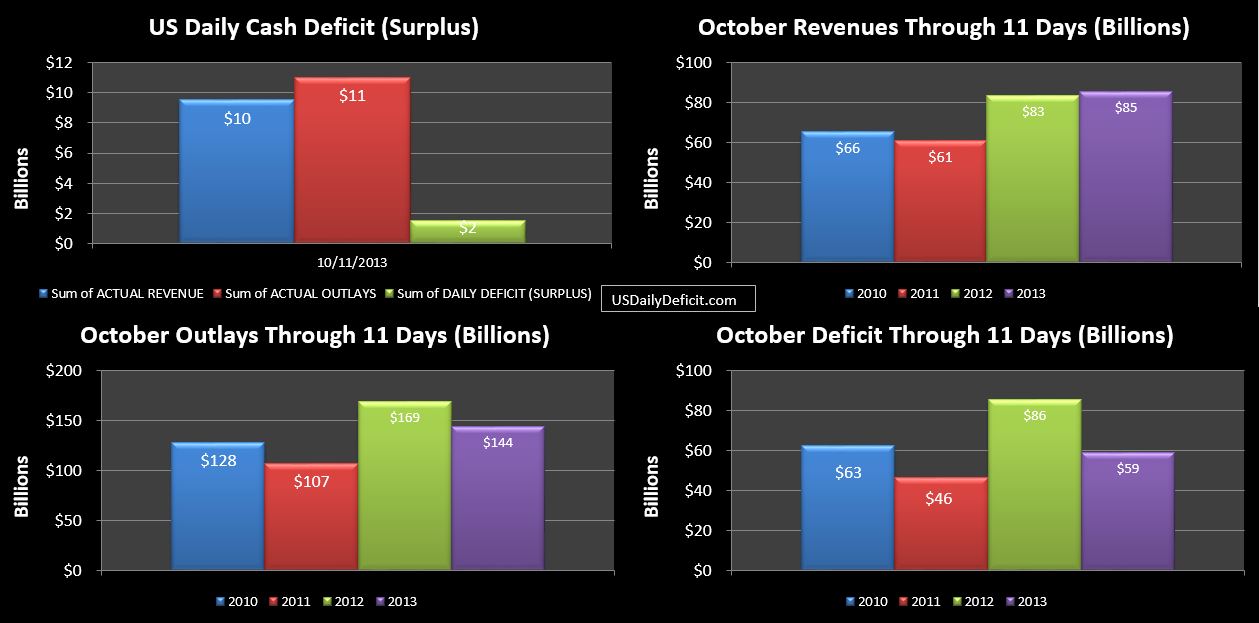

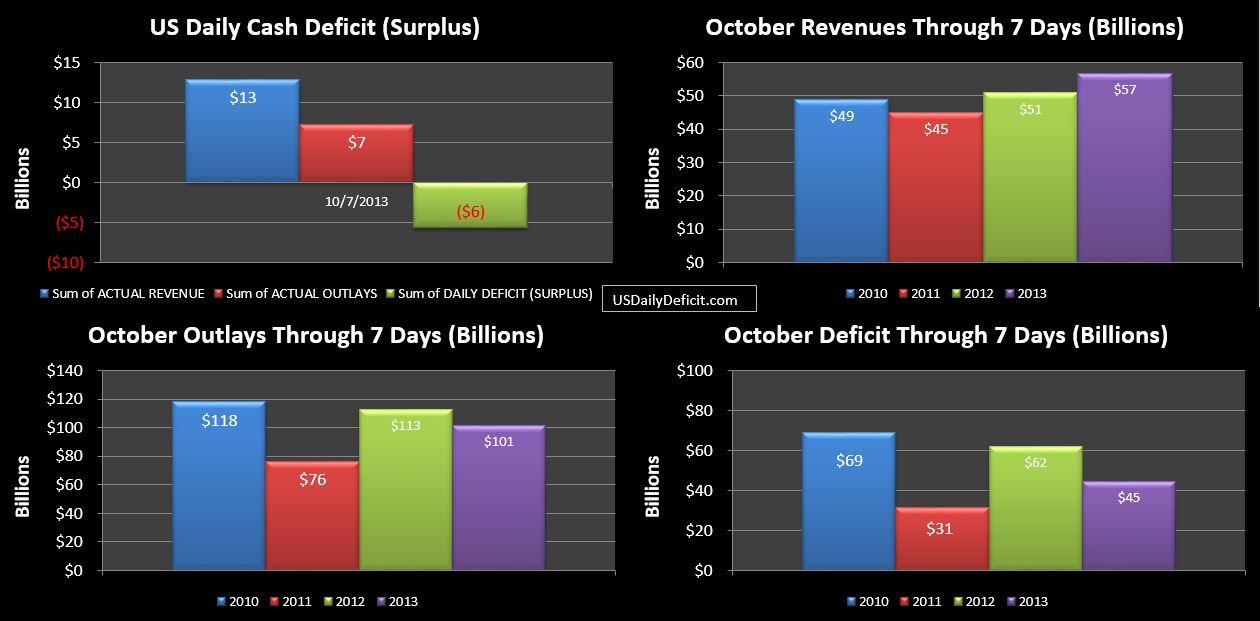

The US Daily Cash Deficit for Friday 10/11/2013 was $1.5B pushing the October 2013 deficit through 11 days to $59B. For the third day in a row, no tax refunds went out. We aren’t talking big $, but I’d guess at least $2-3B of refunds are now pending, growing by~$0.5B per day.

No real changes to see here…revenues slowly creeping up and costs continuing to look suspiciously low. Tomorrow’s report should get us more or less back into sync with last year with Columbus day behind us and a nice slug of corporate taxes on deck.

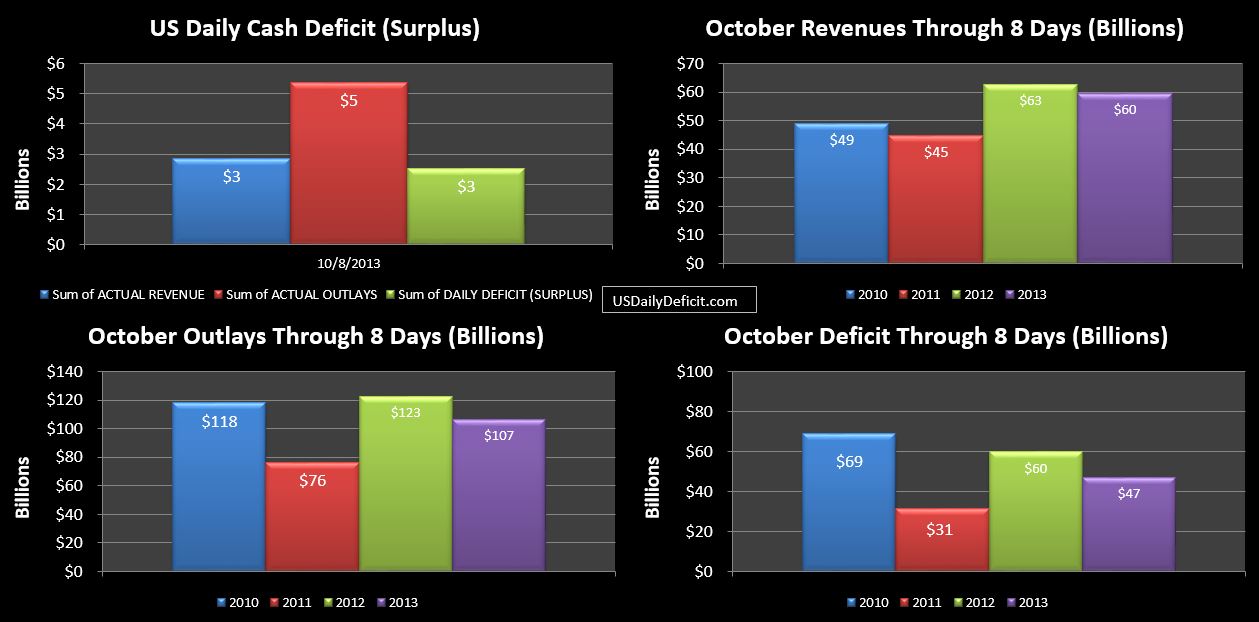

Cash in hand fell to $35B with just a few more days to go until the 10/17 non-event date, so that $30B estimate still looks reasonable to me, and like just about enough to squeak by until the end of the month…especially if the government is still shut down. So circle 11/1….that’s the day things start really getting messy. Cash in hand will be pretty close to zero, and while revenue will be about ~$20B…there are about $70B of payments due, including about $40B of SS and Medicare along with a lot of other government pensions and military active duty pay. Somebody’s check is going to bounce….

If there isn’t a deal by then, I have to think things could get real bad real fast. I still don’t expect that to happen, but you never know….I mean who thought a month ago the government shutdown would happen….much less still be going on mid month?