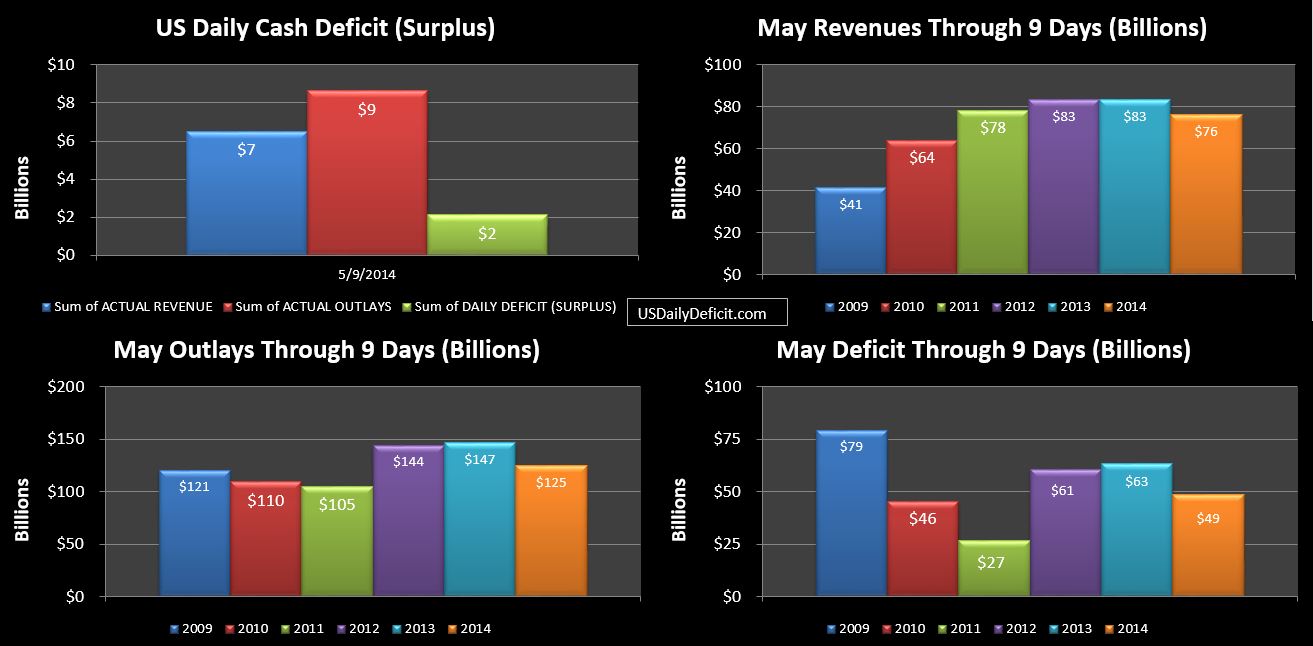

The US Daily Cash Deficit for Friday 5/9/2014 was $2.1B bringing the May 2014 deficit to $49B through 9 days.

Revenues continue to gain slowly on 2013 trimming the gap to $7B with 14 business days remaining. Just looking ahead, this Thursday the 15th may be the most interesting day of the month with a large $30B+ interest payment likely to go out, along with some corporate taxes likely to be received in the $6B range. We’ll get to see how these payments compare to last year’s numbers

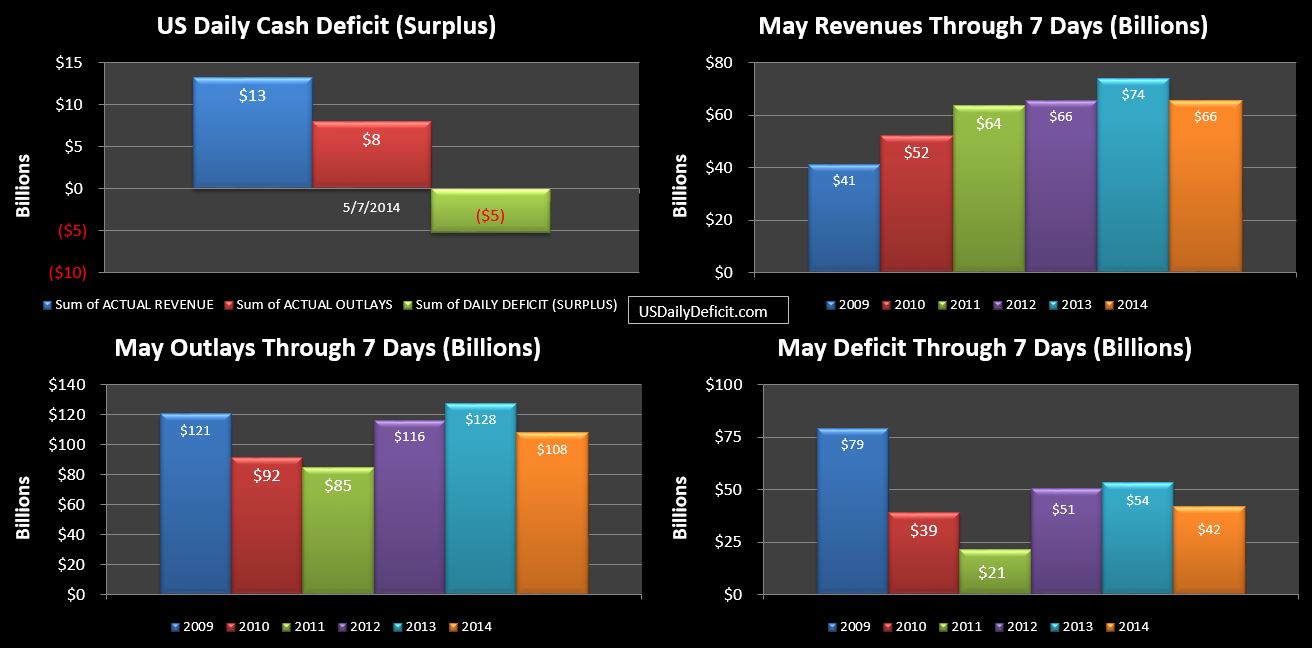

The US Daily Cash Surplus for Wednesday 5/7/2014 was $5.2B bringing the May 2014 deficit through 7 days to $42B.

We don’t typically see a Wednesday surplus mid month due to SS payments going out on the 2nd-4th Wednesdays….but this is actually the first Wednesday of the month, while last year Wednesday 5/8 was the second. Because of this we have a one week timing issue that won’t resolve up until May 28…so just note that about $13B of the apparent reduction in outlays is timing.

Revenues actually were up about $3B dropping the YOY to -$8.4B vs. yesterday which was closer to $12B…rounding and such…So all together…a good day….we’ll need quite a few more of these to get revenues where they need to be by month end.

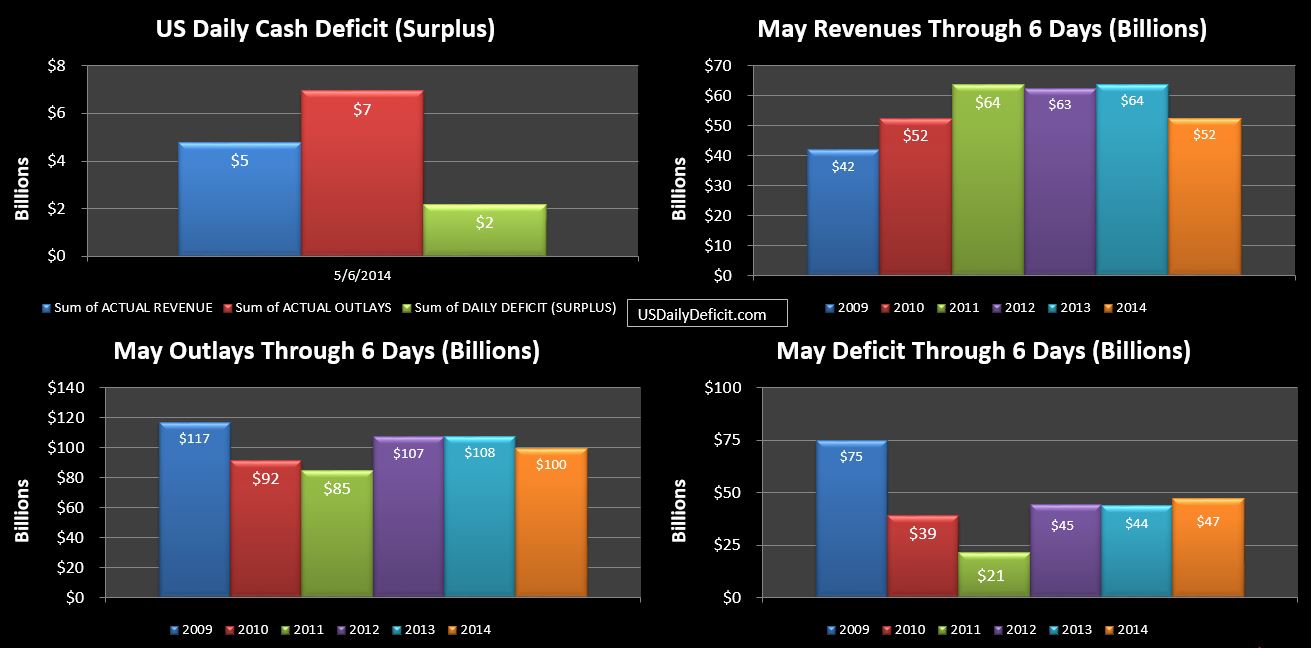

The US Daily Cash Deficit for Tuesday 5/6/2014 was $2.2B bringing the May 2014 deficit through 6 days to $47B.

For starters…I have synced up on days like I typically do…so we are comparing May 2013 through Tuesday the 7th to May 2014 through Tuesday the 6th. 2014 is down one business day…and will remain that way for the entire month. Being down one business day, 2014 revenues and outlays are running under 2013 as we would expect.

Keep an eye on Revenues…currently at -$12B….we are hoping to get to +$13B by the end of the month….look for slow but steady progress. As I mentioned in my last post…the odds are already kinda stacked against May (and June…but we’ll discuss that later) so I’m preparing myself to be disappointed.

So…admittedly…my April forecast was a bust….my projection of a $180B surplus was $55B too optimistic as I overestimated revenues and underestimated tax refunds.

But now it’s time to get back on the horse. May is typically a high deficit month as Revenues fall off a cliff and a big chunk of interest payments go out. Last year, for all of April 2013’s glory at a $117B surplus…May 2013 came along and completely wiped it out with a $159B deficit.

My guess for May is going to be $133B deficit. I have revenue gains at only 6%….I have adjusted down a bit due to the weakness we saw in April, and some unfavorable timing for May 2014…primarily one less business day. Outlays I actually have down 3% primarily due to a spike in “other” last May well above the average I’ve been using in my forecast. This category is fairly volatile, so I’m not sure if that spike was something seasonal that will repeat itself or if it was a one time hit, but I’ll stick with the more conservative number for now.