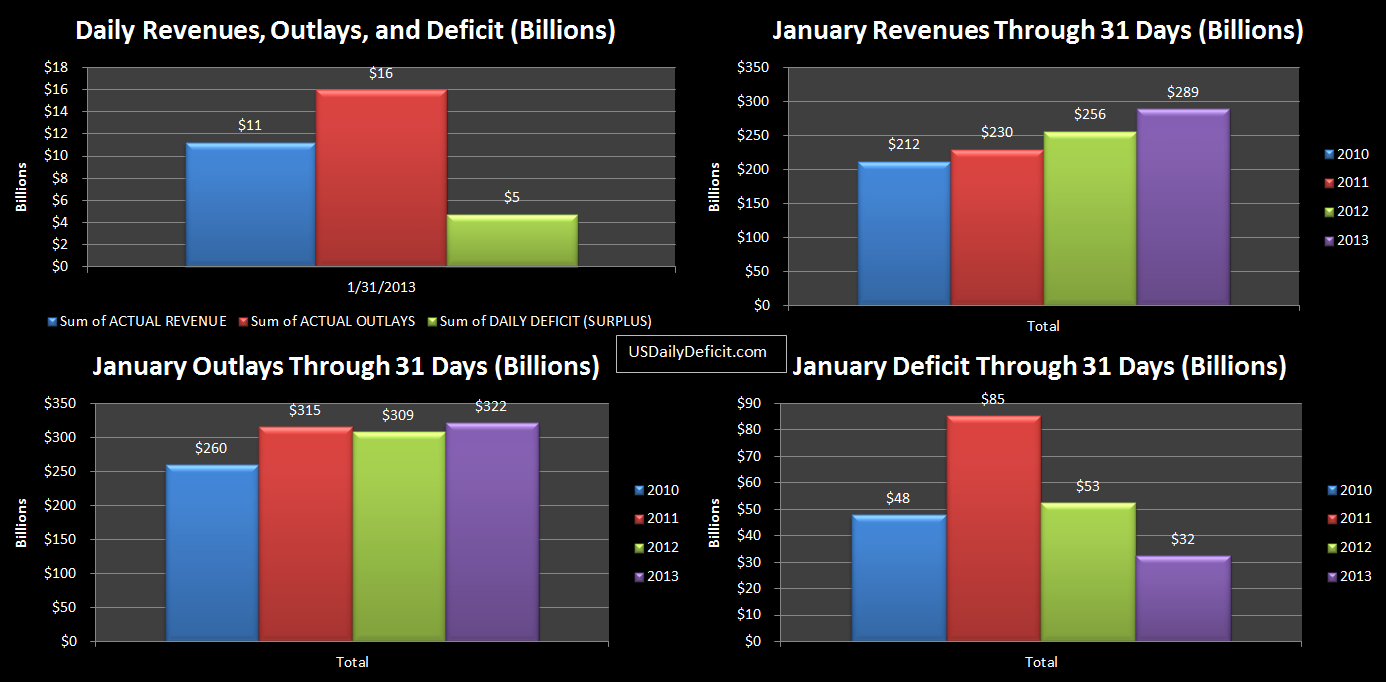

The US Daily Deficit for 1/31/2012 was 4.8B, bringing the January total to $32.4B, $20B less than January 2012. Revenues increased $33B, 15B from increased withholding, $12B from increased nonwithholding payments, with the remaining coming from miscellaneous other sources. Note that due to the delay in the tax filing date 8 days to 1/30/2013, tax refunds, which I net against receipts, were $9B lower than last year.

Outlays Increased $13B over last year, with increases pretty much across the board with the exception of interest which was down $8B from $19B to $11B. Looks to be a timing issue, where 12-2011 payments were shifted into 1-2012, spiking last years Jan interest payments. The difference, $20B is the improvement over 2012. Will the improvement be sustainable? February will give us a good idea, but I don’t think we will really know until May when tax season is over.

If anyone remembers, at the beginning of the month I predicted a deficit of $10B, so I missed it by$22B…a substantial improvement over last months $50B miss. Looking ahead, last February had $80B of revenues (net of refunds) and 329B of outlays for a deficit of $249B. I could see next month going either way. I’ll just stick with last year’s number and hang on for what could be a wild ride.