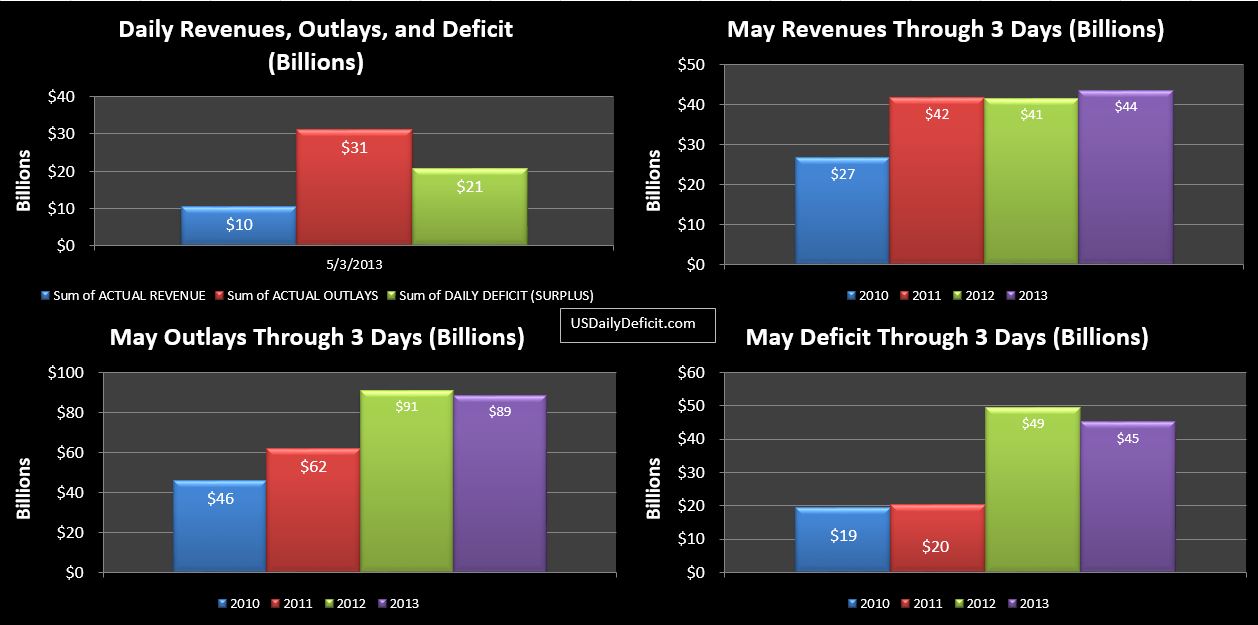

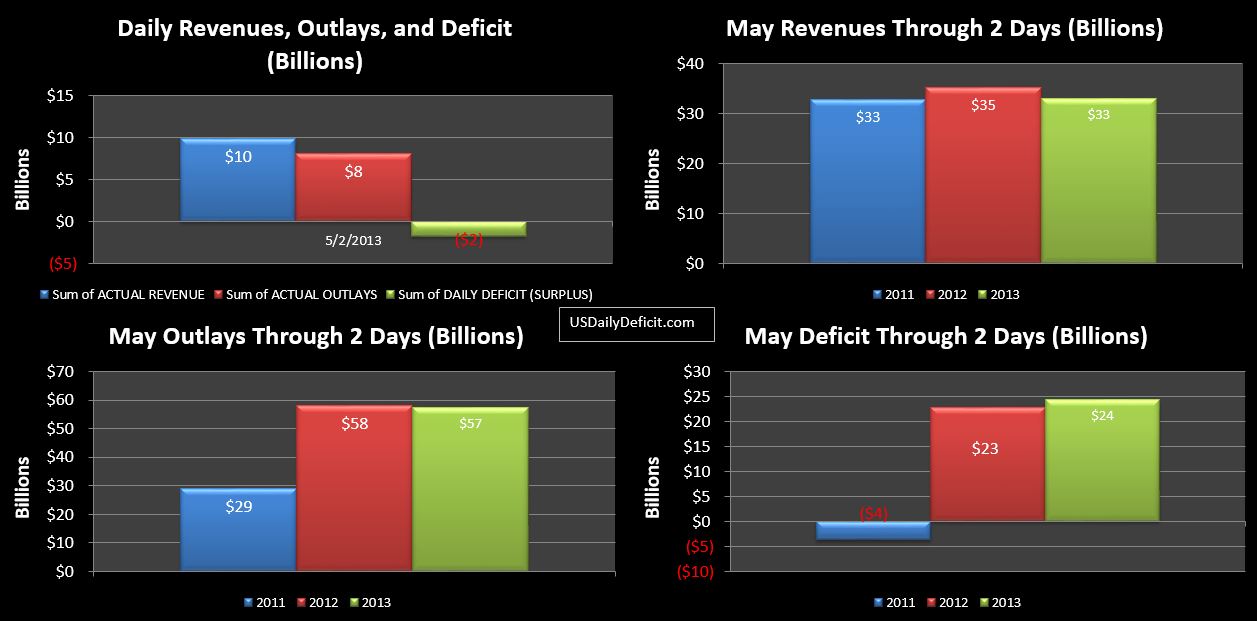

The US Daily Cash Deficit for 5/3/2013 was $20.8B bringing the May 2013 deficit through 3 days to $45B. The large deficit was primarily caused by Social Security payments of $24B… Social Security payments go out in 4 rounds throughout the month. The first and largest at ~$25B goes out the 3rd….but is bumped up if the third falls on a weekend or holiday. The next three rounds go out the 2nd-4th Wednesdays of the month, each at $11-$12B. Because of this, it isn’t surprising that we almost always see a deficit on Wednesdays.

Looking at the charts…through 3 days, all is pretty much in line with last May…..certainly nothing indicating 15%+ revenues, but the month is young. If this month follows last years script, the rest of the month should be a gentle accumulation running up to about $100B…probably more.

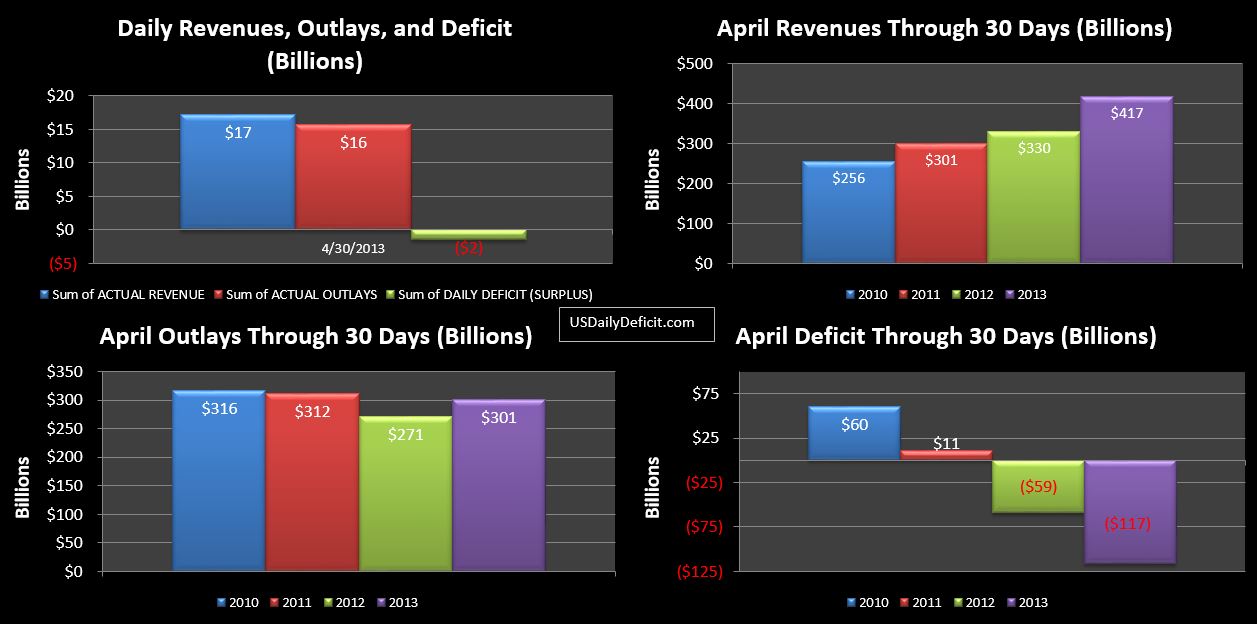

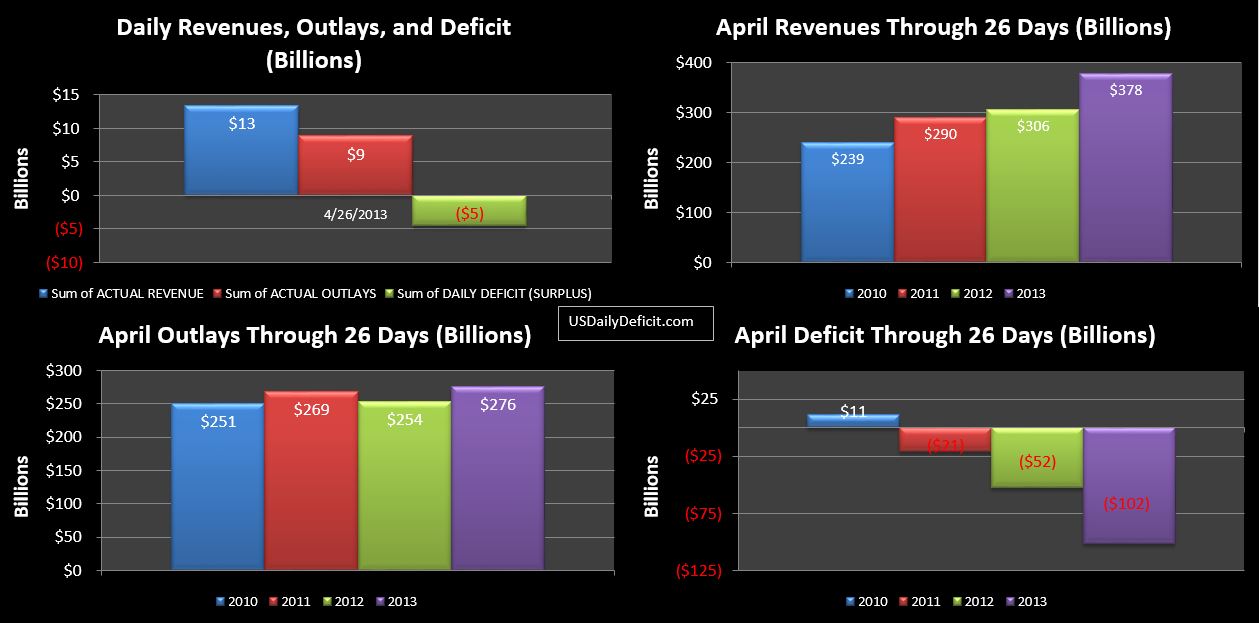

Two notable events stand out. On 5/15 a large interest payment around $30B will go out….giving us some insight into how ZIRP manipulation is going. For a few months now, monthly interest paid has actually come in lower YOY, despite having an additional $1T of debt. So savings from lower interest rates are more than offsetting the growing principle….hey…it’s a good deal if you can get it. However, March and April are very light in interest payments anyway…May provides us about $35B or so…twice the last two months combined, so a much better glimpse. I’m not expecting anything, but always on the lookout.

In my data series…which goes back to 2000 (and a few months of 1999) I see a high of 4.639% in 12/2001, and a new low last month at 1.837%. What we are looking for is a bottom, and a new trend back up above 2%….that’s when the trouble starts.

The second notable event will be 5/31…a Friday, when we will probably see about $20B or so of payments due 6/1 be paid out a day early. This may be enough to push the May deficit into the $125-$150B ballpark…but it all depends on what happens with revenue. This same cost shift also makes it likely that June 2013 will run a surplus…we’ll see.