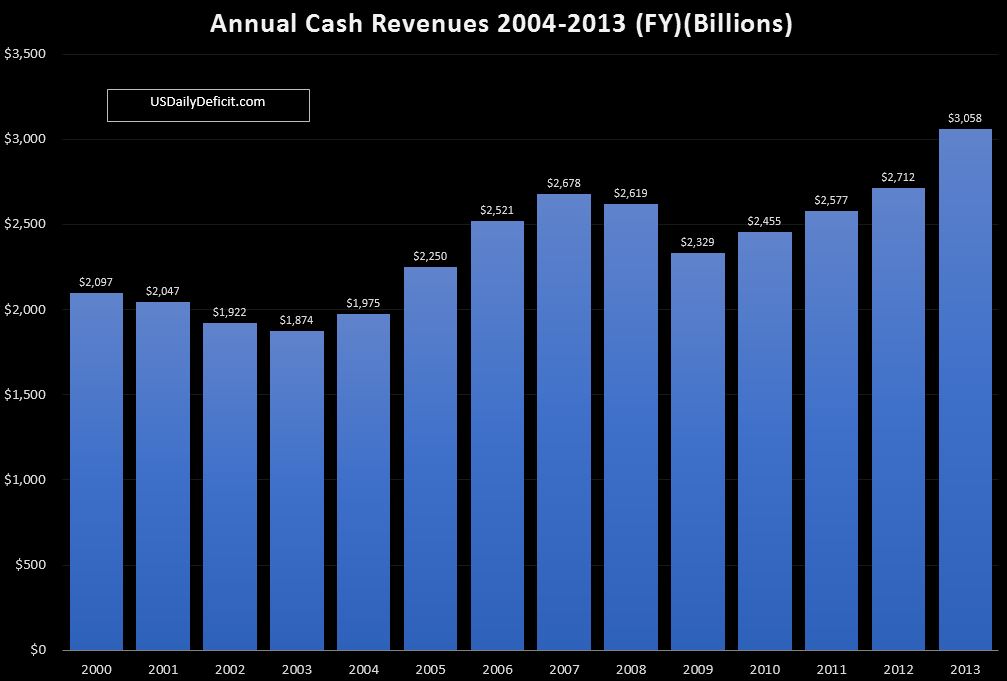

FY 2013 is now in the bank….racking up a $774B cash deficit, which is still absolutely terrible, but it does mark the fourth year in a row of improvement, and the first sub $1T deficit since 2008. This marks a $318B improvement over FY 2012 which came in at $1092B.

Revenues:

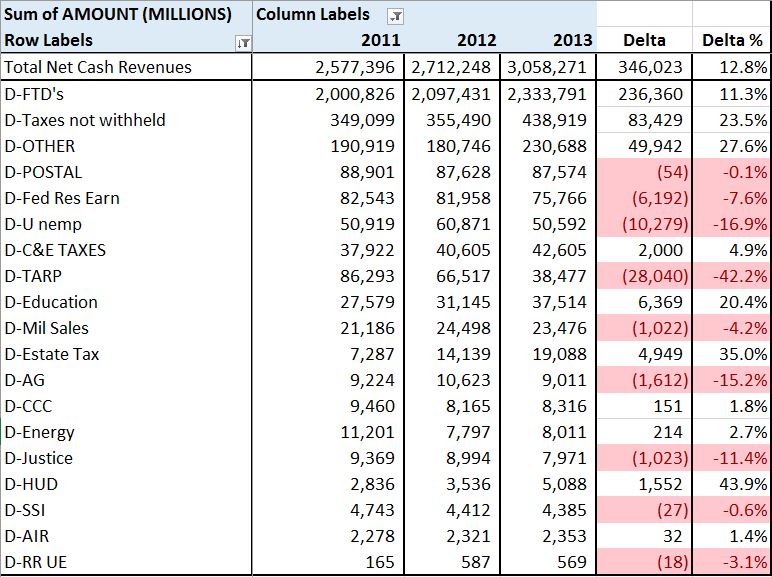

Revenues are pretty much the whole story of FY2013. Driven by tax increases that went into effect in January 1, 2013 and the tax avoidance behavior that preceded it, revenues were up an impressive $346B (13%) for the full FY. Corporate taxes were up $30B (11%), taxes withheld from paychecks were up $201B (11%) and taxes not withheld were up $83B(24%). These results are about $160B higher than I was predicting back in February, so there is no denying it…raising taxes raises revenues…at least in Y1. Of course…$60B of that miss was due to the Fannie Mae payday loan, but a miss is a miss.

Below is a further breakdown of revenues by source(note**they don’t add up because tax refunds offset revenue, but are not included in the table; Deltas compare 2013 to 2012):

All of our major categories have healthy gains, though “Other” includes the $60B from Fannie Mae. Deposits from the states related to unemployment insurance were down 17%…I would guess that the rates were lowered. Deposits from TARP reimbursements were also down big….a trend that will continue as they have pretty much slowed to a trickle in recent months.

I think even a pessimist such as myself has to be impressed by the YOY revenue gains we have seen in 2013, and will likely continue to see through December. The big question in my mind though is what will happen in calendar year 2014. Imagine a steady state country with $1T of annual revenues in Y1. Then, say they decide to raise taxes across the board 10%. It should not be a shock to anyone if at the end of Y2, revenues have grown 10% to $1.1T. But what to expect for Y3? All else equal, we will likely come in right about $1.1T again. Taxes were only raised once, lifting revenues up to a new steady state. Without a second round of new taxes, we have no rational reason to expect another 10% revenue growth right??

And yet…that is more or less what the CBO is projecting for the next 2 years….continued high growth of revenues. I’ve yet to make a FY 2014 forecast, but I’m thinking right now that 5-6% growth for 2014-2015 would be pretty optimistic. If they stick with 10%….we are going to end up pretty far apart. This is the big unknown at this point. If come April 2014, revenues are only marginally up….it is going to be abundantly clear to all that there is no chance of ever “growing out” of this problem. If, on the other hand…2014 does see 10%+ gains for the second year in a row….even I would have to see at least a glimmer of hope 🙂

Stay Tuned for Part 2…Outlays

Catch up (June/July 2018 Cash Deficit)