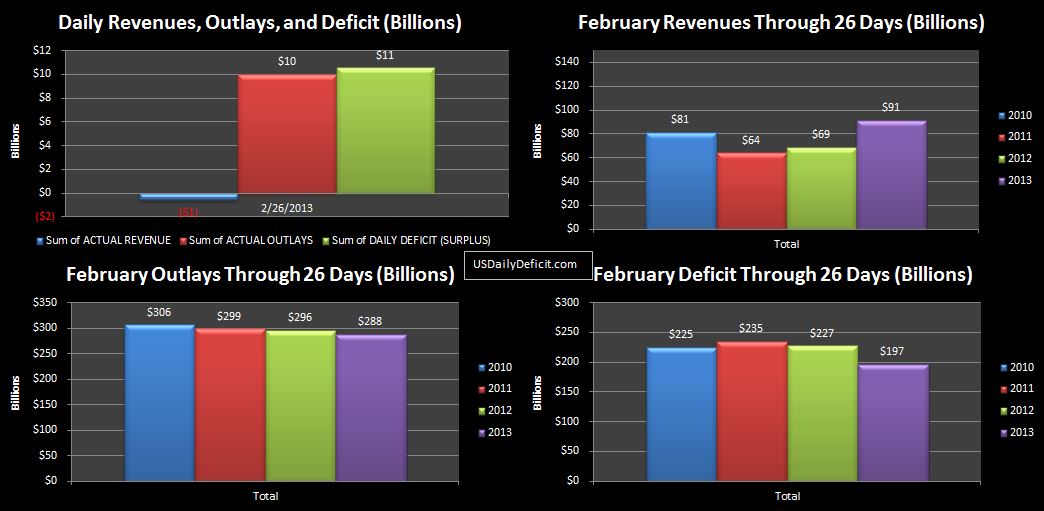

The US Daily Cash Surplus for 2/25/2013 was $0.6B bringing the February total through 25 days to $186B. With only three business days remaining, it is increasingly unlikely that the 2/2012 deficit will match or exceed the 2/2012 deficit. There are several moving pieces, but the two primary drivers for the improvement are likely to be a bona fide increase in tax revenues of about $$10B-$20B and tax refund delays pushing refunds into March and April of $10B-$20B. The extra business day in 2/2012 will also be a factor. We will have all our answers this Friday 3/1, with a monthly recap to follow.

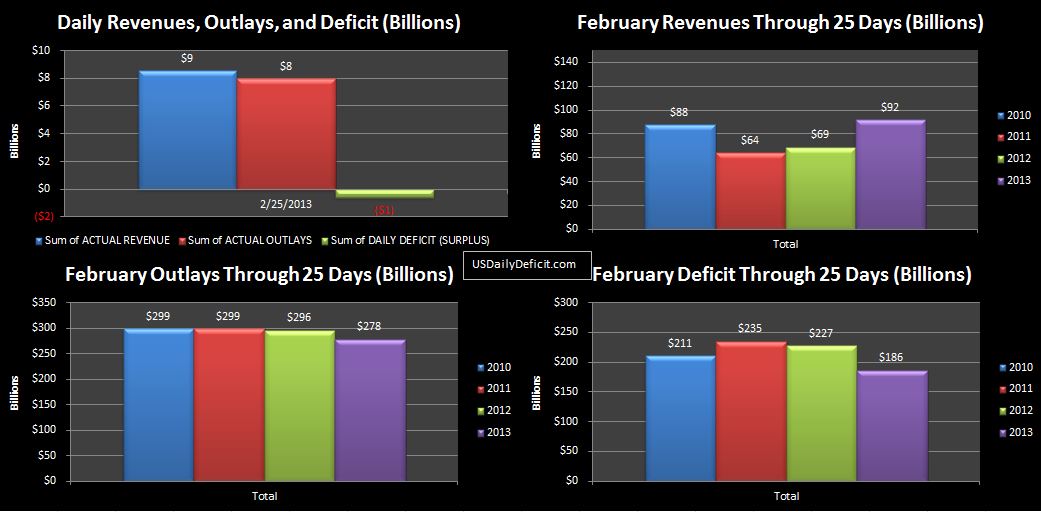

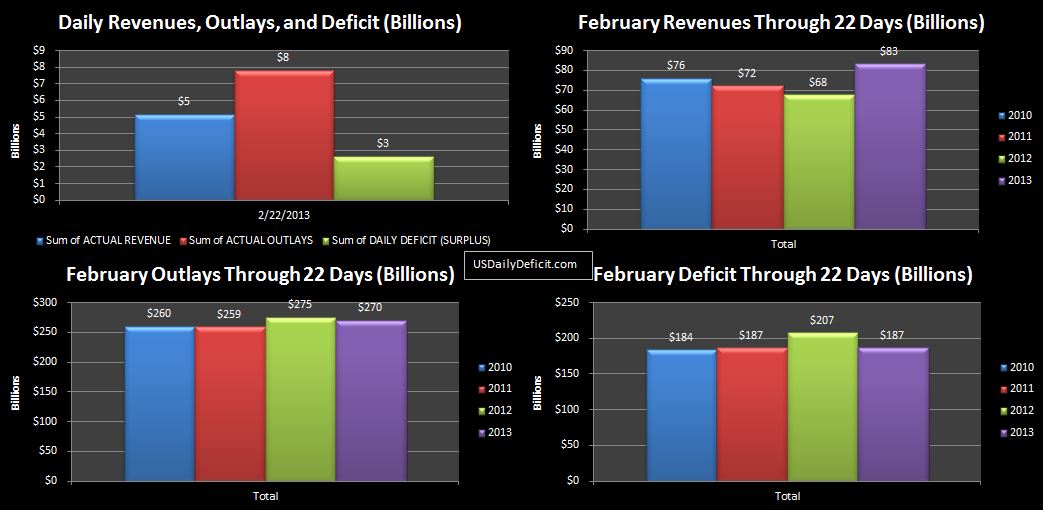

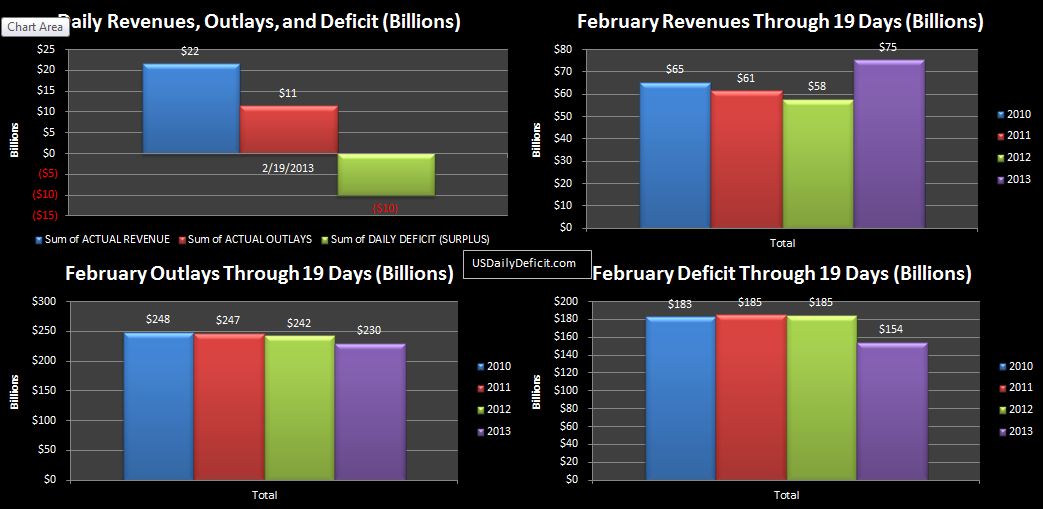

The US Daily Deficit for 2/22/2013 was $2.6B and the 2/21/2013 daily deficit was $10.1B, bringing our February total through 22 days to $187B, a $20B improvement over 2012 through 22 days. With 4 business days left, it does not appear unlikely that Feb. 2013 will top Feb. 2012’s record $249B deficit for a single month. Hooray!! that’s a good thing right? Unless we see some dramatic uptick in refunds, $225B seems like a reasonable estimate for where we will end up.

Unadjusted revenues through 22 days are up $15B over last year…more evidence that the recent tax increases are bringing in additional tax revenue. We will continue to watch this very closely, but it will probably be June before we get a clean year on year comparison because according to some reports I have read, tens of billions of income that would have normally been recognized in 2013 was pulled forward by companies and individuals into 2012 to take advantage of the lower rates. If true, this would create a spike in revenues in early 2013…through April 15, as people pay 2012’s taxes due. This spike would largely play out, potentially resulting in a trough on the other side where we see minimal year on year increases or even decreases in revenues.

On the outlay’s side of the ledger, we see cost actually a little lower than last year. I don’t think that sticks since 2013 still has a social security payment due tomorrow that will probably be in the $11B range. Even with an extra business day in 2012, it seems likely that 2013 ends a bit higher than 2012’s $329B of outlays, but you never know.

Though I’ve missed the last few days, it seems that the word of the day is “sequestration”, which I thought had something to do with jury duty, but apparently is actually a $10B per month…or so… cut in spending. Looking at the last 12 months, I see we average about $322B of spending per month, so we are talking about a 3% reduction that has everybody all hot and bothered. The left is worried the all the homeless democrats will starve, and the right is worried that maybe some of our nuclear missiles will have to wait until next year to get a new paint job. I haven’t a clue what will happen, but in the big scheme of things, even if they let this thing go through without “fixing” it next month and everybody claiming victory, it sure seems like a big nothing.

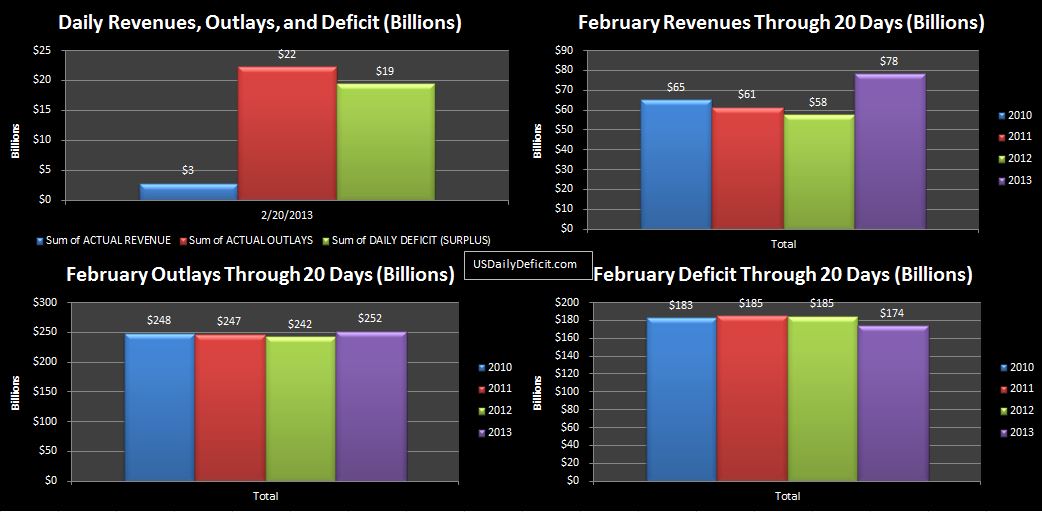

The US Daily Deficit for 2/20/2013 was $19.5B bringing the total February deficit through 20 days to $174B with the primary driver being yesterday’s $11.5B social security payment.

I’m taking a few days off for rest and relaxation, so no update tomorrow. My next post will probably be Monday…enjoy the weekend!!