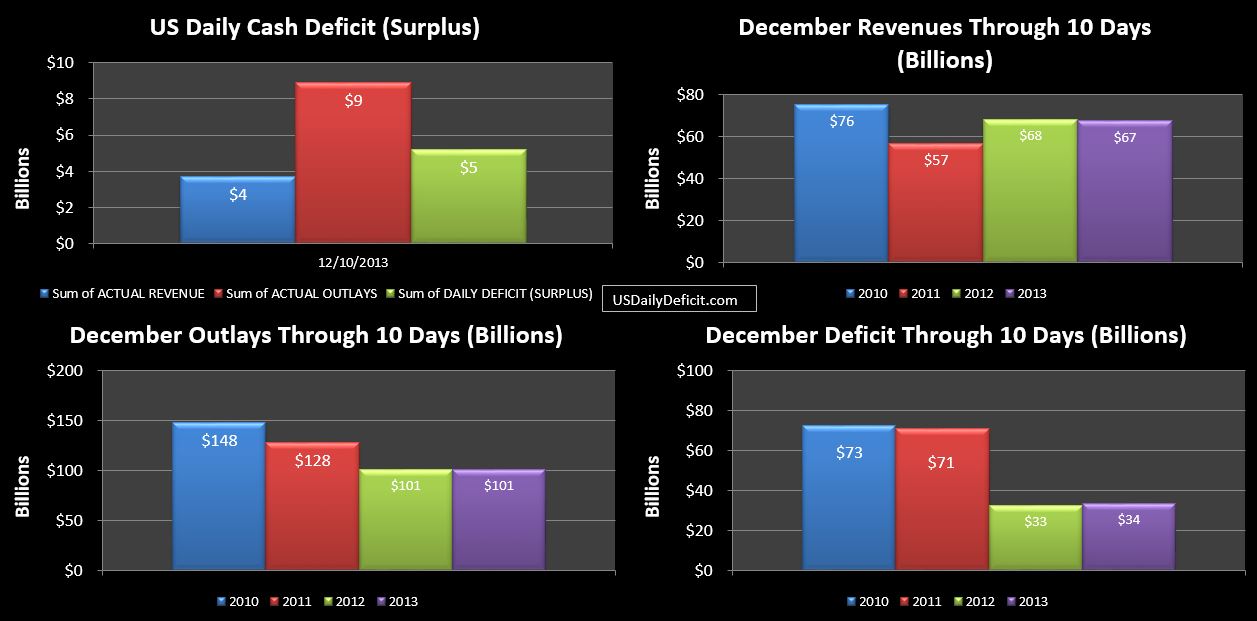

The US Daily Cash Deficit for Tuesday 12/10/2013 was $5.2B pushing the December 2013 cash deficit through 10 days to $34B.

Revenue lost $1B of ground, but so did outlays, so we are still pretty much even compared to 2012. It is curious that 10 days into December….in a year with surging revenues…we are still down a bit when we would typically be expecting 10% revenue growth…If we are still flat after next week….it would definitely be time to get concerned. For now though…it’s just interesting. A strong revenue push over the next week could make this weak start a distant memory…

So…looking at the full year…344 days into 2013 by my count…Revenues are up 13.82% at +$348B. Looking at this data set which goes back to 2006, the only year that comes close to this level of revenue growth is 2011 at 9.46%, with everything else under 5% down to -9.7% in 2009.

Compare that to outlays, which are down $53B…or -1.45%….an actual small reduction, but we’ll take it.

Looking forward (2014+), we can probably count on outlays continuing to grow at low single digit rates…say 1-3%, with a pretty high confidence level (absent a recession and “stimulus ect…). Revenues, on the other hand, are the wildcard and are the critical variable. If they continue to grow at 10%+…mathematically we would be in pretty damn good shape by the end of the decade. That kind of growth is possible in spurts, but stringing more than a few together is highly unlikely. However…even something lower….like 5-6% YOY growth would be a huge help…delaying the inevitable perhaps out to the end of the decade….maybe. If, however…we can only manage low single digit growth in federal revenues…the situation starts to deteriorate fast…we could get back to the $1T annual deficit level again by 2018 and never look back. If we actually got another recession somewhere in the mix that drove revenues down and spiked outlays….it could get real ugly(er??) in a heartbeat.