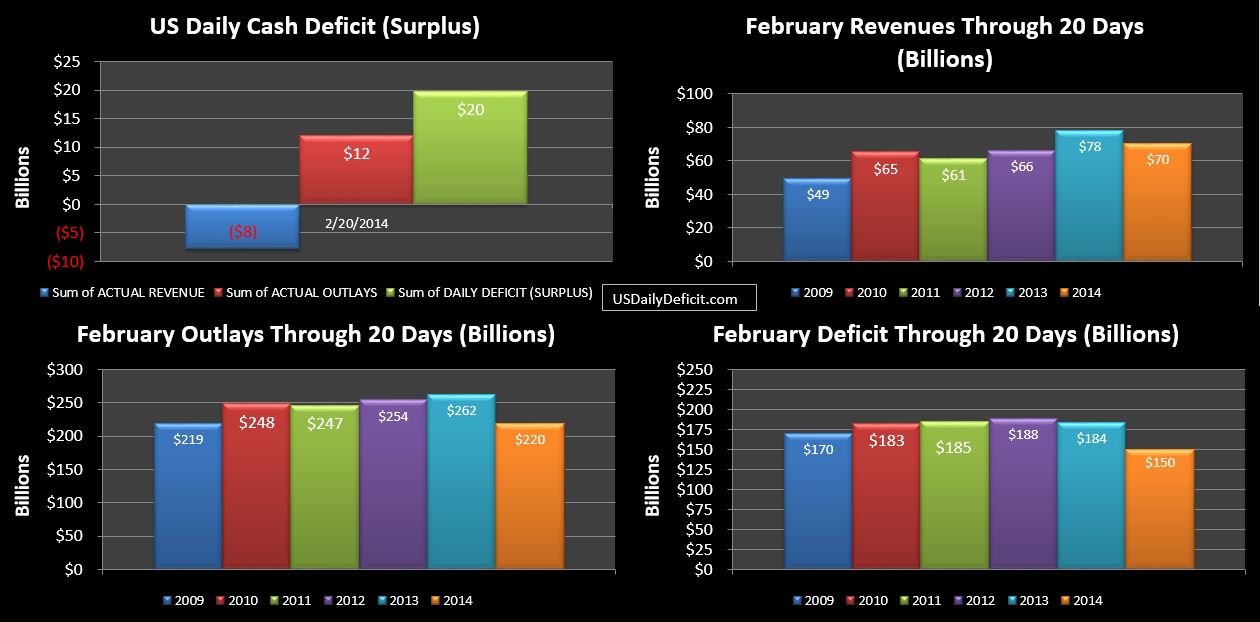

The US Daily Cash Deficit for Thursday 2/20/2014 was $19.8B bringing the February 2014 cash deficit through 20 days $150B with 6 business days remaining.

After almost no refunds 2/19, 2/20 has a huge day coming in at $17B…as noted earlier today…this series has become unpredictable, so all I can really do is sit back and watch. As of today, tax refunds are up $15B, and 18% YOY. Withheld taxes are up 2% for the month, but will likely end the month closer to +10%, which is actually quite good…and surprising to me, but we’ll definitely take it.