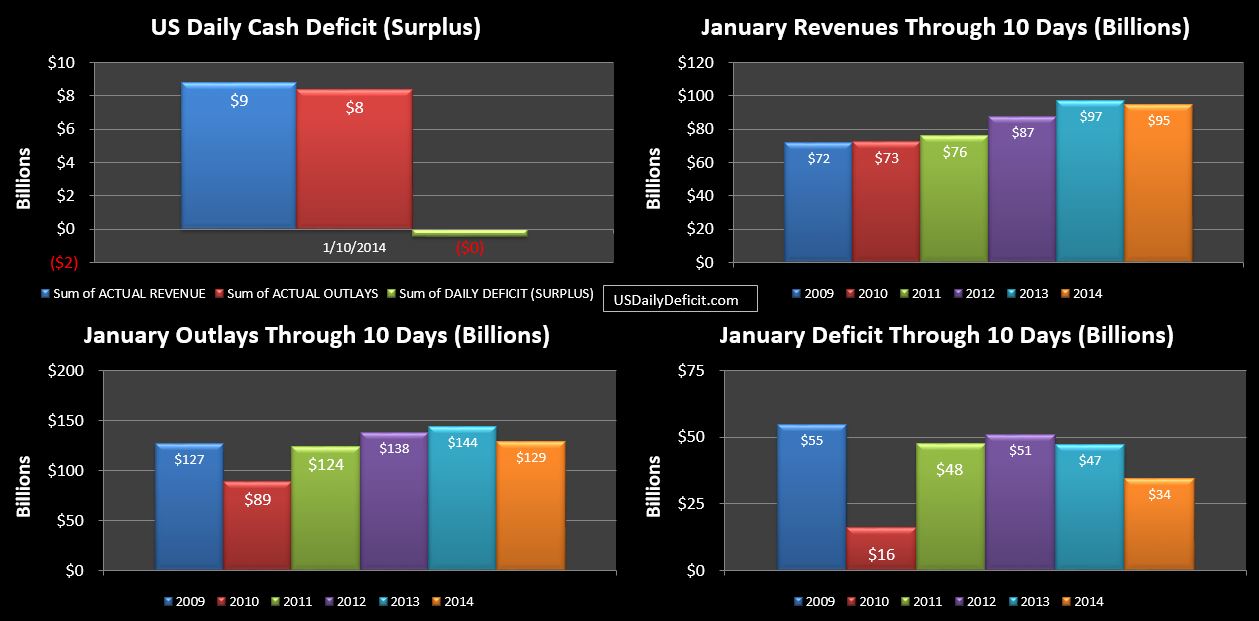

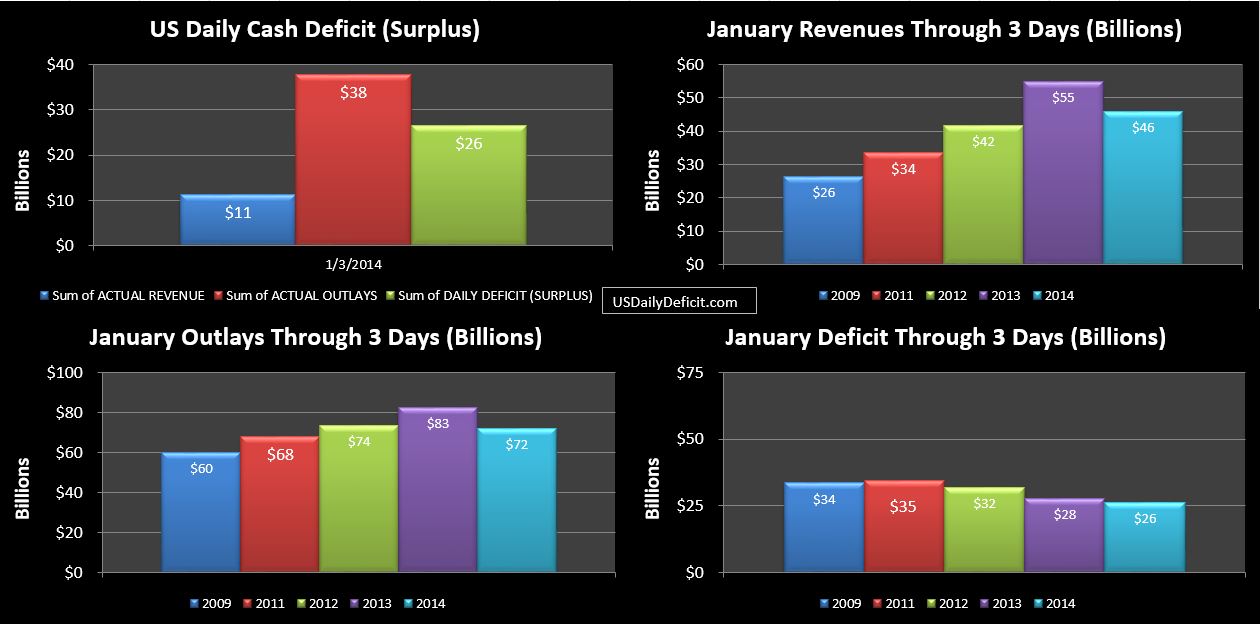

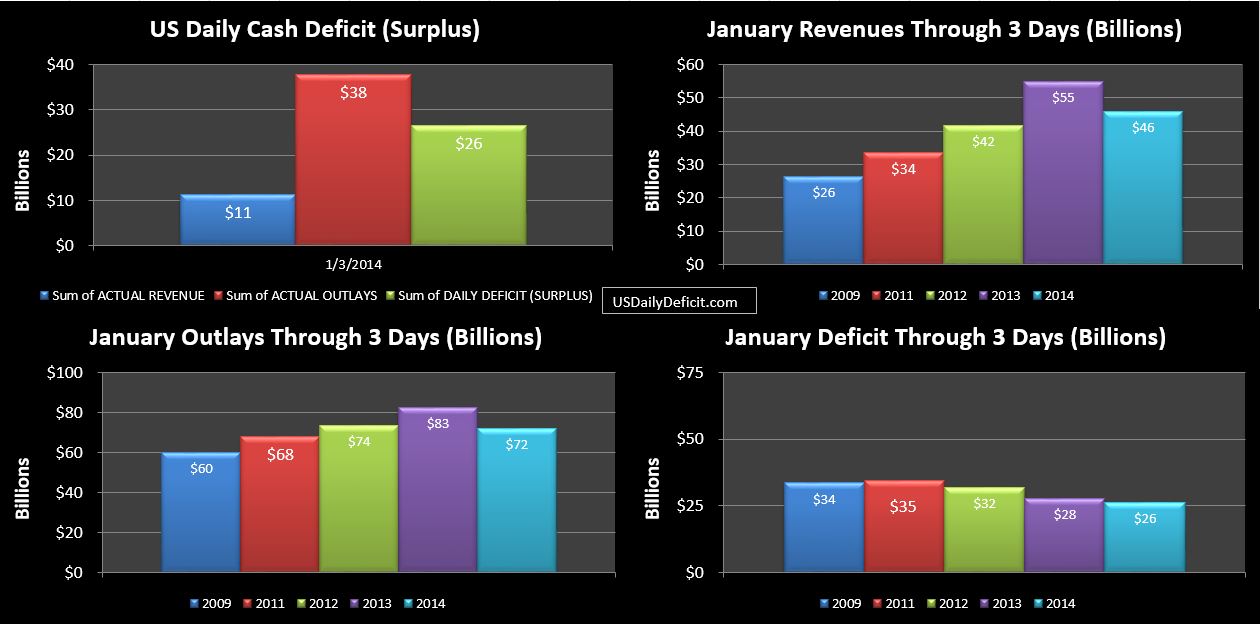

Hello 2014!! The US Daily Cash Deficit for Friday 1/3/2014 was $26.5B…less a $0.2B surplus on 1/2/2014 leaves us with a $26B deficit for January with 3 days under our belt. Don’t fret though…January is likely to be a light deficit month thanks to January tax payments flowing in…I hesitate to guess because I have a high degree of uncertainty about YOY revenues…it is probably going to take a month or two to re-calibrate expectations. If we assume revenues gain ~5-7% and outlays only grow at a 2% rate….a $25B deficit for the month looks about right. If, however we see revenues collapse…or spike…this could end up being a huge miss.

Above are the charts…now honestly it’s too early in the month to really start looking at the YOY….mainly I want to discuss timing and the adjustments I will make to sync up 2013 and 2014 for the rest of the month. Recall…different revenue and outlay streams are driven by different variables. Social Security, for example is paid out in 4 big chunks with one being on the 3rd of the month, and the remaining 3 being on the 2nd-4th Wednesdays of the month. Some, on the other hand are driven simply by business days…being more or less flat throughout the month. While there is no perfect way to do it, I prefer to sync up on days of the week, which usually syncs up Social Security as well as tax deposits, which seem to be strongest on Mondays, followed by Wednesday and Friday which have moderate revenues, while Tuesday and Thursday are generally weak.

So…for January, I will be syncing up by adding one day to 2013…thus the chart above compares January 2014 Thursday 1/2 and Friday 1/3 to January 2013’s Wednesday 1/2 through Friday 1/4…This pattern will continue for most of the month….so tomorrow I will add Monday 1/6/2014 and Monday 1/7/2013. Now the obvious flaw for now is that 2013 has an extra business day…and thus higher revenues and outlays. This should work its way out over the course of the month…just remember that on revenues…we are starting at -$9B…this early in the month…don’t be too concerned about the number itself…but which direction it is heading.