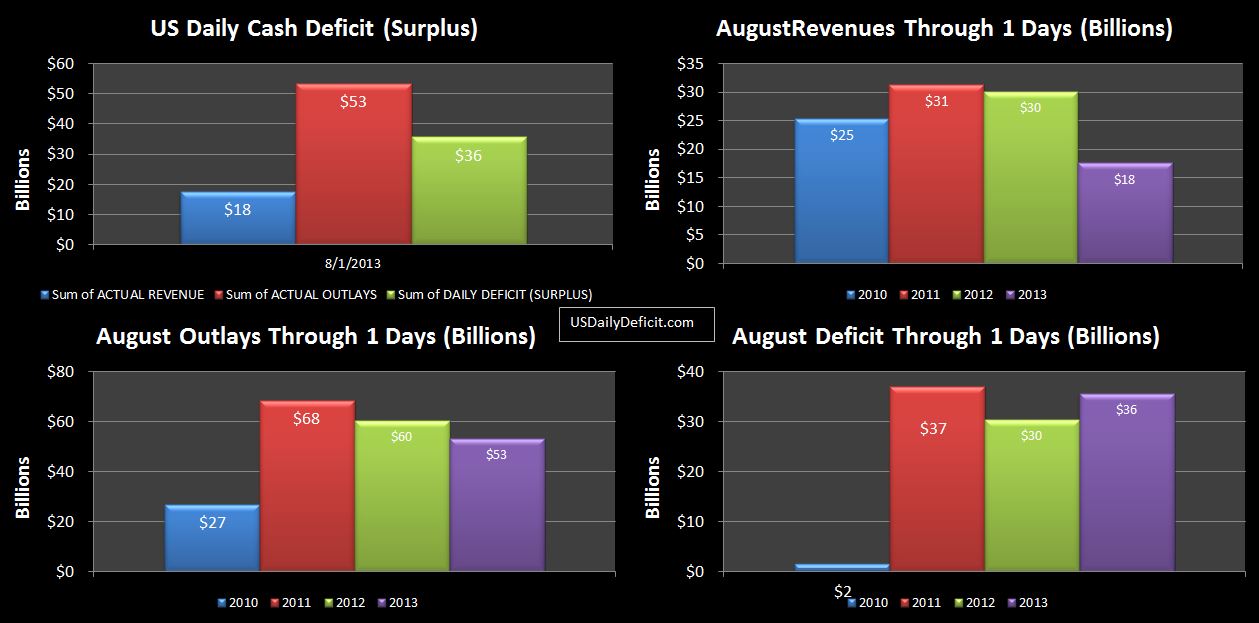

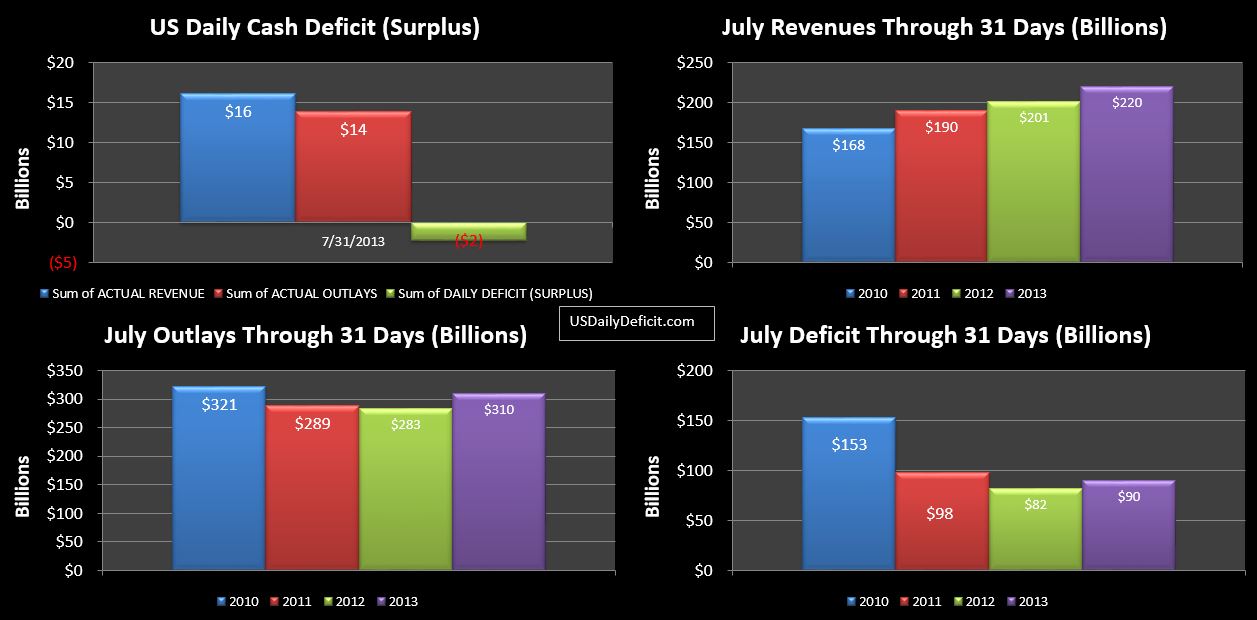

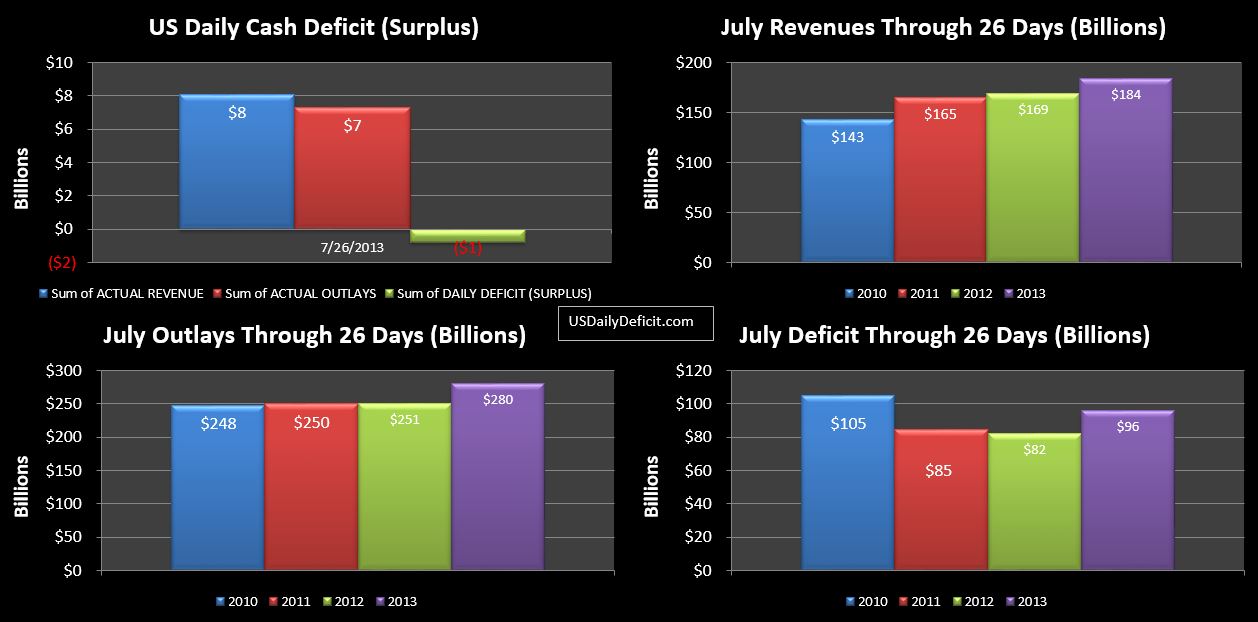

The US Cash Surplus for 7/31/2013 was $2.2B bringing the July 2013 deficit for the full month to $90B exceeding the July 2012 deficit of $82B by $8B.

As expected, the last day of the month brought in strong revenues and strong outlays. $16B of revenues helped push yesterday’s meager 1% YOY gain all the way back up to 9%…respectable, but well under the pace set in the Jan-April period. Just for reference…YOY gains in revenue from Jan-April were about 15%…May through July, adjusting for the Fannie Mae payday loan is running at 9% YOY growth.

I’m pressed for time now, but will try to crank out a more in depth July review over the weekend. In the meantime…we get a first glance at August in just a few hours.

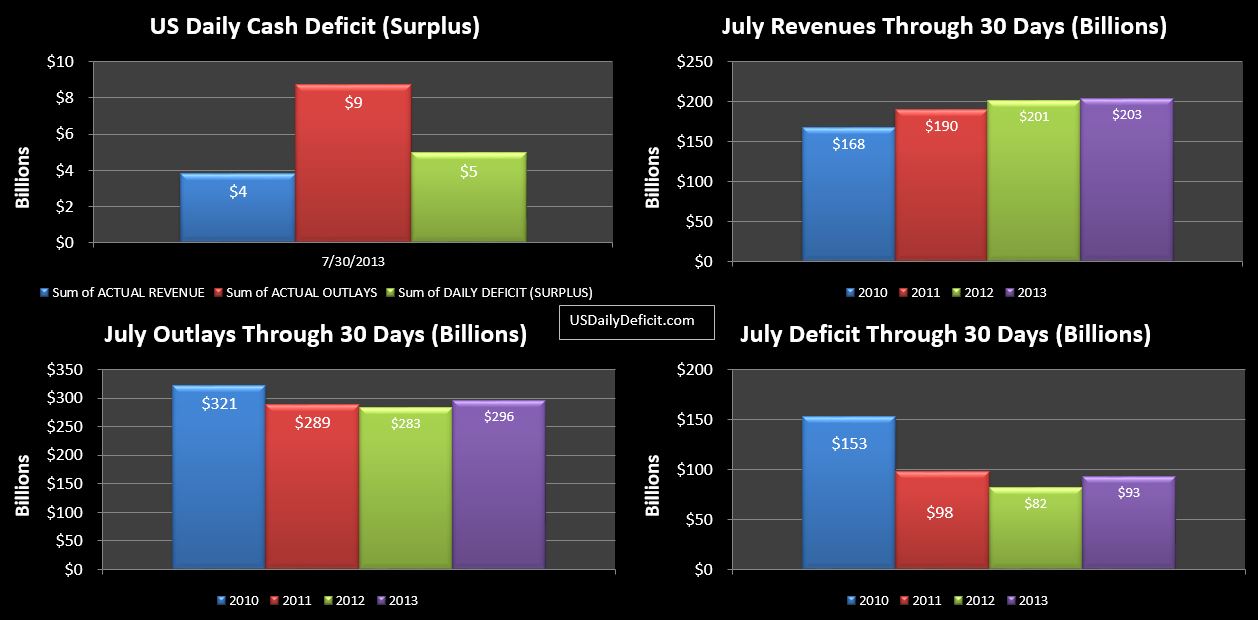

The US Cash Deficit for 7/30/2013 was $5.0B pushing the July 2013 deficit through 30 days back up to $93B with just one business day remaining.

Recall…I aligned 2013 and 2012 by business days and day of week…So we are comparing 21 business days to 21 business days, but July 2013 has an extra day, so we are comparing All of July 2012 to 30 days of July. This is more or less what the month would have looked like without the extra business day….Flat revenues, and adjusted for timing, small, but noticeable reductions in outlays.

Yet…we do have an extra business day, so we can probably expect an additional $10-15B or both revenues and outlays. It still looks more likely than not revenues, even with the extra day will come in under 10%….August…which loses a business day could be downright ugly…

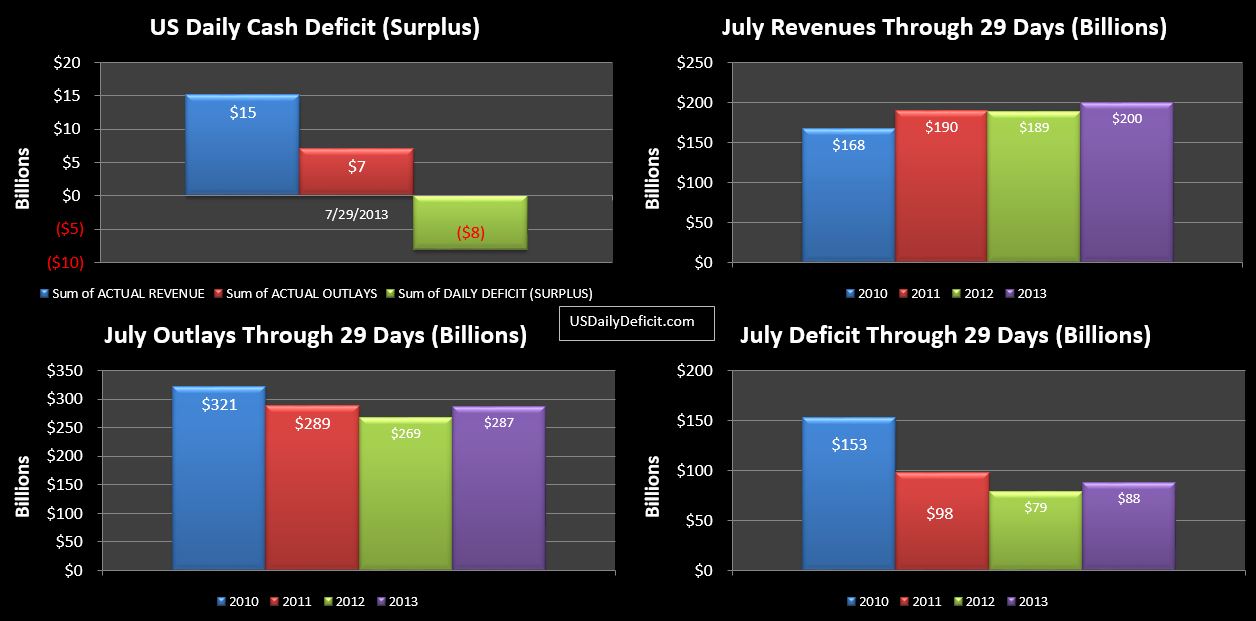

The US Cash Surplus for 7/29/2013 was $8.1B on strong Monday revenues and typical outlays. With two business days left, the July 2013 deficit is sitting at $88B. Tuesday normally yields a moderate deficit, and Wednesday…well, anything goes on the last day of a month. I expect revenues to be elevated, but there will also be a $5B or so interest payment…I’m more or less expecting a wash. I believe my initial estimate for the month was $80B…later revised to $90B +/- $10B (somebody correct me if I’m lying here…no time to go back and check right now). That still sounds good to me…we’ll know for sure in 48 hours.

Remember….I’ve attempted to synchronize the months based on business days…so we are actually comparing through Monday the 30th of last year. I think this gives us the most useful YOY comparison… we’ll catch the extra day this Wednesday…should be good for an extra $8B or so revenue…and cost:(