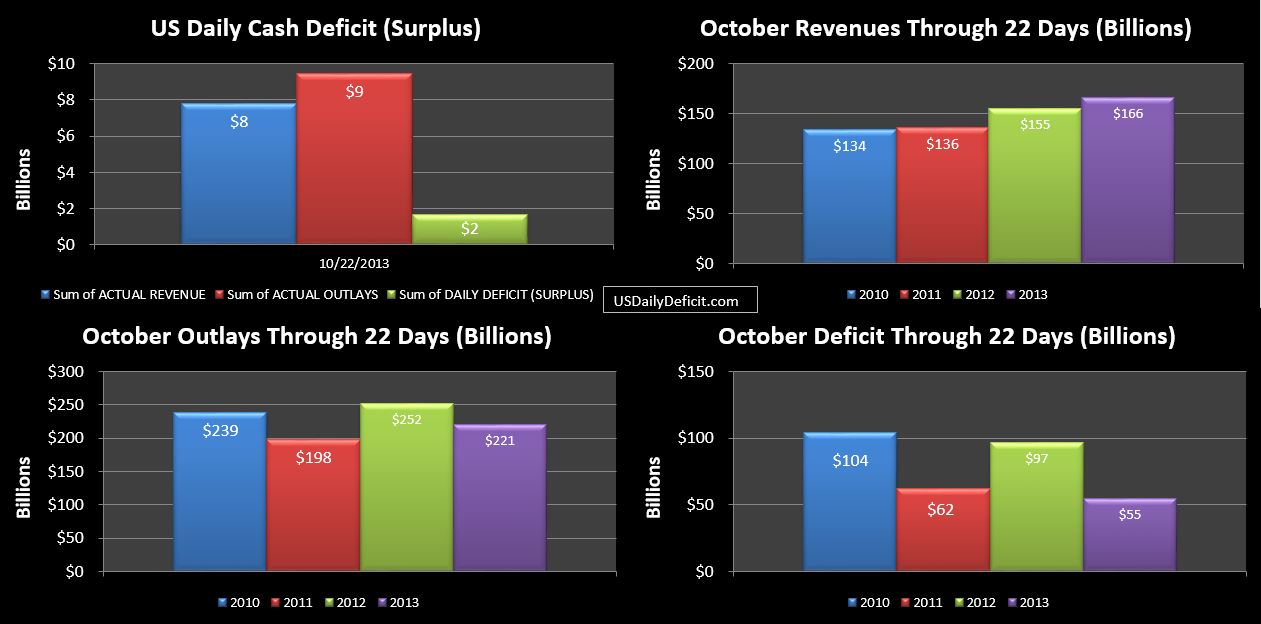

The US Daily Cash Deficit for 10/22/2013 was $1.6B. Revenues continue to gain ground on 2012 and while they aren’t exactly popping…outlays are starting to come back up as expected with the shutdown over…including $37M of individual tax refunds…the first to go out in about 2 weeks. On the month, refunds look to be down 7.5B over 10/2012…good for the cash deficit…not so good if you happen to be waiting on a tax refund.

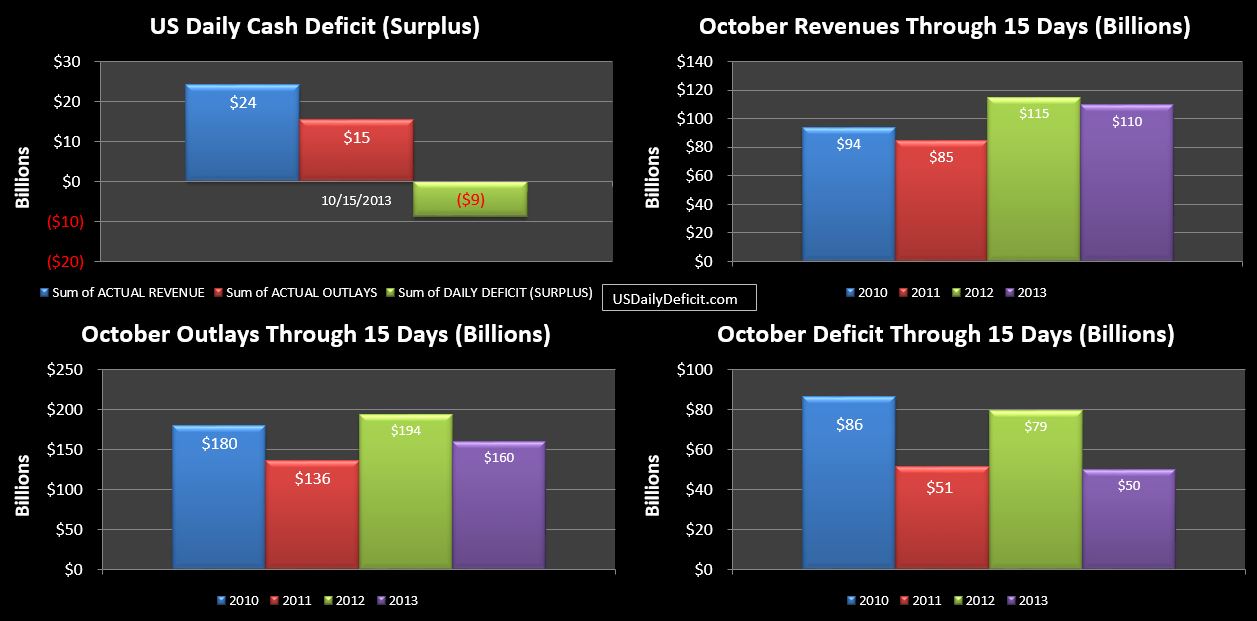

There are seven business days left, and the October deficit currently stands at $55B. My original projection for the month was $91B…assuming that the shutdown either wouldn’t happen or would be brief and it’s affects contained in the calendar month. Well the shutdown did happen, and while it is possible all of the back payments are made up by next Thursday, I haven’t seen much evidence yet that it is happening. So while $91B is still possible, we may end up better than $91B if revenues continue to gain ground and our missing outlays don’t materialize in October.