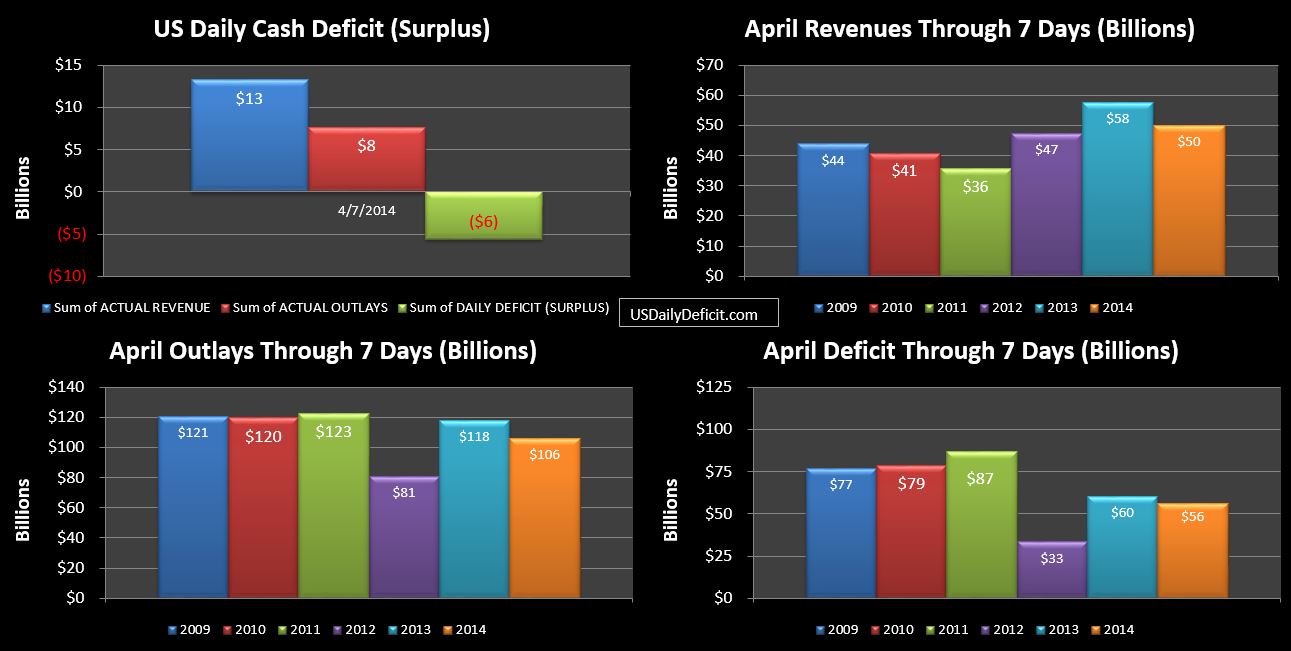

The US Daily Cash Surplus for Monday 4/7/2014 was $5.6B following a $0.5B surplus Friday 4/5/2014, and bringing the April 2014 deficit through 7 days to $56B.  Through one week, nothing really stands out….this year looks a lot like last year so far. Revenues and outlays appear low on the chart, but that’s mostly due to the extra business day for 2013… Things won’t really get started until 4/15 next Tuesday.

Through one week, nothing really stands out….this year looks a lot like last year so far. Revenues and outlays appear low on the chart, but that’s mostly due to the extra business day for 2013… Things won’t really get started until 4/15 next Tuesday.

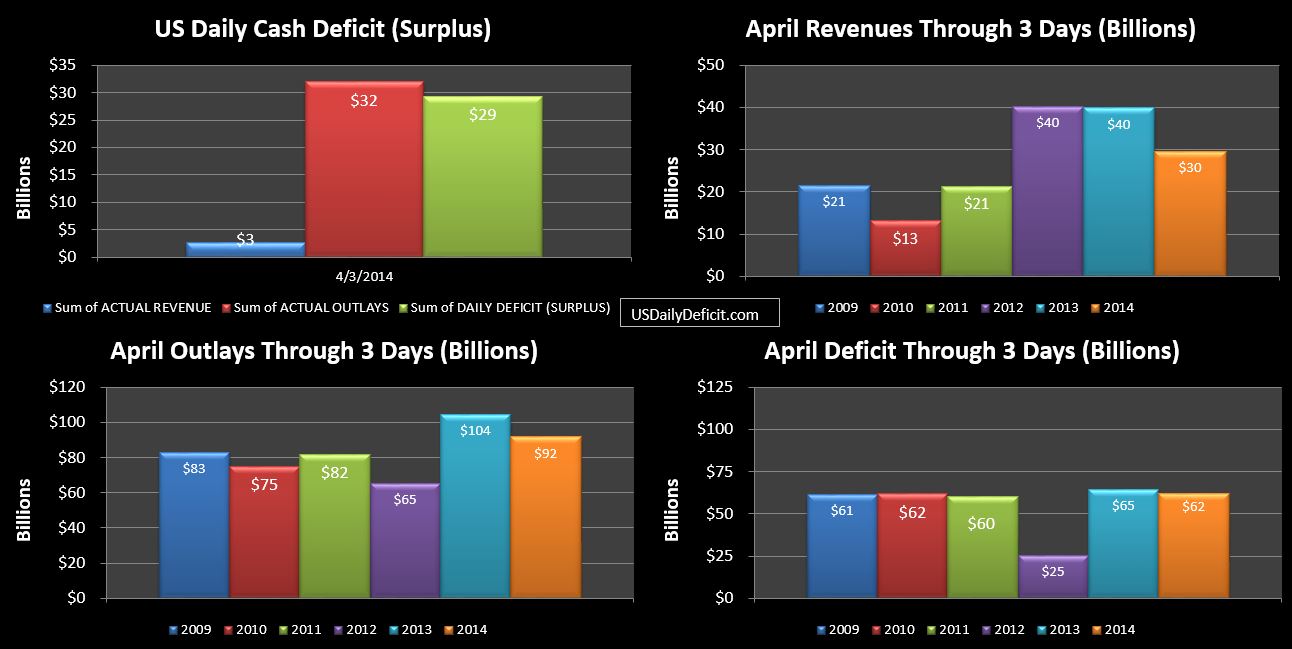

The US Daily Cash Deficit for Thursday 4/3/2014 was $29.3B bringing the April Deficit through 3 days to $62B, which is quite common given that a lot of monthly outlays are heavily front loaded.

As is standard, I have taken the liberty of aligning 2013 and 2014 on day of week rather than day. It’s not perfect, but many of the inflows are driven by day of week, giving us a better YOY comparison throughout the month. So at this point, we are comparing April 2014 through Thursday the 3rd with April 2013 through Thursday the 4th. Since 2013 has an extra business day, this early in the month, it is not a big surprise that revenues are down by about $10B, as are outlays.

We’ll just leave it at that for now. It’s too early in the month to really see anything, and the real fireworks don’t kick of until the 15th anyway….so stay tuned.

First…a look back at March. After actually nailing the February forecast…mostly by luck, I reverted to the mean in March with my $15B forecast missing the $25B actual by $10B. Still…that’s a forecast error I can live with, though as I have discussed before….you really shouldn’t be all that impressed. Forecasting a monthly deficit a month out is kind of like forecasting the evening weather based on what you see when you wake up….it’s probably going to be more of the same.

That said…..rather than looking at the April 1 deficit… of $36B…let’s take a crack at the full month forecast. April is probably one of the tougher months to forecast because revenues pour in mid month, and can be quite volatile. Last year, for example, April revenues surged 27% YOY…try forecasting that with any degree of accuracy. My forecasts are ground up…independently forecasting about 20 revenue streams and about 40 streams of outlays. However, at the end of the day, a few large streams dominate the forecast…get them about right and the rest falls into place. So…admitting up front that this is a bit wilder than normal guess….$180B Surplus. Last April had a $117B surplus…I am assuming we see about 13% YOY revenue growth, refunds continue to be down a bit, and outlays are flat…maybe even down a smidge.

The month will start off with a deficit, currently at $36B as mentioned above, but right around the 15th, corporate and individual tax revenues will start flooding in and remain elevated for the remainder of the month. Any material beat of this on the revenue side, and we could see a sub $300B deficit for the year….still large, but light years away from the $1.6T deficit we posted in 2009….

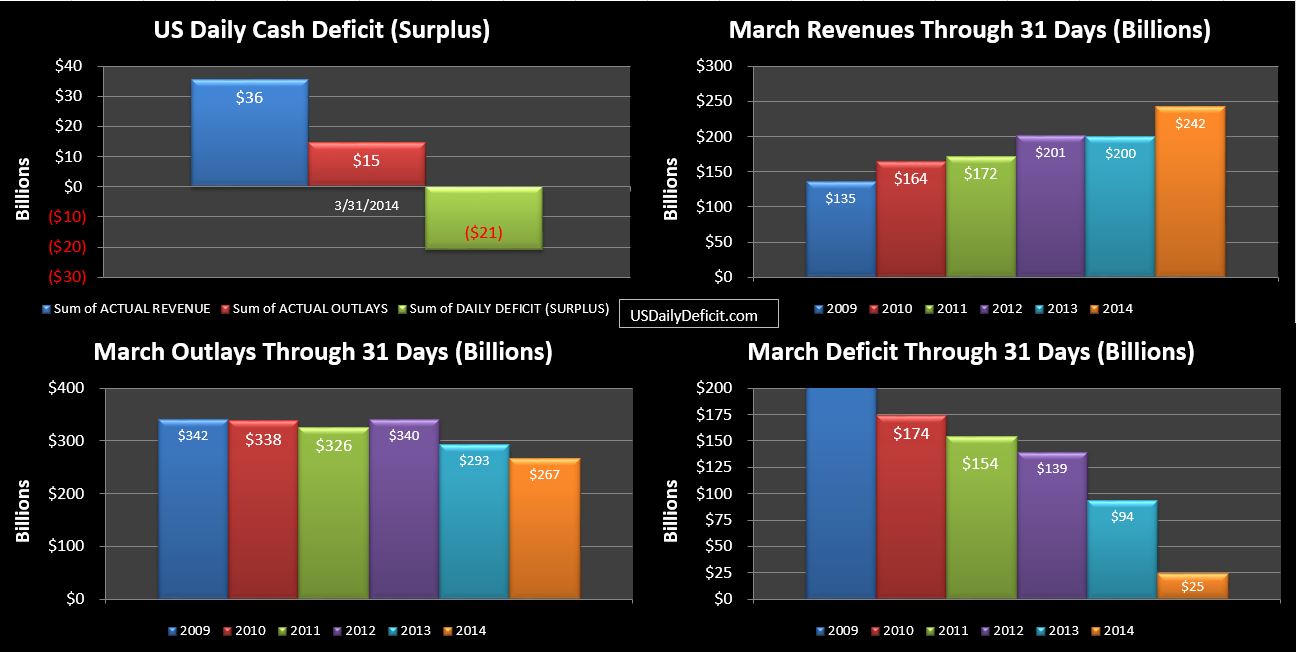

The US Daily Cash surplus for Monday 3/31/2014 was $20.9B bringing the March 2014 Deficit to $25B for the full month…$10B over my initial $15B forecast, and a bit over my expectations…as late as a week ago, I wouldn’t have been surprised by a small surplus, but that simply didn’t materialize.

Still…..and this is no April fools joke…for the month revenues were up 21% and outlays were down 9%, though a good chunk of that was timing. No doubt about it, this was a great month, and 2014 through 3 months is off to a great start. If these trends continue, and they never do….we are headed for a sub $400B deficit….maybe sub $300B. I’ve reworked my forecasts, but have decided to hold off for a few more weeks to see what April looks like before I pull the trigger.

I do apologize for the light posting…real life seems to be getting in the way, but hopefully in a few weeks things will get back on track. I’ll try to follow up with some more March analysis, but I wanted to get this out there while it’s still news. Bottom line…great month, not as great as I thought it might be, but still pretty damn good….now on to April….large surpluses are a lock…the only question is how large…

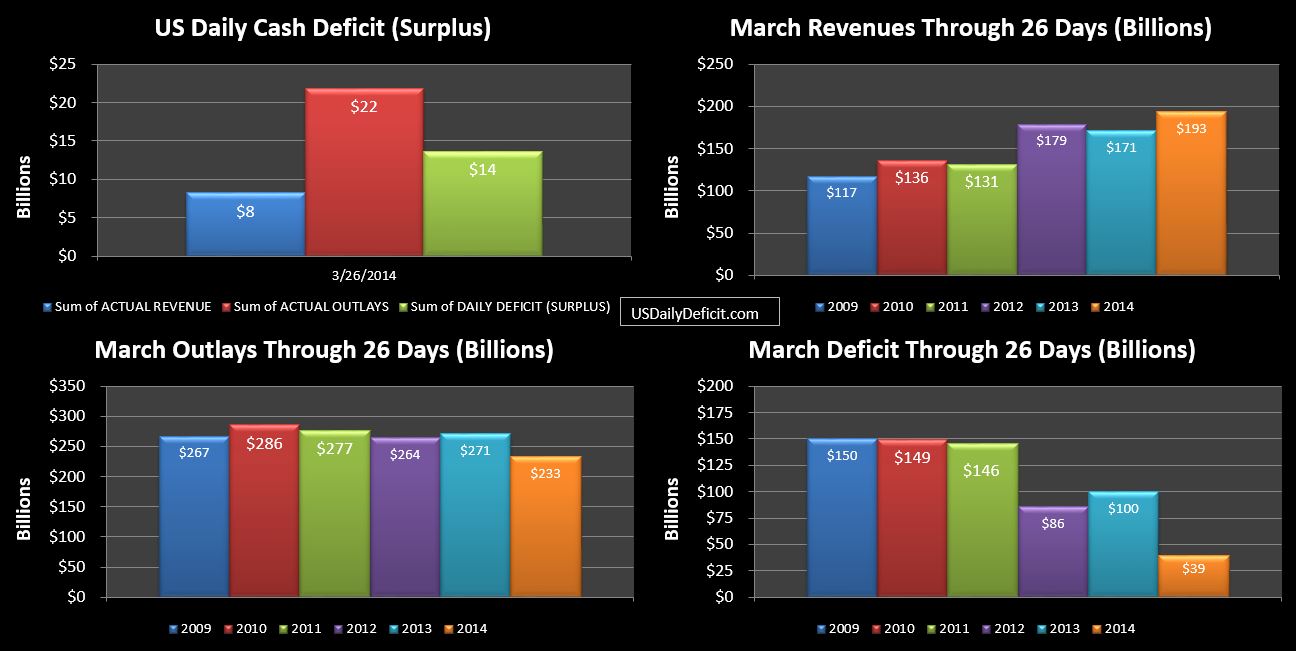

The US Daily Cash deficit for Wednesday 3/26/2014 was $13.7B bringing the March 2013 cash deficit to $39B through 26 days.

Revenues are up 13% so far and will likely gain a bit more over the next 3 business days. At this point…about half is due to lower tax refunds and the rest higher tax revenues. Outlays are down, but this can almost entirely be explained by the beginning of the month timing that pushed about $35B from March and into February.

The deficit currently sits at $39B with 3 days remaining. Thursday will likely post a moderate deficit, Friday a healthy surplus, and Monday 3/31 a large surplus on end of month payments including Fannie/Freddie payments. It seems likely that the deficit will shrink from here, but making it all the way to surplus seems like a bit of a stretch, though still possible.

Regardless, this is shaping up to be a good month considering last March posted a $94B deficit, and this March is knocking on surplus territory. Sure… a good chunk is timing, but the year is looking good too, with Revenues up about 10% and outlays down 1.5%. One more month of that, and this pessimist may just have to change his tune…at least for the short run. Projecting this trend out puts us at a sub $400B deficit for the calendar year…still a huge deficit, but a huge improvement over where we’ve been.