While I suppose it’s all relative, October is kind of a dull month in regards to the deficit. It’s not a quarter, so no revenue surges to predict or Fannie/Freddie payday loans to analyze. We do have the backdrop of the government shutdown and the impending debt limit, but the shutdown probably won’t have a material affect on outlays…maybe a few Billion? The Debt Limit could get interesting, but I have to think it will be resolved by month end, and any federal worker back pay will have been paid in full.

I could be wrong about all of this, in which case so will be my forecast, but honestly, it’s going to be wrong anyway, so why add additional uncertainty? So, I’ll stick with the same ol’ playbook, guessing we see ~10% YOY revenue gains and moderate reductions in cost. For the record, let’s just say $225B of net cash revenues and $316B of outlays, good for a $91B deficit…which would be a material improvement over last year’s $123B October deficit.

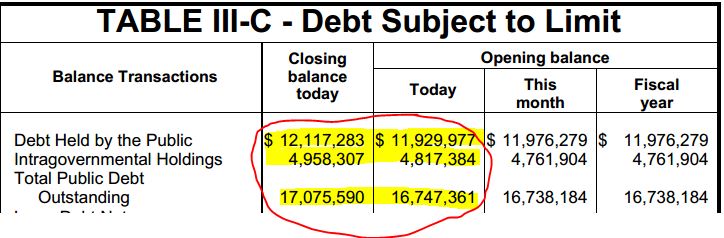

Cash in hand as of 9/30 was $88B, so we would normally think there was enough cash on hand to get us to the end of the month, but I recall reading a CBO publication mentioning some intercompany cash true ups that happen in October that may increase intercompany debt by about $80B…which would require a paydown of $80B of external debt to stay under the limit. That would probably be offset by some additional “Extraordinary Measures”…according to the same publication, there were about $90B or so left in that tank. So…You have to believe that there is a good chance we make it to the end of the month, but getting past the heavy outflows of early November might be a challenge. Of course…a higher deficit over the month would pull forward the “default date”, while a lower deficit would push it out a few days. In the long run, it really doesn’t matter. I haven’t put out a FY 2014 forecast yet, but it will probably be in the $700-800B range regardless of whether we run out of cash on 10/17 or 11/3.