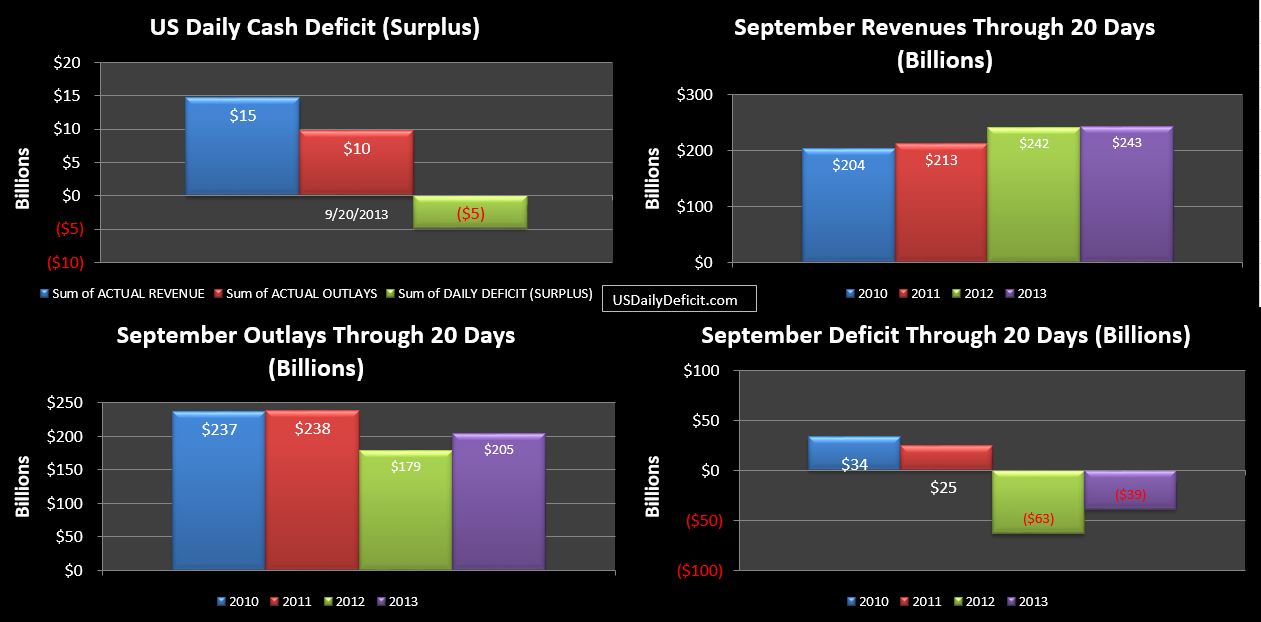

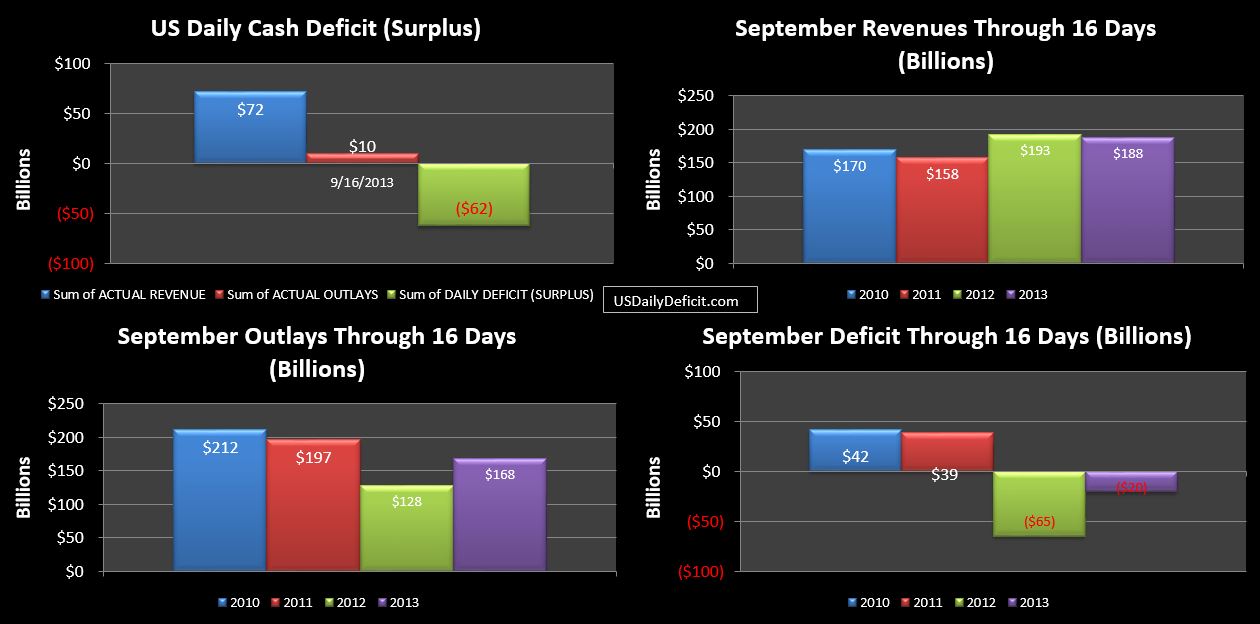

The US Daily Cash Surplus for 9/20/2013 was $4.9B pushing the September 2013 surplus through 20 days to $39B.

Friday was actually a pretty good day, with Revenues gaining about $4B YOY and finally catching up with last year, ending at $+1B…good for a 0.5% YOY improvement. “Taxes not Withheld led the charge with nearly a $2B improvement, actually increasing from the prior day, where we typically expect these to start tapering off pretty heavily as all of those checks that were “in the mail” are received and cashed.

With six days left before the end of the FY, there is a bit more uncertainty left than I expected. First there are the Freddie/Fannie Dividends…which look to be about $10B higher than last year. Second is the extra day…a Monday (typically strongest weekly revenues), and finally, it is impossible to predict how “tax deposits not withheld” are going to finish the month. Were it not for these things, I’d probably guess we would see very little deficit action over the rest of the month, ending right about a $40B surplus. However….given these outstanding items…. a $70B surplus (my initial forecast) still seems like a possibility if the stars align. If not… a bit lower.