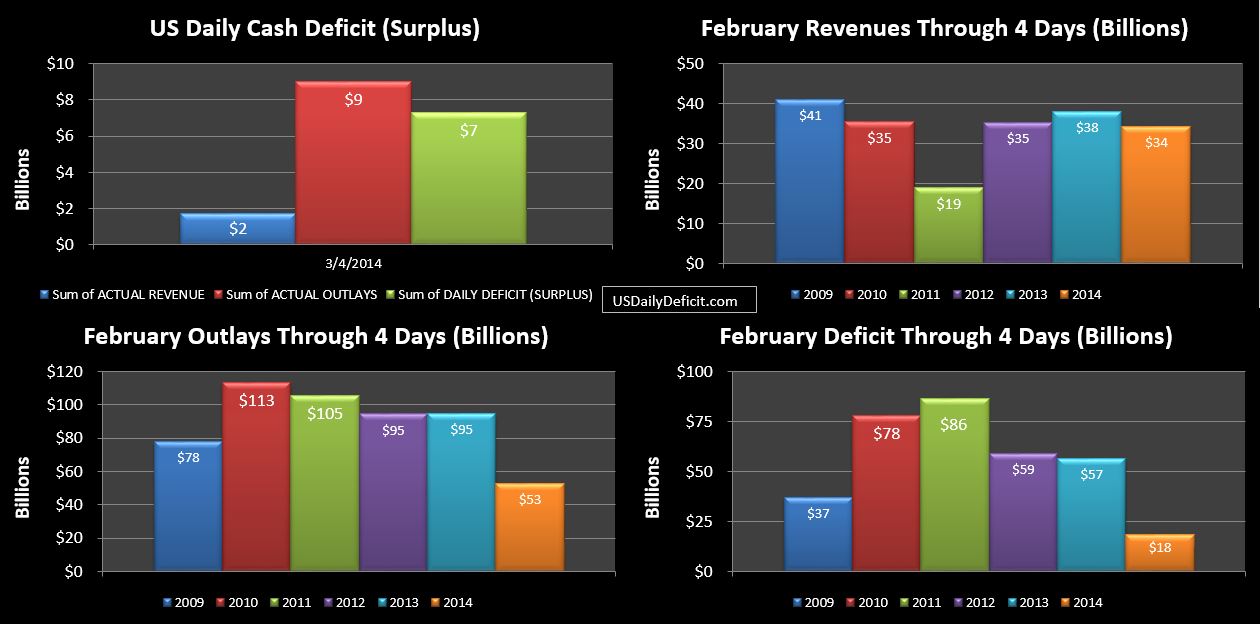

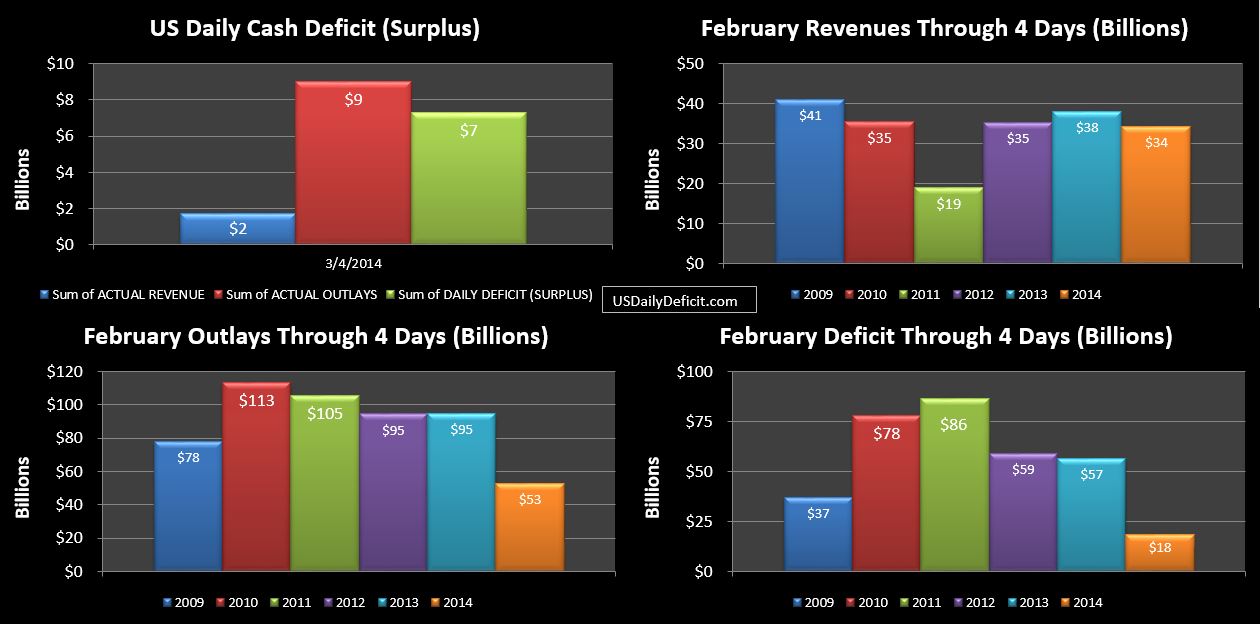

The US Daily Cash Deficit for Tuesday 3/4/2014 was $7.3B, adding to Monday 3/3’s $11.2B and pushing the March 2014 cash deficit to $18B through 4 days.

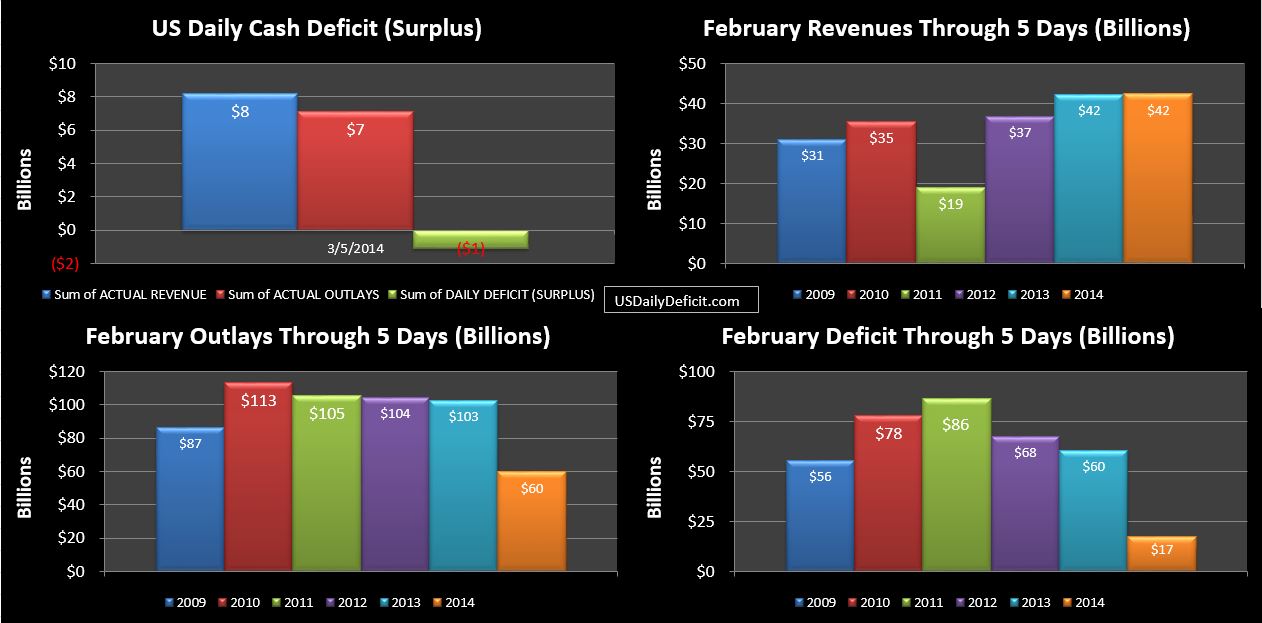

First…I have taken the liberty…as usual to sync up 2014 and 2013 on days of the week. So at this point, we are comparing 2014 3/1 through Tuesday 3/4 to 2014’s 3/1- Tuesday 3/5. This leaves 2013 with an extra business day…. Friday 3/1. Of course, the extra day gives 2013 a head start in both revenues, and costs. 2014 will pick up the business day on Monday 3/31.

Next…timing. March 2014 had about $35B of payments pulled forward…going out February 28 since 3/1 was a weekend. This has happened for a few months in a row now, but will not happen at the end of March, so we will be back in sync after this month. however…all else equal, March 2014 is going to be $35B lower in cost YOY….the offset was back in Jan, so YOY, we are back in sync.

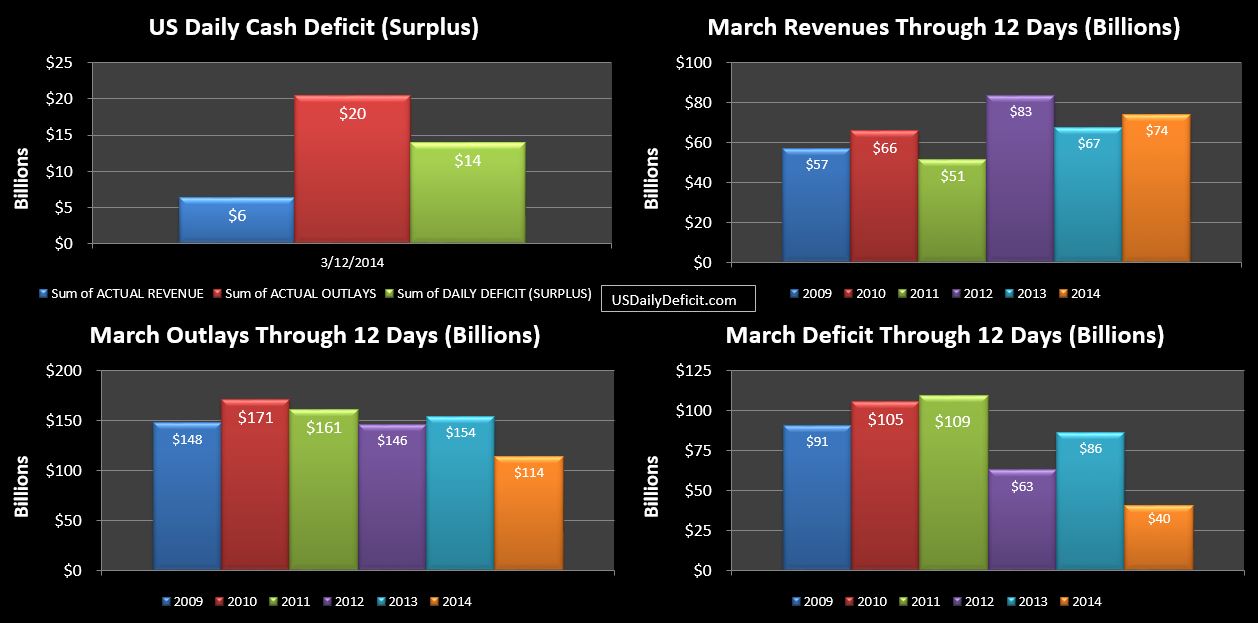

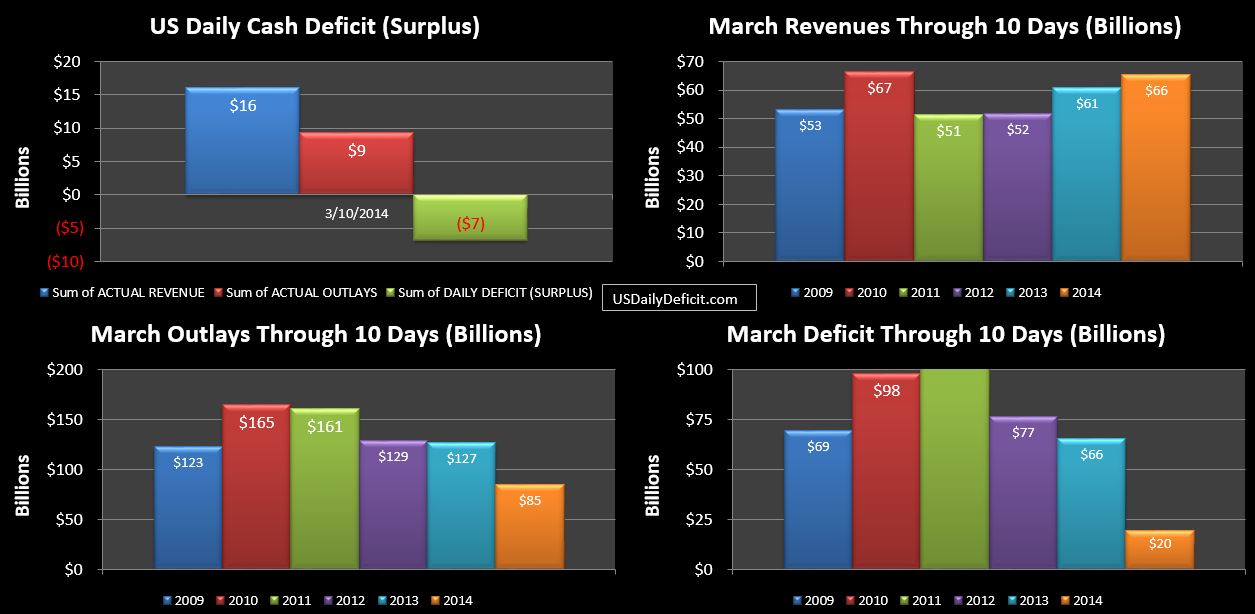

To the charts….it’s really too early to know much….revenue is down due to one less business day. Unless refunds continue to surge like we saw in February, I would expect 2014 to continue to make gains and end up well ahead of 2013.

Outlays are currently down $42B…$35B due to the timing discussed earlier and let’s just assume the difference is the extra day. Assuming outlays will be more or less flat….I don’t expect a lot of movement here until the end of the month when 2014 gets that extra business day back.

As it stands….I would peg the March 2014 cash deficit at $15B thanks to strong revenues, timing, and more or less flat outlays. Refunds are the big wildcard in my mind….they could easily add a +/-20B of volatility.

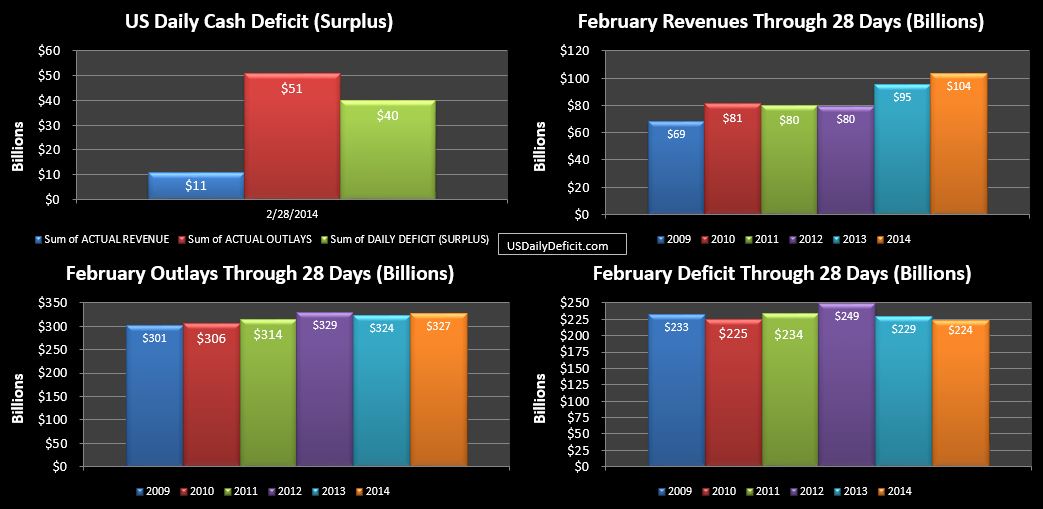

**Just an update…I haven’t updated it in a while, but I took a look at my forecast accuracy…comparing the projection I typically try to make early in the month to the actual by month end. Going back to December, I had forecasted a $51B surplus…actual was $54B. In January, I forecasted a $25B deficit…the actual was $24B. And then…last month, I forecasted $224B….and sure enough…we ended up at $224B.

Now…I have to admit….the level of accuracy surprised me, and I have to assume that it’s more or less a fluke. If you look closer, there were plenty of misses in each of the ~60 revenue and outlay categories that make up my model…..but they more or less netted out…leaving my overall forecast pretty close to actuals.

I’ll reiterate….I do not expect this trend to continue….there are just too many moving pieces with far too much volatility. And…let’s put this in context….predicting a monthly deficit a month out is probably about the same as predicting the weather the day after tomorrow….odds are it’s going to look a lot like today. Over the long term…I would expect a sustainable accuracy to average +/- $10B. per month…. So…with that all down on record…. it’s probably a safe bet this month’s forecast will be demolished 🙂