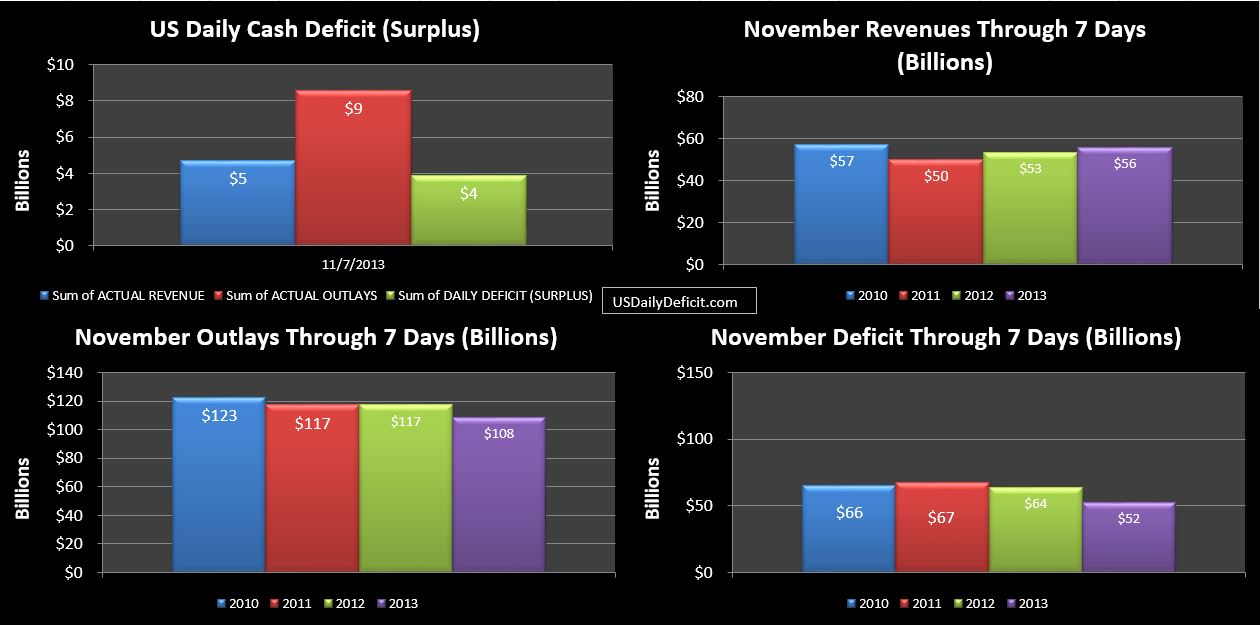

The US Daily Cash Deficit for Thursday 11/7/2013 was $3.9B bringing the November 2013 cash deficit through 7 days to $52B, $12B under the 11/2012 benchmark through 7 days of $64B.

Revenues continue to look solid currently at +5% YOY and gaining. Outlays still look weak, though they may make up some ground next week.

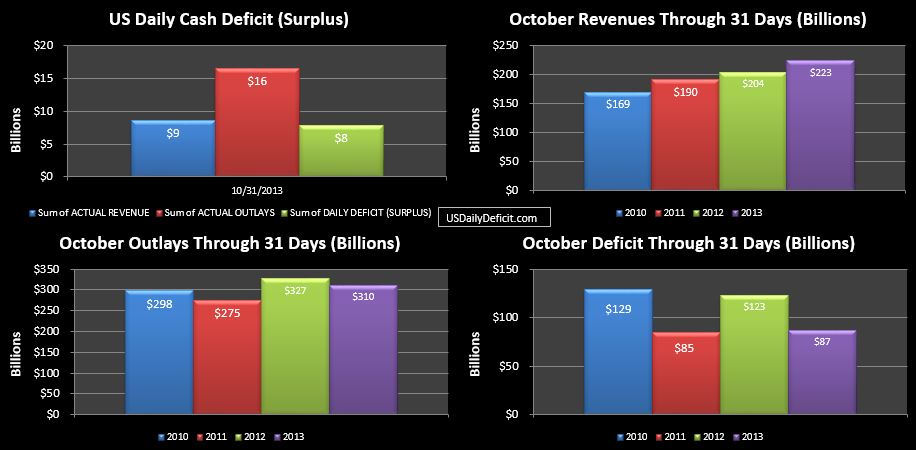

I was poking through the data and found it very interesting to compare the YOY change in revenues over the course of the year. For the first six months of 2013 we saw phenomenal YOY revenue growth at +18%. Over the same period we also saw outlays decline 3%. However….compare that with July-October with revenue up only 9% (still impressive…but not +18%) and outlays at +1%. It seems pretty clear that the tax avoidance timing and the Fannie Mae games have been flushed out, and a lower baseline has emerged.

Come 2014…I suspect a new baseline will emerge…certainly for revenues which will not have the benefit of a Jan 1 SS tax hike to pad their stats, and perhaps even for outlays. For example, by the end of 2013, payments to defense vendors will likely be down about 11%, or $45B below 2012. What will 2014 bring? Another $45B cut, or have we reached a new baseline? The second $45B is going to be a lot harder to cut than the first, so stay tuned. There is no doubt that 2013 is making some significant headway in decreasing the annual deficit, but I am still doubtful that progress can be maintained in 2014 and beyond. Hope I’m wrong 🙂