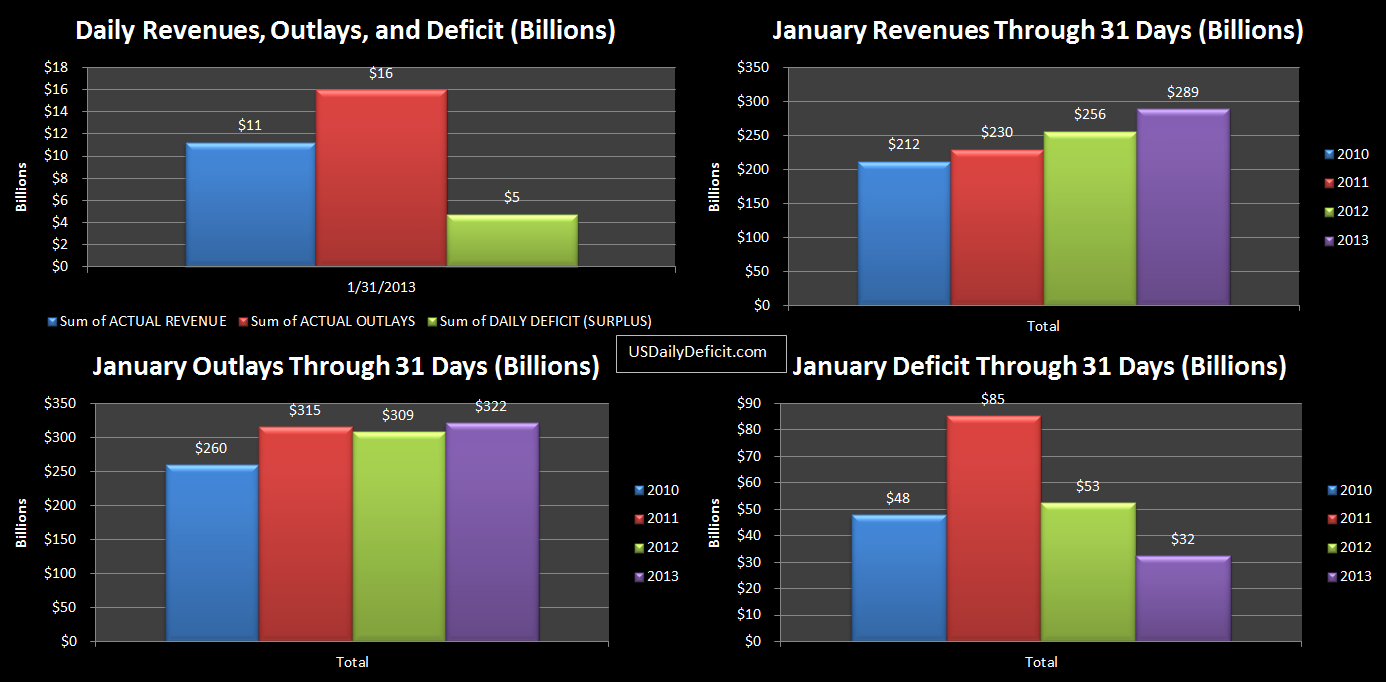

The US Daily Deficit for 1/31/2012 was 4.8B, bringing the January total to $32.4B, $20B less than January 2012. Revenues increased $33B, 15B from increased withholding, $12B from increased nonwithholding payments, with the remaining coming from miscellaneous other sources. Note that due to the delay in the tax filing date 8 days to 1/30/2013, tax refunds, which I net against receipts, were $9B lower than last year.

Outlays Increased $13B over last year, with increases pretty much across the board with the exception of interest which was down $8B from $19B to $11B. Looks to be a timing issue, where 12-2011 payments were shifted into 1-2012, spiking last years Jan interest payments. The difference, $20B is the improvement over 2012. Will the improvement be sustainable? February will give us a good idea, but I don’t think we will really know until May when tax season is over.

If anyone remembers, at the beginning of the month I predicted a deficit of $10B, so I missed it by$22B…a substantial improvement over last months $50B miss. Looking ahead, last February had $80B of revenues (net of refunds) and 329B of outlays for a deficit of $249B. I could see next month going either way. I’ll just stick with last year’s number and hang on for what could be a wild ride.