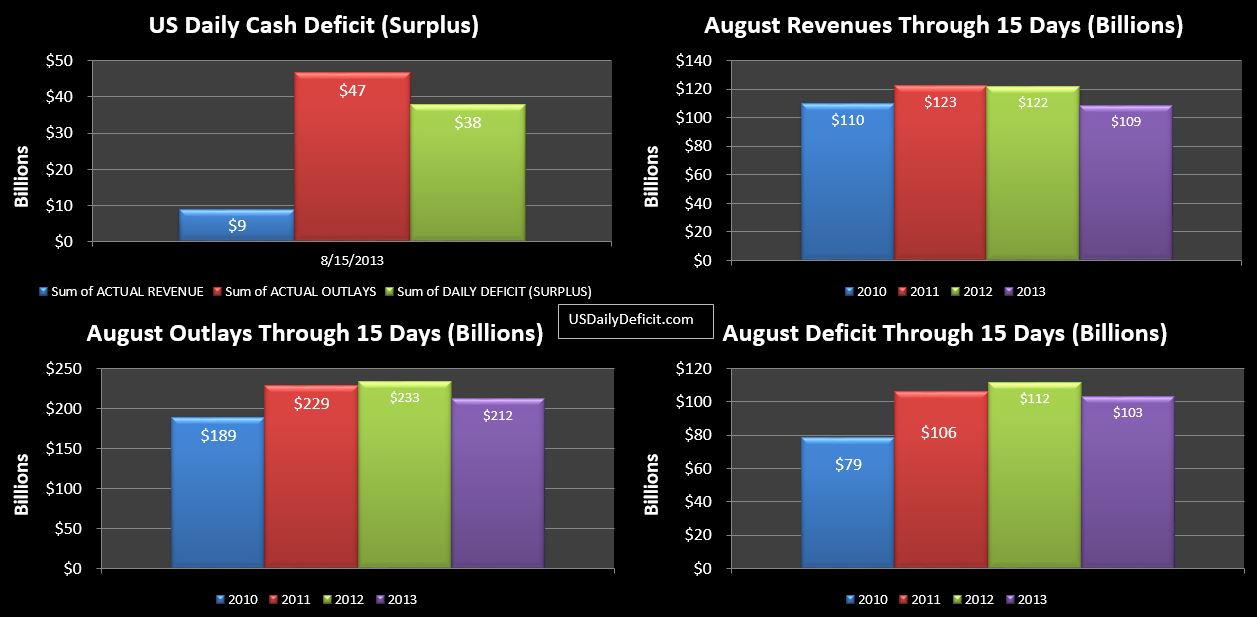

The Cash Deficit for 8/15/2013 was $37.9B bringing the August 2013 deficit through 15 days to $103B.

As expected, cash interest payments went out on the 15th…$34.5B worth…about $1B higher than last year…I had expected a small drop. Adjusted for Social Security timing, outlays are down about $9B YOY, with $5B of that reduction coming from defense vendor payments.

On the other side…we did receive the corporate tax deposits I had expected, but on the month, we are down 8% YOY…though that’s only $300M since August is not a strong month for corporate tax receipts. Halfway through the month, we are down $13B over last year (-11%) where we have come to expect ~10% gains. There probably aren’t any revenue surprises left…just the typical monthly payroll deposits. Is this a turning point? Or will the next 2 weeks bring with them a flood or revenues? Stay tuned folks!!