Over the years, I’ve noticed something about most financial journalists….they generally don’t know what the hell they are talking about. Case in point, today I read “The geeky debt fix that might work” by Jeanne Sahadi at CNN Money. The article is about using “Chained CPI” instead of CPI when computing the monthly increases to Social Security, government Pensions ect… Bottom line, Chained CPI typically runs a fraction of a percent under CPI. According to the article:

Social Security payments would continue to grow every year, but by 2030, the median payment would be 3% less than it would be if today’s inflation measure were used.

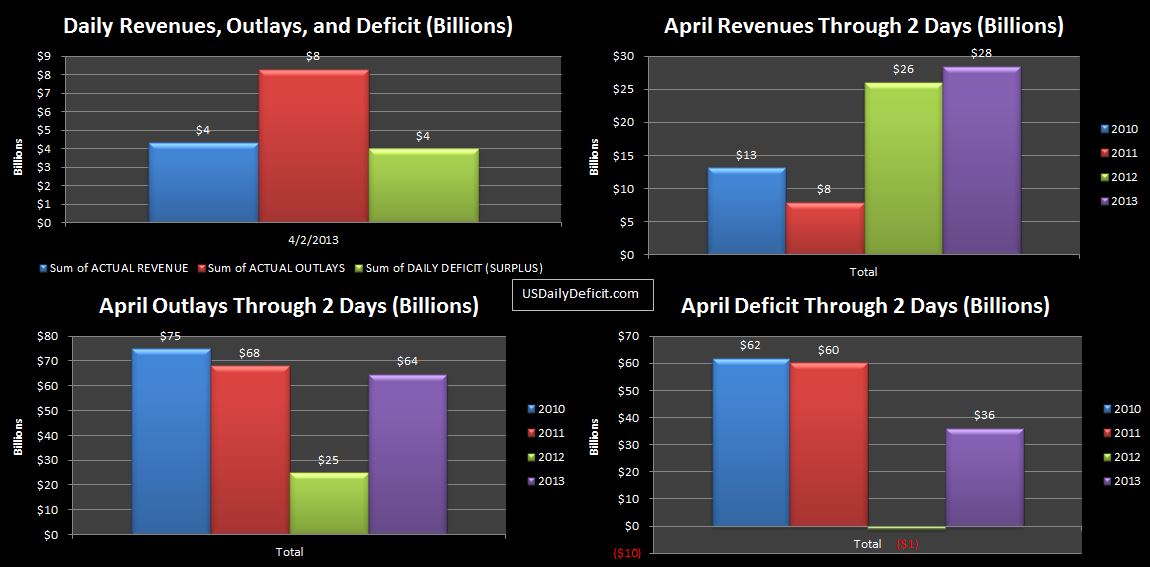

Got that? I thought it was a joke at first. In 17 years…2030, this switch would result in Social Security being 3% less than the current trajectory. So I went to my CBO vs CBO file, and took a look at 9/2030. Using some pretty conservative estimates (6% annual growth through 2023, then 3%), I get annual spending growing to $1.654T. The TTM right now is $689B. So if we adopt this now, we get $50B of annual savings in 2030…$4B per month. News flash…we spent about $ $25B just yesterday on Social Security, with another $35B to go this month. I’d be surprised if this train makes it to 2020, much less 2030, and yet Jeanne says:

It’s dull. It’s controversial. And it might work.