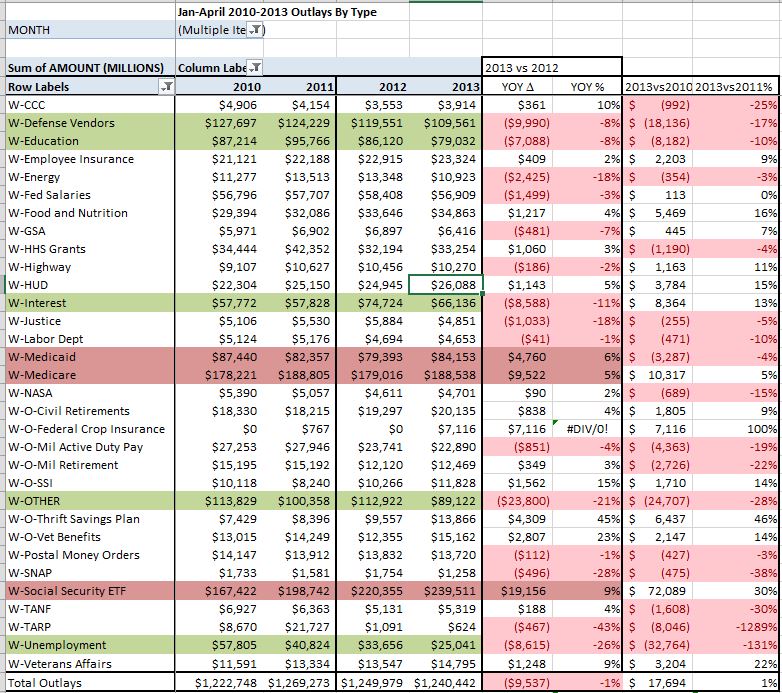

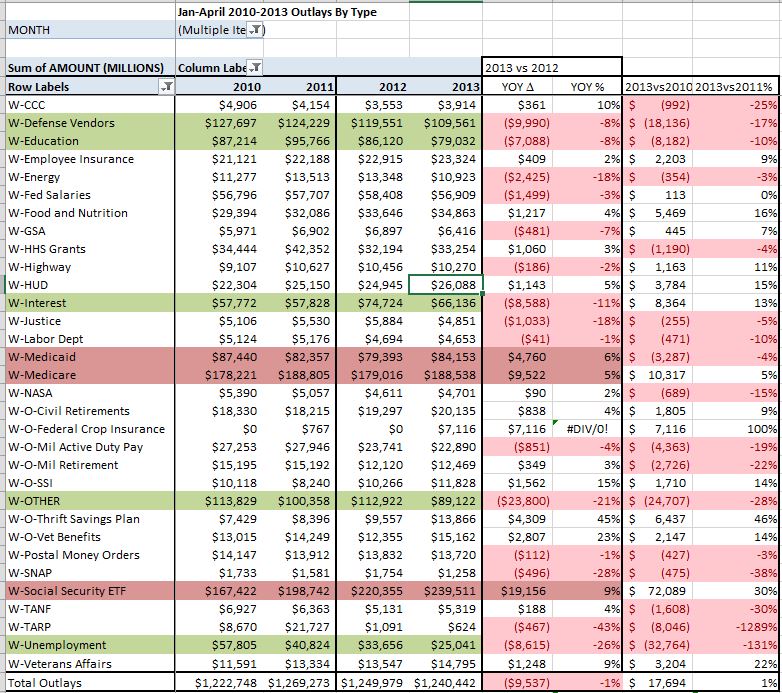

For the last three years now, 2010-2012, Federal cash outlays have more or less stayed the same at $3.8T per year. 2013, it turns out is shaping up to be more of the same…despite all of the talk of cutting spending, furlough’s and sequestration…outlays through 4 months are down by $9.5B compared to 2012 through 4 months…. a 0.76% reduction. Well…at least they technically aren’t lying when they say they cut spending…baby steps right?While entitlement programs, especially Social Security continues its exponential growth, this has been offset by cuts elsewhere…but where?

A few things jump out comparing 2012 to 2013. The big reductions came from defense vendors, education, unemployment, and a bit surprising…interest.(Hooray for ZIRP!!)On the other side…the usual suspects…Social Security, Medicare, Medicaid. Sooner or later…the delicate balance between entitlement gains being offset by cuts elsewhere is going to break….the exponential growth will overpower the linear cuts….throw in the gentle breeze of a mild recession and a mild rise in interest rates and down goes the house of cards

Comparing 2013 to 2010 yields similar results…huge gains from reduction in unemployment, defense vendors, and our good friend “Other”, offset primarily by social security Curiously, Medicaid and medicare are little changed…the Medicaid number appears to be legit…but the Medicare # looks to be skewed a bit by timing where May 2010 cost got pulled into April….a TTM analysis would probably scrub that out, but who has time for that.

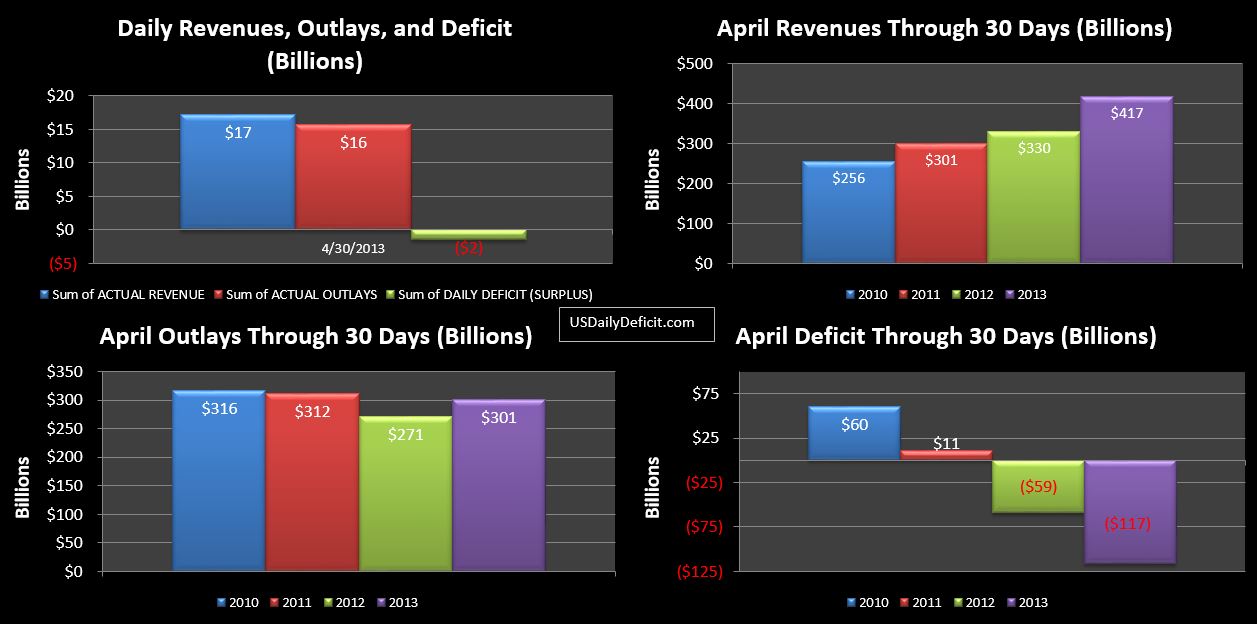

So…through 4 complete months of 2013….outlays truly are down…at least for now. Say…is that a breeze I feel?

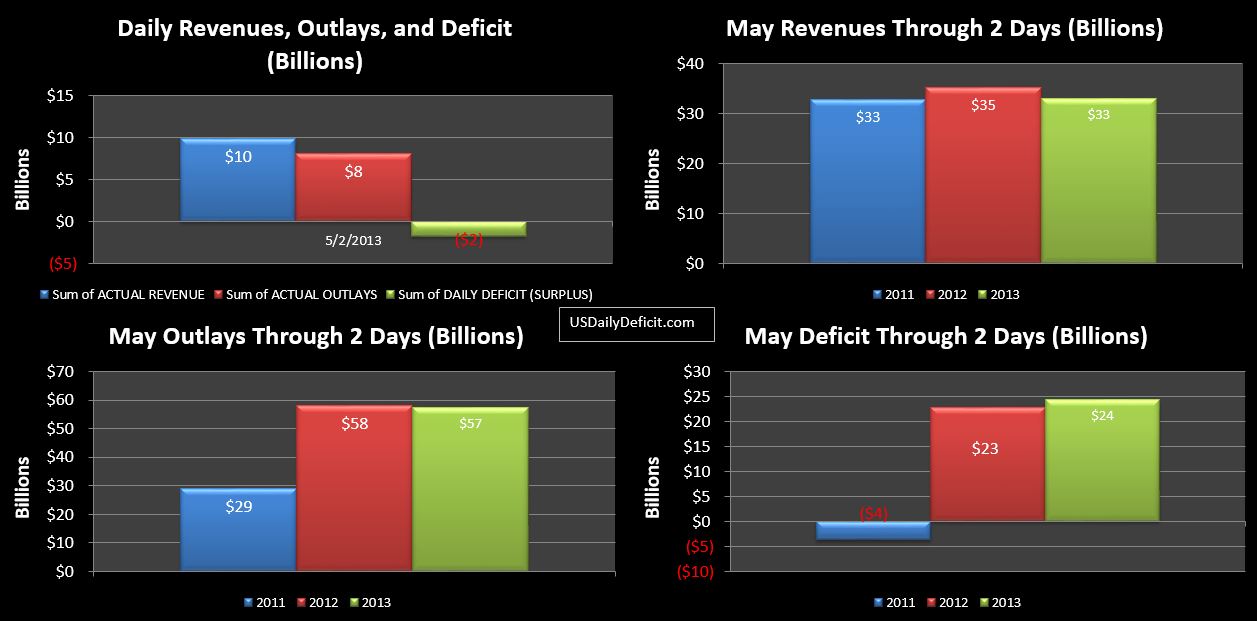

Oh…one more thing…The daily cash deficit for 5/1 was $26.1B….so we’re back in familiar territory…I haven’t done a detailed analysis yet, but probably looking at a deficit between 100B and 125B….roughly washing out the April Surplus 🙁