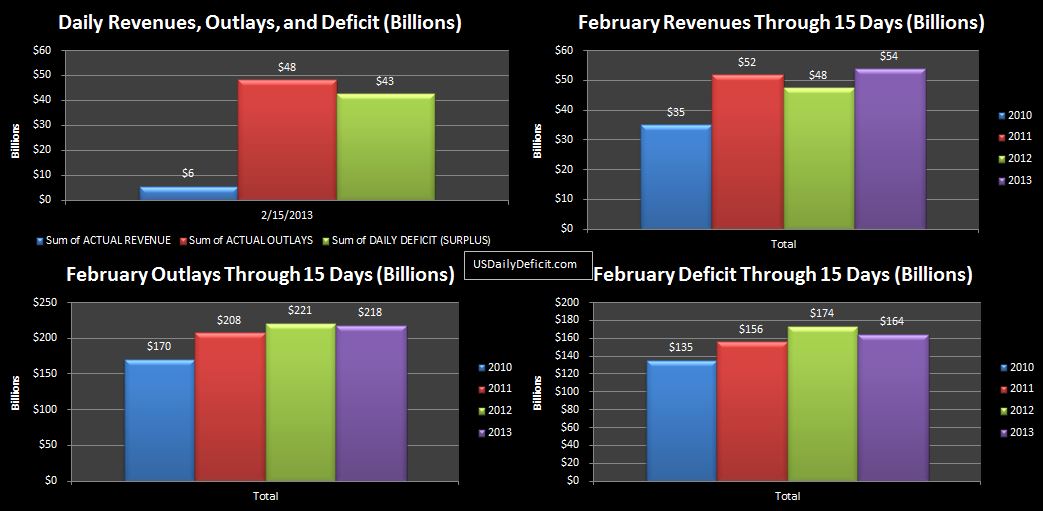

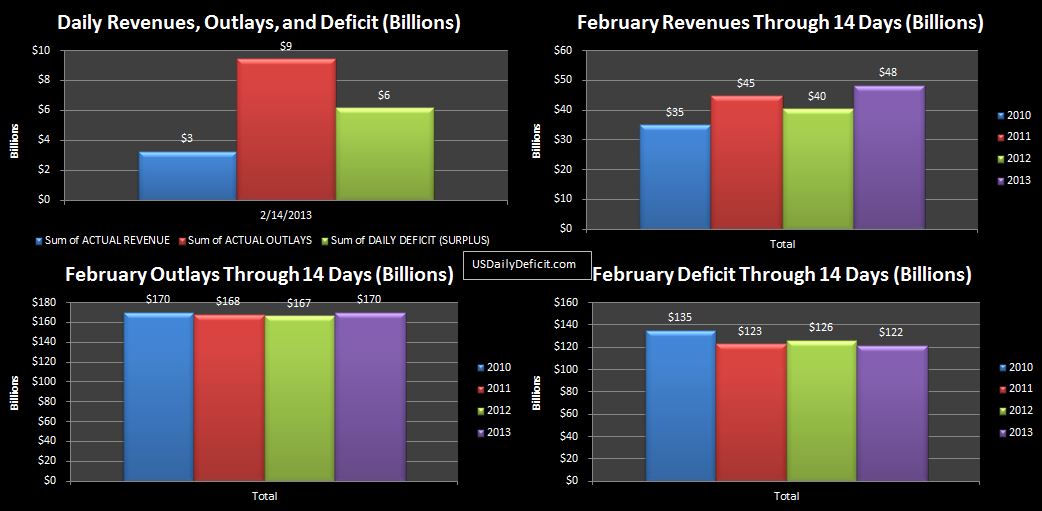

The US Daily Deficit for 2/14/2013 was $6.2B bringing the February 2013 deficit through 14 days to $122B, still pretty much in line with 2012 on all fronts. In other news, it has been about two weeks since the debt limit was raised, and not surprisingly, the debt has increased $107B over that period after an immediate $41B increase. The current cash balance is $51B, and there are approximately three more months until we get to start playing that game again…May 19 if memory serves. The next DTS won’t be issued until next Tuesday because of Presidents Day, but it could be another whopper due to a large interest payment I am expecting will be made today. $40B+/- deficit for 2/15/2013 is in the ballpark of what we can expect.

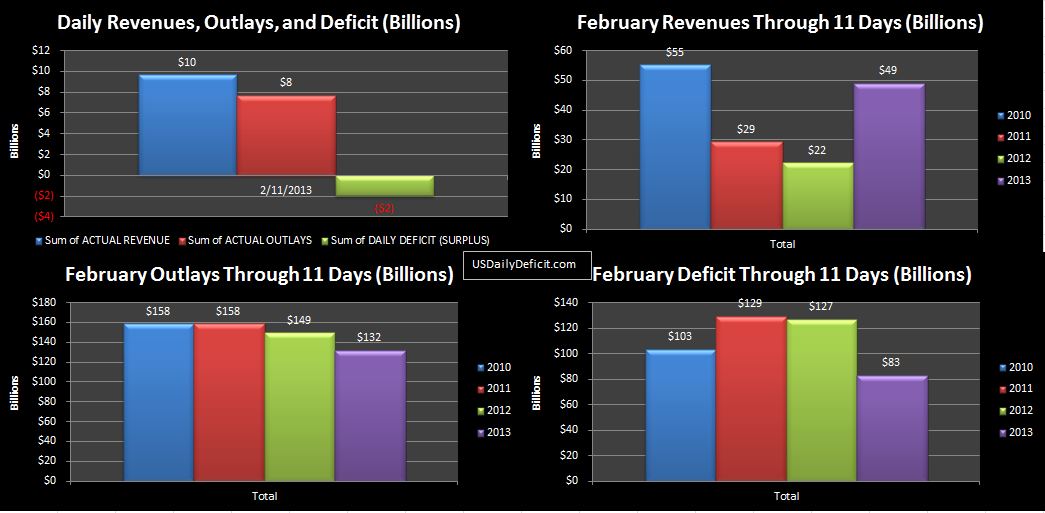

The US Daily Deficit for 2/13/2013 was $23.3B bringing the February deficit to $116B, almost completely closing the $35B gap between 2013 and 2012 we saw as recently as yesterday. With net revenues and outlays flat, and refunds accelerating, we appear to be on track for another February deficit in the $250B range. It is worth noting that gross tax deposits unadjusted for refunds are higher than 2012 by 8%, unfortunately, that’s only $6B, just barely enough to pay for about half of the refunds that went out just yesterday. Just a final note, net revenue does show as negative for 2/13, this is because refunds issued exceeded tax deposits.

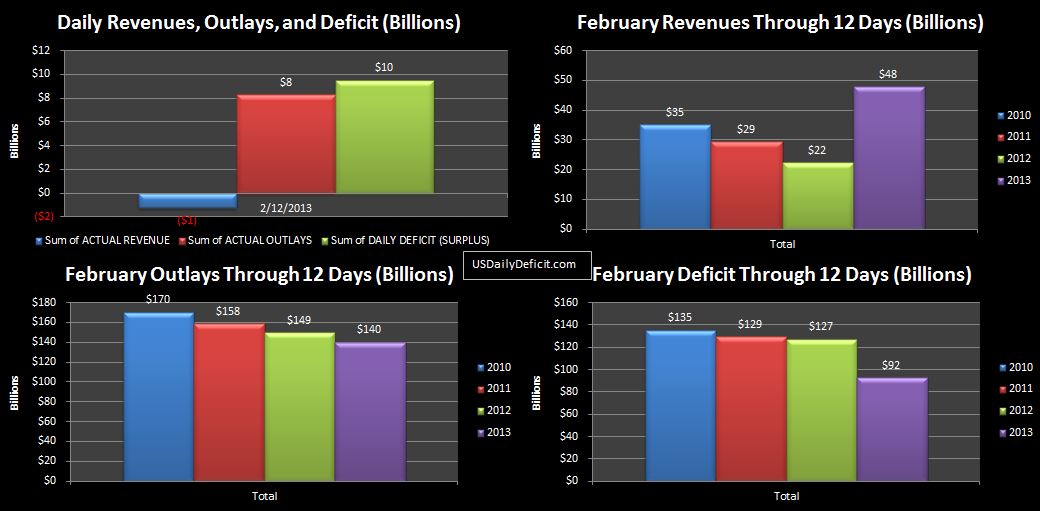

The US Daily Deficit for 2/12/2013 was $9.5B bringing the February deficit through 12 days to $92B. Refunds, once running $20B under 2012 have narrowed the gap to $11B. 2013 is currently $35B under last years’s deficit, but as we have been discussing, a lot of this is timing. I wouldn’t be surprised if tomorrow this narrows down to $15B or so as the second round of Social Security payments are made, especially if refunds continue to accelerate. The rest of the month looks like it will be more of the same…steady deficits in the $5-10B range, with the exception of this Friday, when an interest payment in the $30B range will be made, pushing the probable daily deficit up in the $40B range. The only other thing to keep in mind is that last February was a leap year, giving it one additional business day. All else equal (and we know it isn’t) this would lower our 2013 forecast by about $10B.