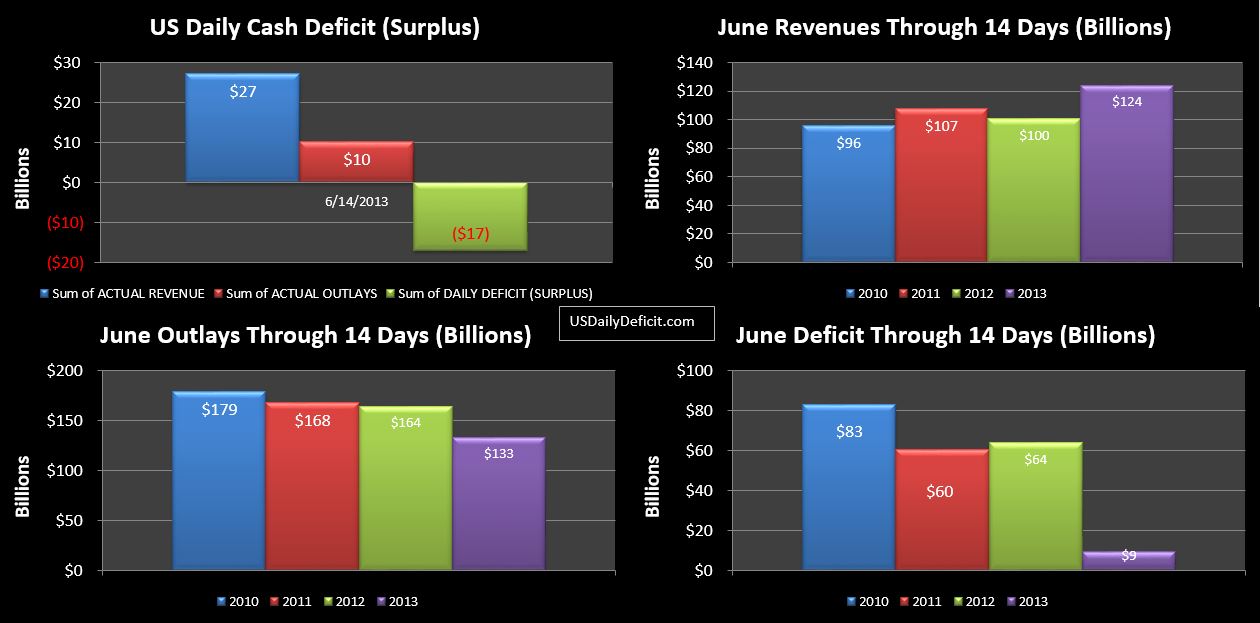

The US Daily Cash Surplus for 6/14/2013 was $17B as corporate taxes started flowing in. Though due 6/15…with the 15th on Saturday, $14B of corporate taxes flowed into federal coffersa day early…expect another $30-$40B before the week is out.

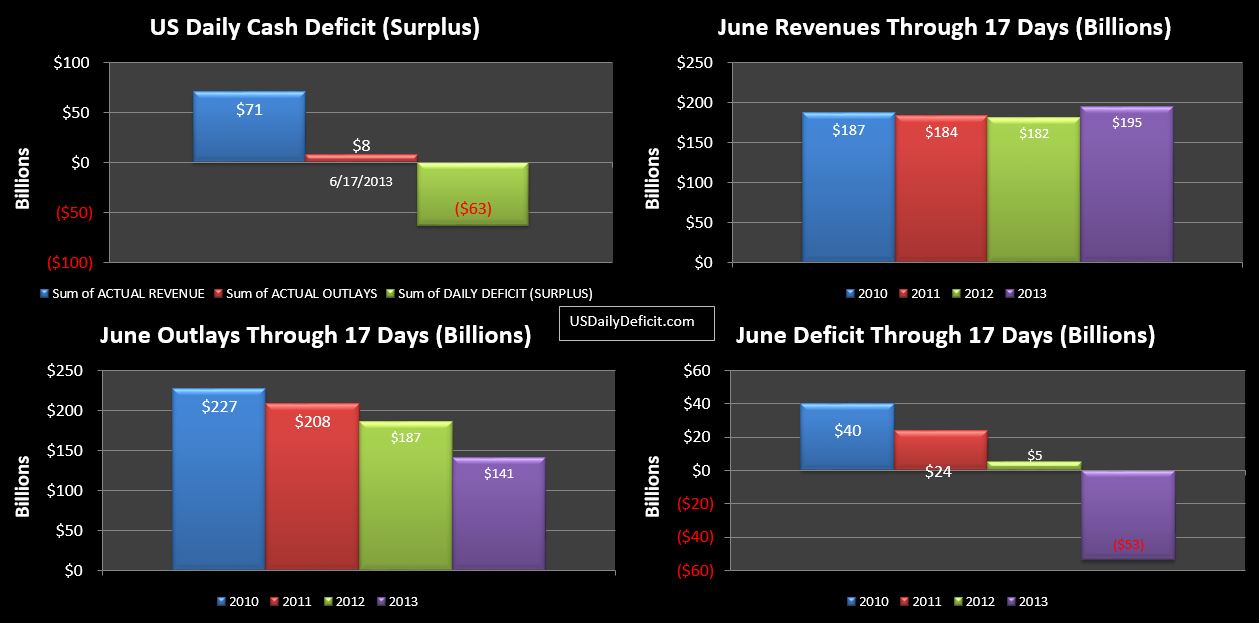

At first glance…the charts look fairly impressive but a lot of this is timing due to a lot of corporate tax payments being made 6/14 that were made 6/15 last year. This should all flush out in a few days. On the cost side….adding back in the $30B we’ve been discussing for a while shows that cost is still flat….no surprises there.

Tomorrow’s report (for today) should show the majority of the remaining corporate taxes we will see in June. Through 5 months, 2013 corporate taxes have been running about 20% over last year….seeing how June compares to that rate should be a very interesting indicator.

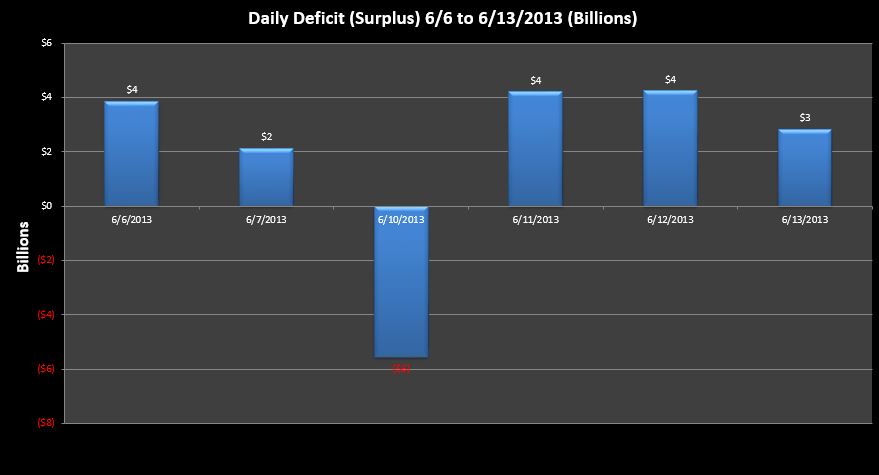

I’m back…

Didn’t really miss a whole lot…the above chart shows the daily deficit for the six days I missed.

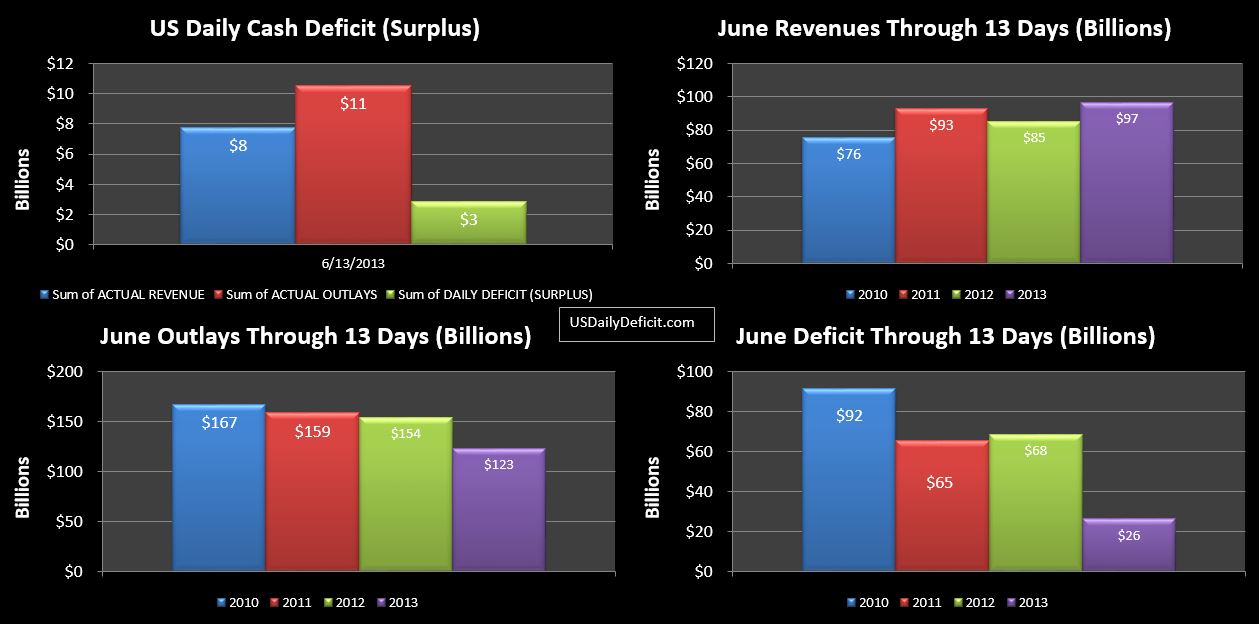

Above is our standard chart for 6/13. Nothing is really in sync, but we have revenue up $12B for a 13% YOY increase. It looks impressive, but I wouldn’t put too much faith in that…yet. If it still looks like that at the end of this week after all the quarterly tax receipts are in…it will be an impressive number.

Costs are down $31B….just about all due to timing…adjusted for that, we are pretty much flat. And of course the deficit follows these…a $42B improvement….which should only get better with the rumored $60BFannie Mae payment….

We should see ~$50B or so of corporate taxes and $30B+ of tax deposits “not withheld” over the next week…so surpluses are on the way…what we are really interested in is the YOY changes. +12% is kind of a baseline…anything under this would be disappointing.

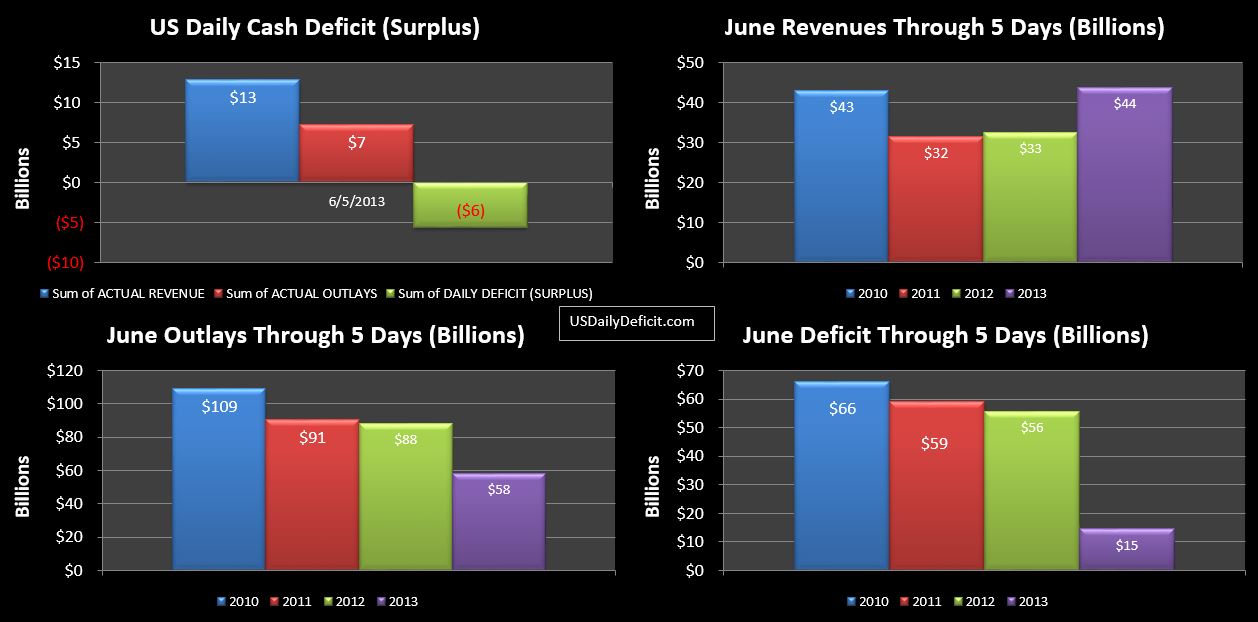

The US Daily Cash Surplus for 6/5/2013 was $5.6B dropping the June 2013 deficit through 5 days to $15B. At this point in the month…we have timing issues galore, so the charts are crazy….I think we are going to have to get used to that this month.

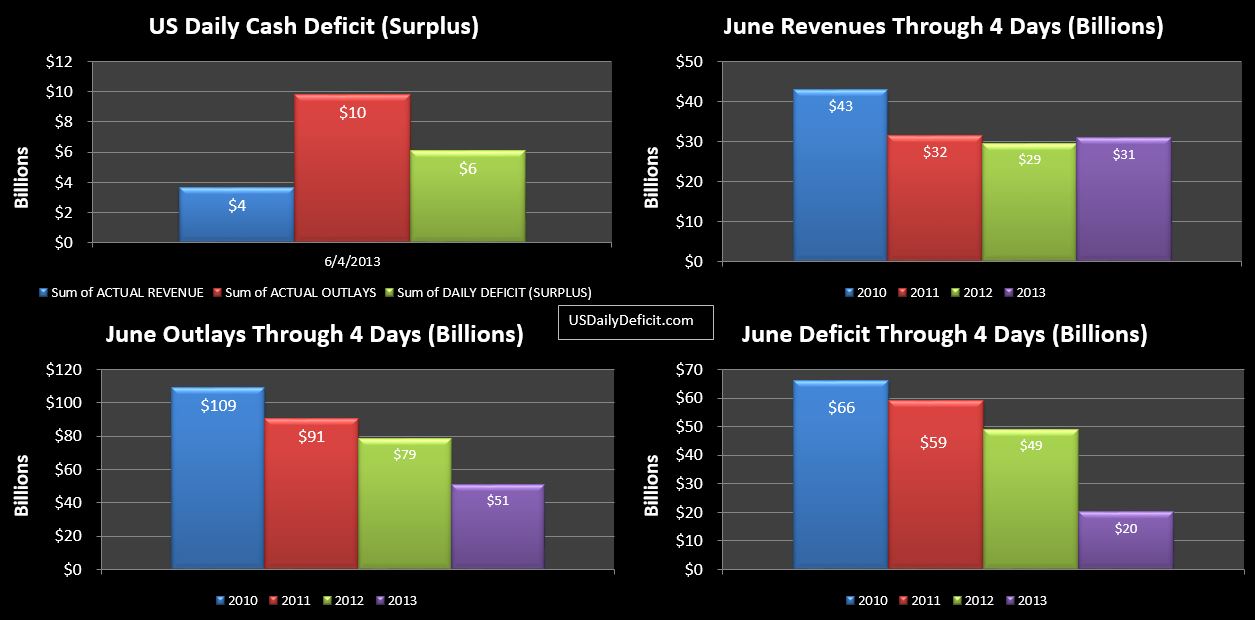

The US Daily Cash Deficit for 6/4/2013 was $6.1B bringing the June 2013 deficit through 4 days to $20B. While this appears to be a $30B improvement over 2012…it’s not really….remember $30B of June outlays were pulled into May, so adjusted for that, we are more or less in line, but with only 2 business days in the books, it’s really too early to identify any trends.

Looking ahead, the next week or so should be pretty low key… we’ll probably run a $10-$20B deficit over this time period. Then, around mid month, corporate taxes and taxes not withheld should start flowing in…probably bringing us back into surplus territory. Then…at some point, Fannie Mae is supposed to send a $60B special one time dividend, thanks to their decision to drop GAAP and convert to Enron Accepted Accounting Principles (EAAP)…..which are almost(but not quite) as shady as government accounting principles :).