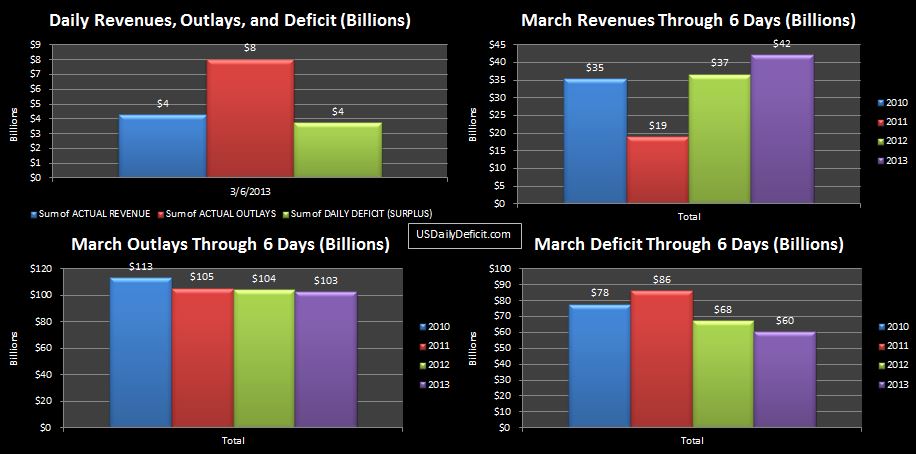

The US Cash Deficit for 3/6/2013 was $3.8B, bringing the six day total to $60B. Timing is still an issue, but through 4 business days, revenues are definitely running higher than 3/2012…I will be keeping an eye on them throughout the month…especially the corporate tax payments that should hit 3/15.