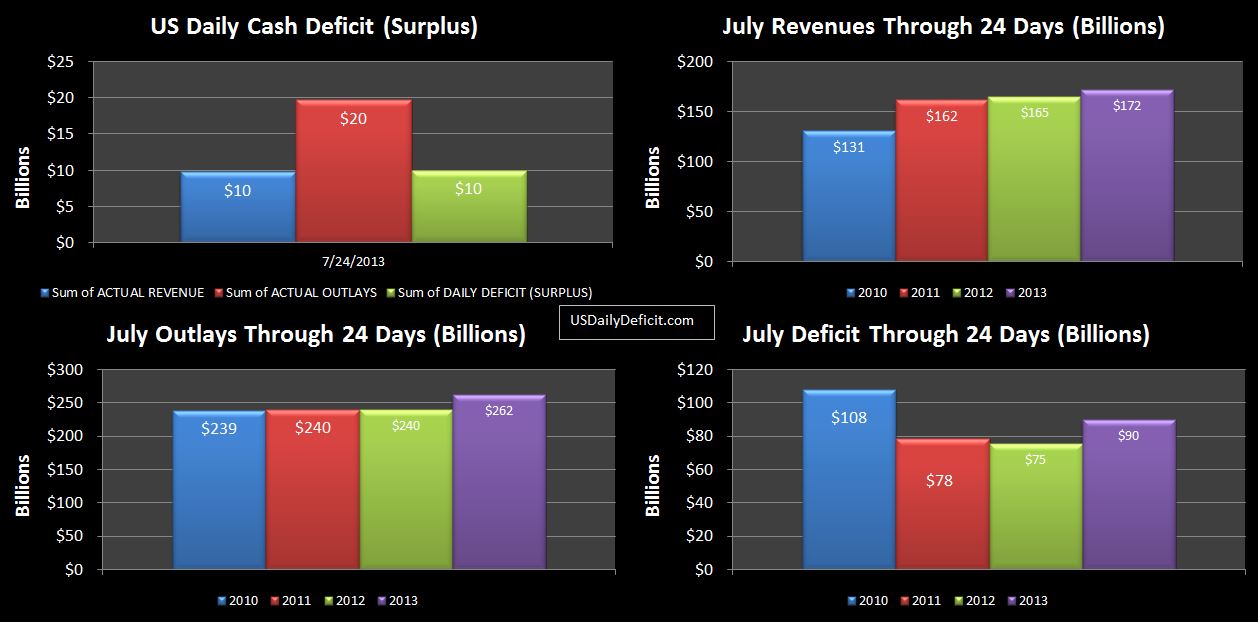

The US Daily Cash Deficit for 7/24/2013 was $9.9B pushing the July 2013 deficit through 24 days to $90B with five business days remaining. After several weeks of pulling away from 2012, 7/24 delivers an apparent 5B setback to revenue bumping us back down to 4% YOY growth. However, after further investigation, I suspect most of this is due to small timing differences…a ~4B deposit from the states is likely to come through tomorrow should put us right back up around 7-8%.

So…with a week remaining, we are at $90B. I could see this going +/-$10B from here with the big unknown being the extra day…next Wednesday. Typically, Wednesdays have pretty solid revenue numbers, but the large SS payments that go out in week 2-4 on Wednesdays typically make it a big deficit day. So outlays should run at reduced levels, but revenue…I am not sure.

Cash:

Cash in hand, at $51B is looking a bit light to make it through August…which will probably run a $125B-$150B deficit. Can Treasury pull $100B out of their magic hat??? Sure…why not?? They’ve done it before…it would be a bit naïve of me to assume otherwise….but still, I can’t help but watch…just in case something crazy happens. Even if they make it through August, they have to squeak by the first two weeks of September before revenue really starts pouring in….then October comes on strong with another nearly $100B deficit.