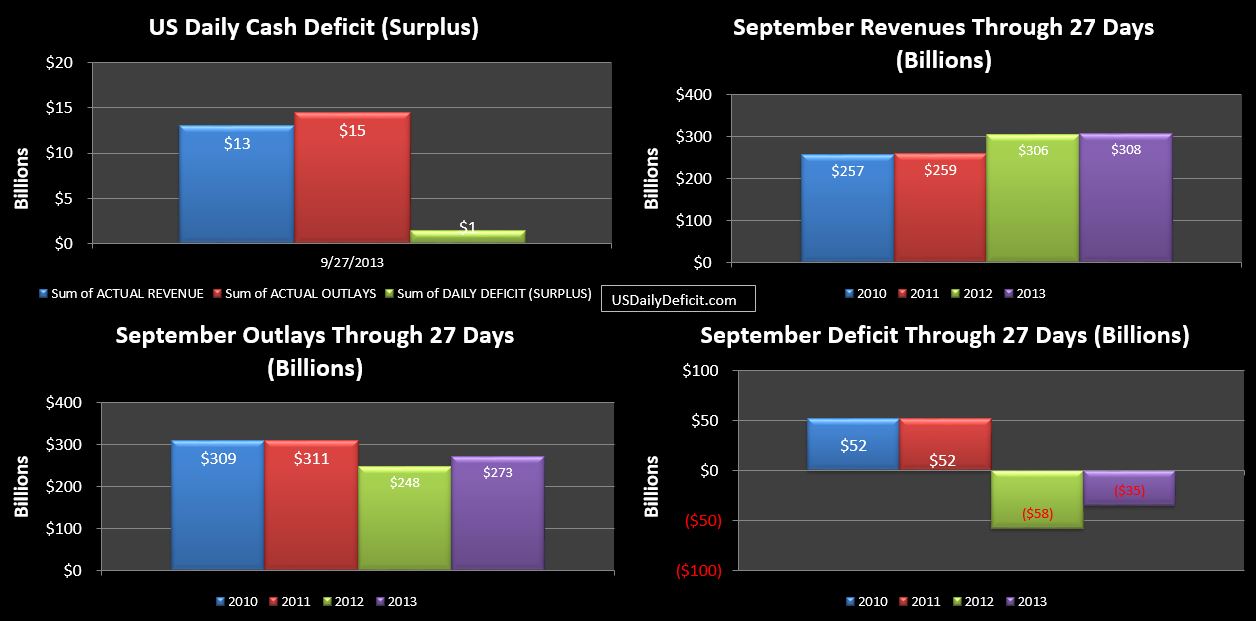

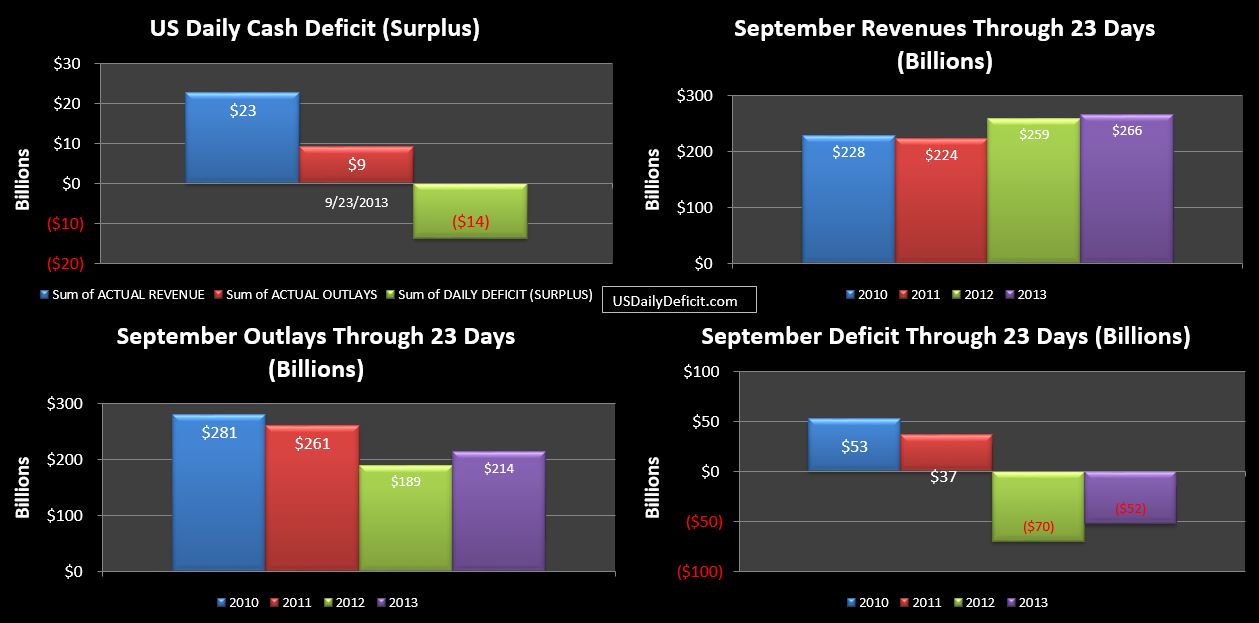

The US Daily Cash Deficit for 9/27/2013 was $1.5B bringing the September 2013 Surplus through 27 days to $35B. I half expected a moderate surplus today, but it wasn’t to be.

So at this point, we are comparing all of September 2012 to September 2013 with one (extra) business day remaining. Revenues are back to flat at only +$2B (0.7%) YOY. Part of that is timing….the last day of the month often has higher than average revenues as special payments are made….like the Fannie/Freddie payments. last year those happened on 9/28..a Friday. this year they will happen on 9/30, a Monday. So we will likely see heavy inflows Monday.

My beginning of the month forecast was a $70B surplus, but that is looking a bit optimistic at this point sitting at $35B, with only one day left. There’s a lot of uncertainty, but we will likely see a large surplus 9/30, I’d guess in the $15-$25B range…$35B would be quite a surprise to me. We’ll find out tomorrow…assuming Treasury is still publishing the DTS during the apparently imminent government shutdown.