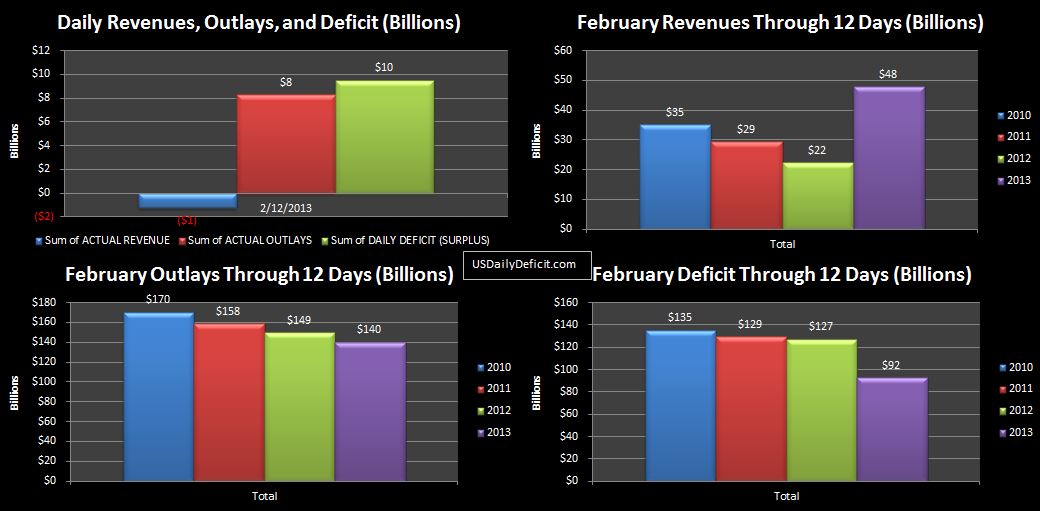

The US Daily Deficit for 2/12/2013 was $9.5B bringing the February deficit through 12 days to $92B. Refunds, once running $20B under 2012 have narrowed the gap to $11B. 2013 is currently $35B under last years’s deficit, but as we have been discussing, a lot of this is timing. I wouldn’t be surprised if tomorrow this narrows down to $15B or so as the second round of Social Security payments are made, especially if refunds continue to accelerate. The rest of the month looks like it will be more of the same…steady deficits in the $5-10B range, with the exception of this Friday, when an interest payment in the $30B range will be made, pushing the probable daily deficit up in the $40B range. The only other thing to keep in mind is that last February was a leap year, giving it one additional business day. All else equal (and we know it isn’t) this would lower our 2013 forecast by about $10B.

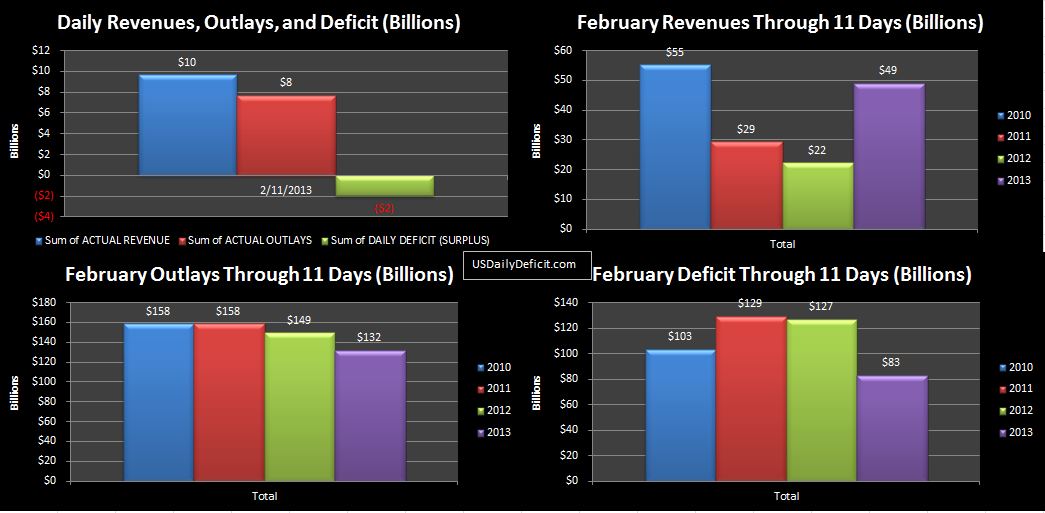

The US Daily Surplus for 2/11/2013 was $2.0B bringing the February deficit through 11 days to $83B. Timing issues are mounting as evidenced by the differences in revenues and outlays. 2012 has an additional business day and an additional Social Security payment pushing up its outlays compared to 2013, and the ongoing timing of refunds which is still in the $15-20B range, though 2013 has made some small gains. We appear to definitely be on pace for a $200B+ deficit for Jan, and if refunds start catching up, we could be pretty close to last year’s $249B deficit.

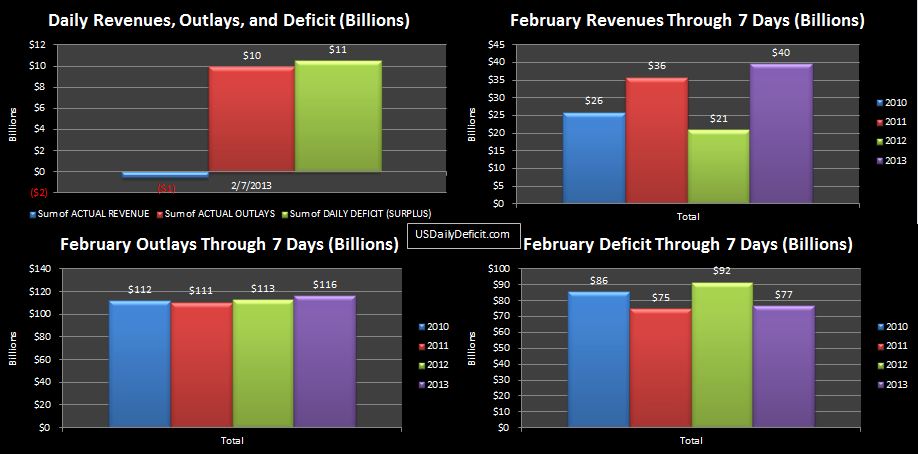

The US Daily Deficit for 2/8/2013 was $8.8B, bringing the 8 day total to $85B. This, coincidentally, is about the same amount of annual spending that is supposed to be cut in the dreaded “Sequester”. That’s right…through 8 days of February, we have already run a deficit larger than the amount sequestration is supposed to save over an entire year. If nothing else, it gives you some scale to how puny these cuts really are compared to what is actually needed. If this tiny little $85B cut is going to hollow out our military, increase unemployment and otherwise wreck havok on our economy, just imagine what’s going to happen when the market takes away our ability to deficit spend. Just something to think about.

Despite the above reality check, we can see that through 8 days, February 2013 is still $31B below February 2012’s deficit through 8 days. unfortunately, about $20B of that is related to delayed 2013 refunds, and about $10B is due to the timing of social security payments, so adjusting for timing, we are on track with last year. Refunds are starting to accelerate…we’ll know in a few weeks if they will catch up to 2012 or get pushed into March.