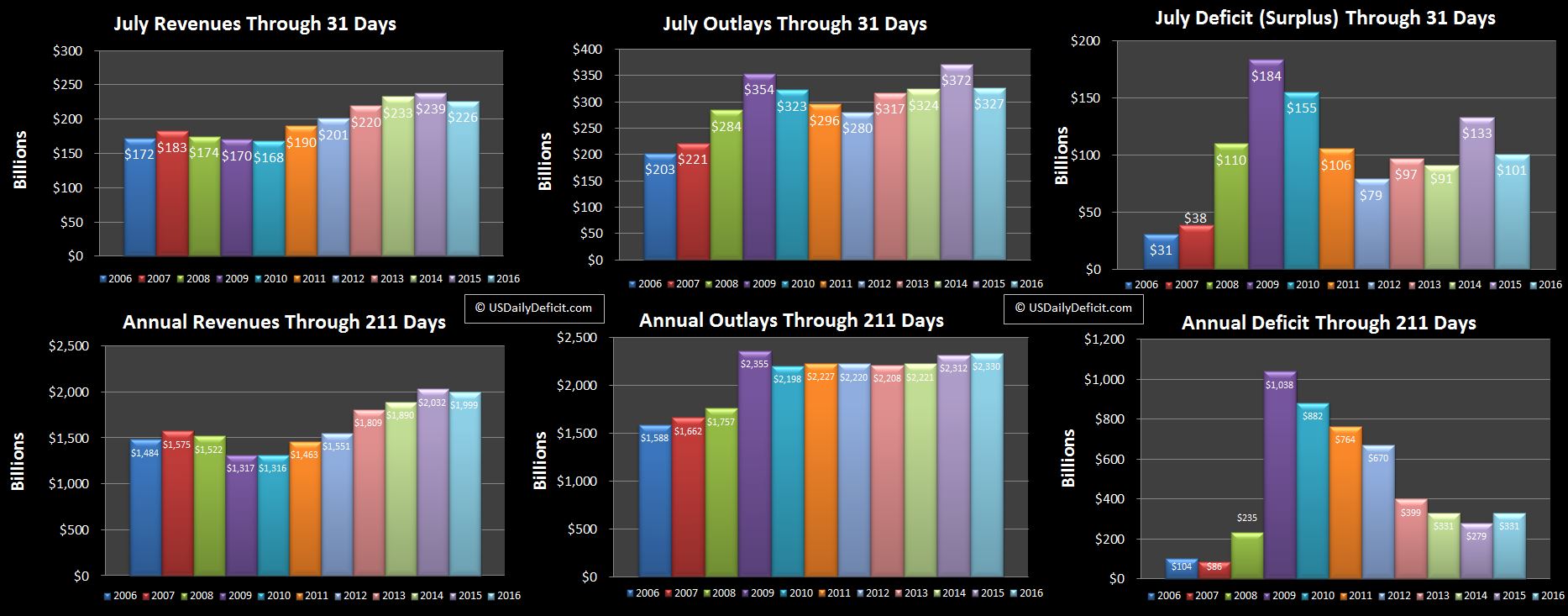

The US Cash Deficit for July 2016 came in at $101B for July, bringing the 2016 deficit through 7 months to $331B.

Revenue:

Revenue was down again, which of course is not a good sign, but thanks to the way the weekends fell, and July 4 falling on a weekend last year, July 2016 had 3 fewer business days than July 2015. Over the long run, it doesn’t matter so much, but that was always going to be a deep hole to dig out of, and obviously we just didn’t quite make it. Not to worry though, August 2016 gets 2 of them back, which should give us an excellent shot at reporting a healthy (looking) revenue gain in August.

Outlays:

Outlays were down big ($45B) YOY, but most of that was the timing of payments last year that were due in August, but paid in late July due to the way the weekend fell. If you back that out, and the 3 extra business days, the outlays would have been up, probably in the 3-4% range.

Deficit:

Thanks to the timing issue in 2015 that increased cost, the deficit for July was $33B lower than last year, but we should expect that timing event to reverse in August.

Summary:

Revenue stank, but it was probably just the business days issue. Cost looked good, but was all timing. Not a terrible month, but mostly just pushes our revenue question to next month. Looking forward to August, last year the deficit was $102B…this year I am looking for it to be about $150B as the timing shakes out, and hopefully we see some revenue growth in the 3-5% range.