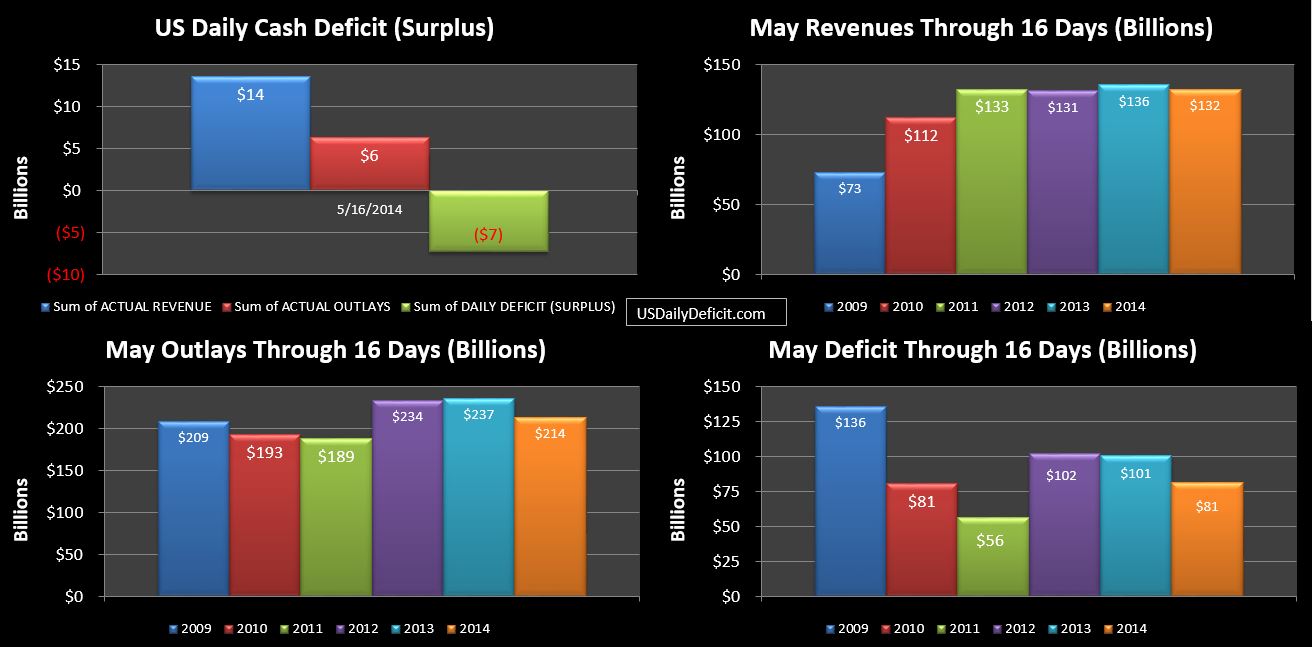

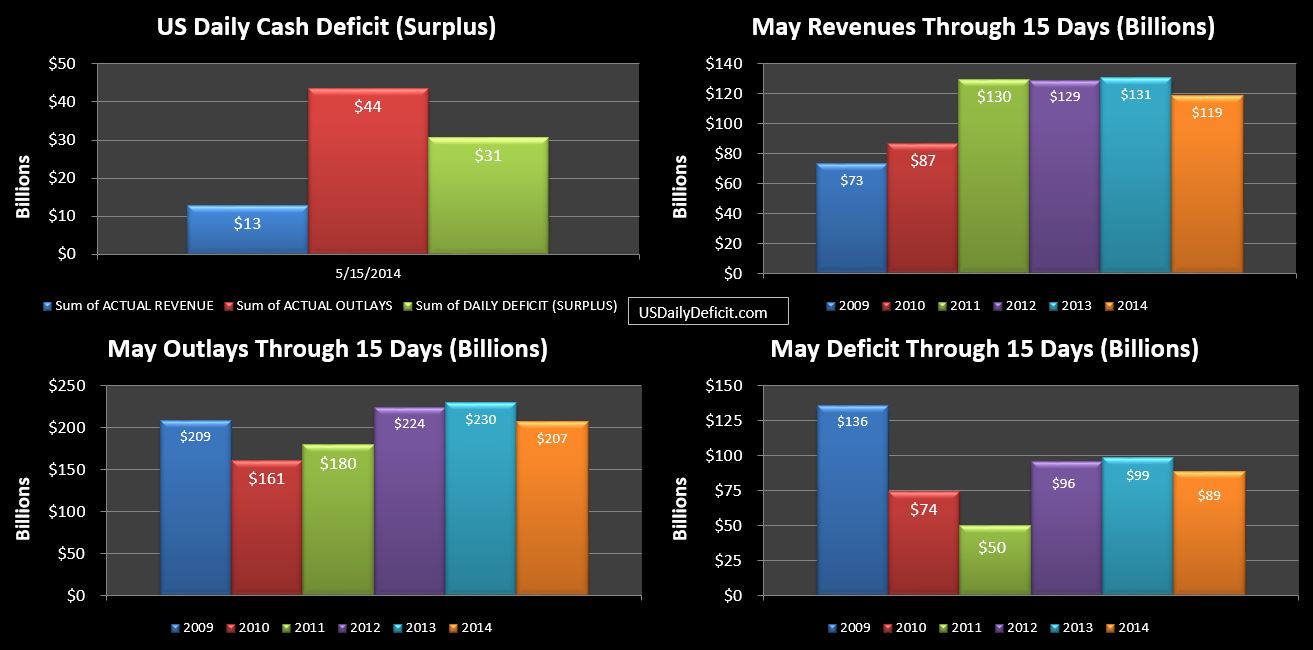

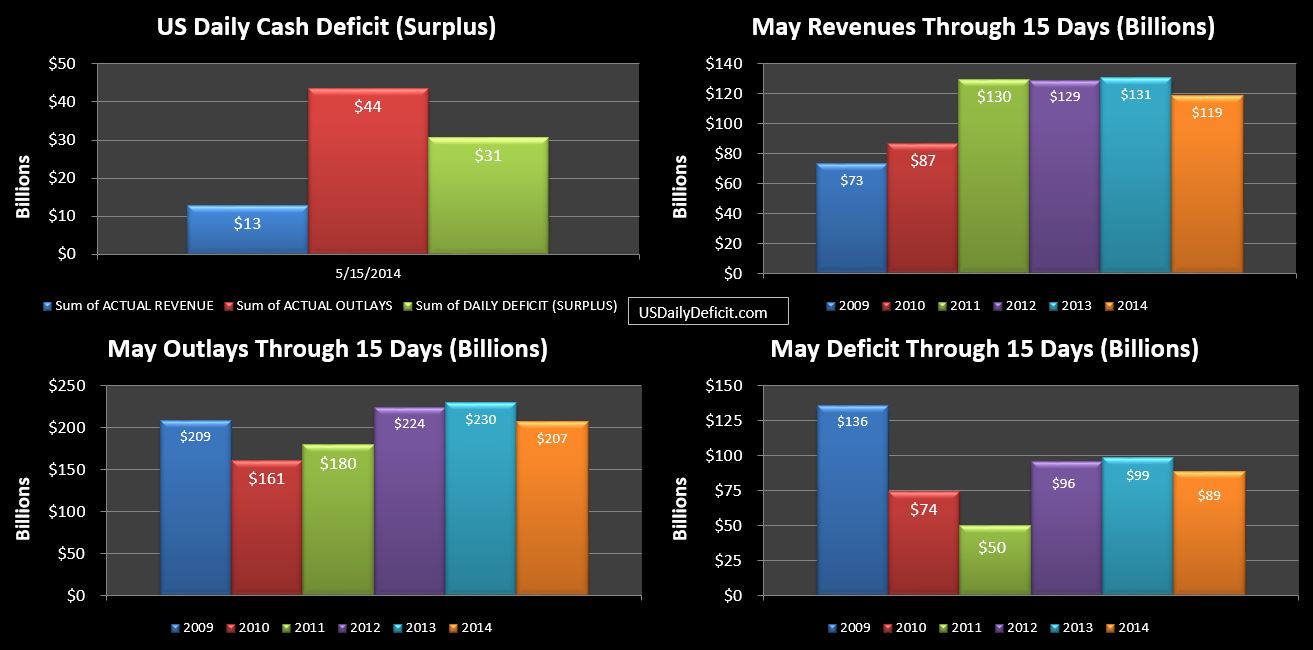

The US Daily Cash Deficit for Thursday 5/15/2014 was $30.8B bringing the May 2014 deficit to $89B through 15 days.

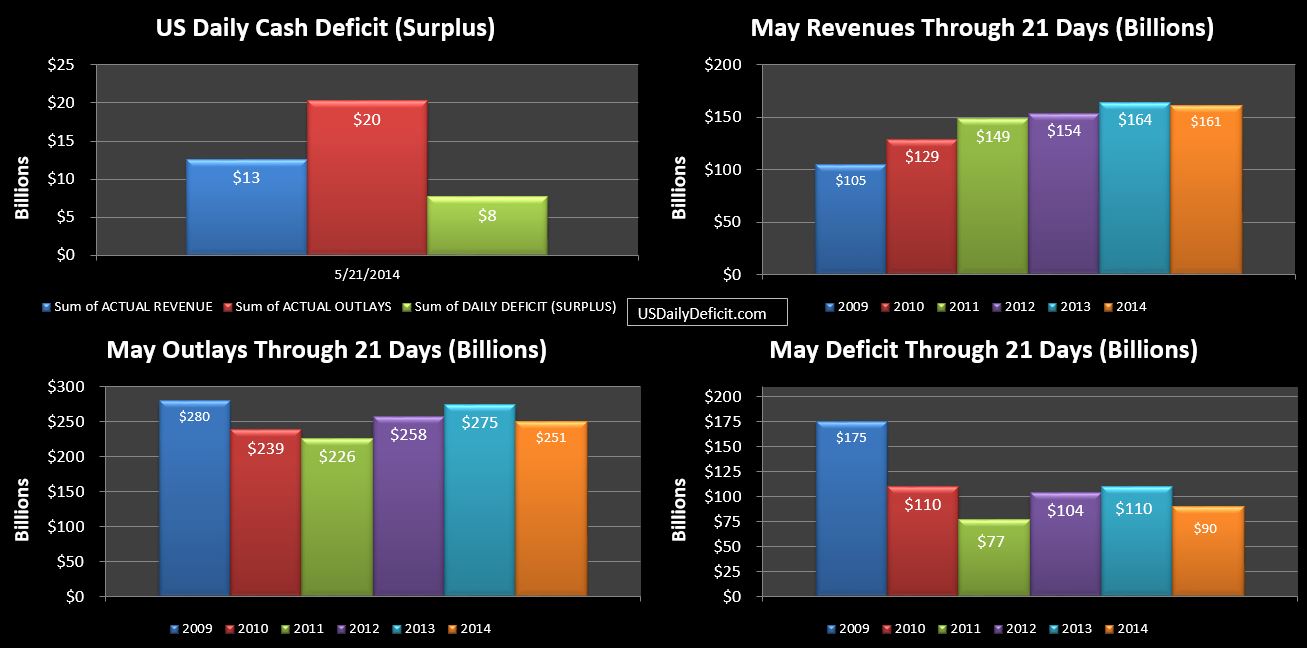

Looking at our chart, we see revenue back to a -$12B YOY. Most of that can be attributed to there being one less business day…pull that out and we’re flat….which would still be disappointment. There’s still a half a month to go…plenty of time for a comeback, but clearly we are not where we’d like to be at this time….which is more or less even despite being down a day. The one bright spot so far is corporate taxes…up 7%….but only good for a $0.5B bump.

Outlays look great at first glance, but their down a day too, plus they are down a ~$13B SS payment…so they are more or less flat once you back all of that out, which is about what we would expect. By the end of the month we will definitely catch back up on SS, but end up down a little overall.

So taking stock at midpoint…outlays are more or less where I expected them to be, but revenues are looking light so far…not a good sign. If May ends up weak, that will make 2 months in a row. June is just about guaranteed to be down since last June got a $50-$60B boost from Fannie Mae that won’t be replicated. Of course we can back that out to compare the fundamentals, but we’d still be at 3 months in a row, following a terrific Jan-March. Obviously I’m getting a bit ahead of myself, but if we are indeed nearing the end of the impressive +10% revenue growth period we’ve seen since Jan-2013, things could get ugly pretty fast.