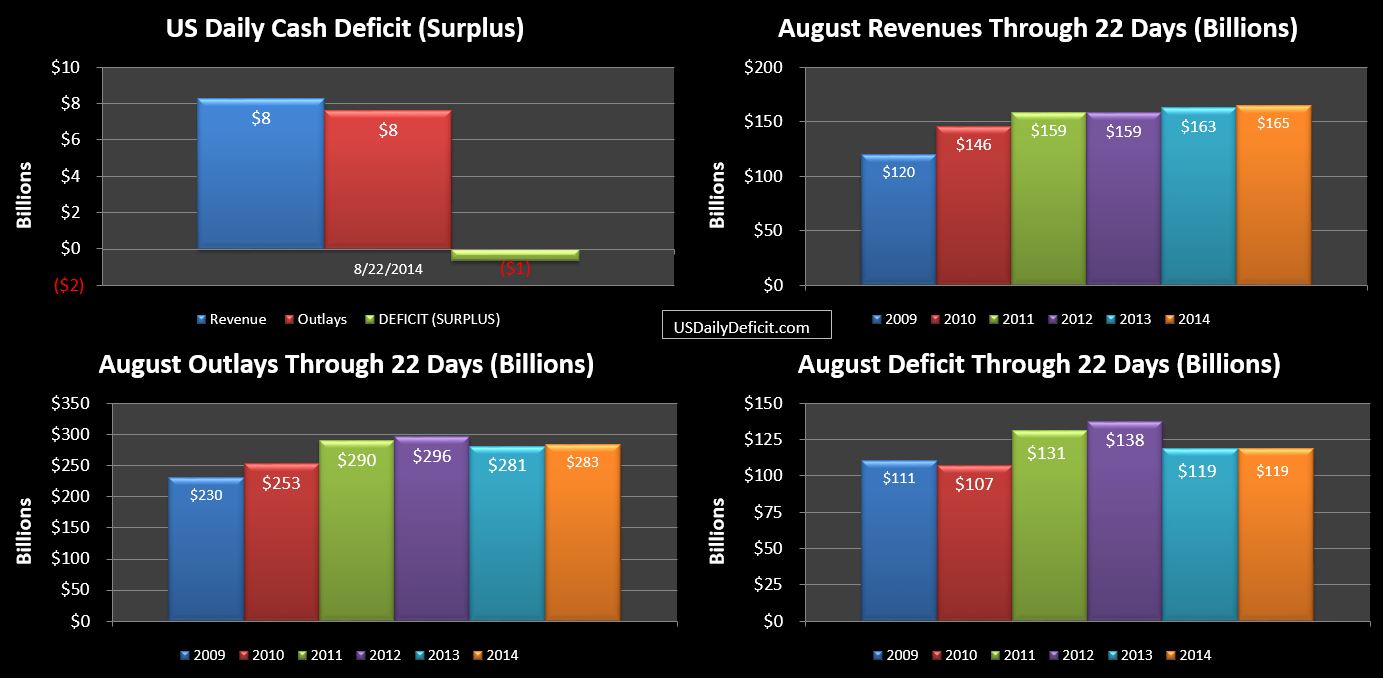

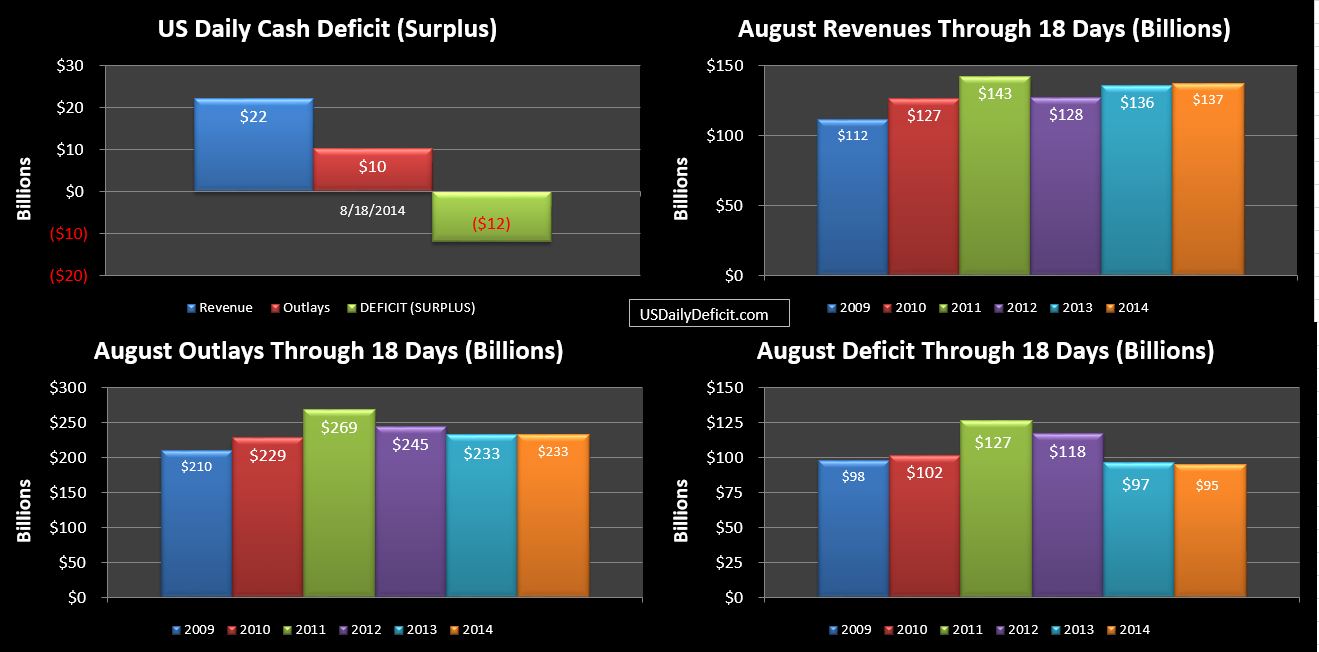

The US Daily Cash Surplus for Friday 8/22/2014 was $0.6B bringing the August 2014 Deficit through 22 days to $119B.

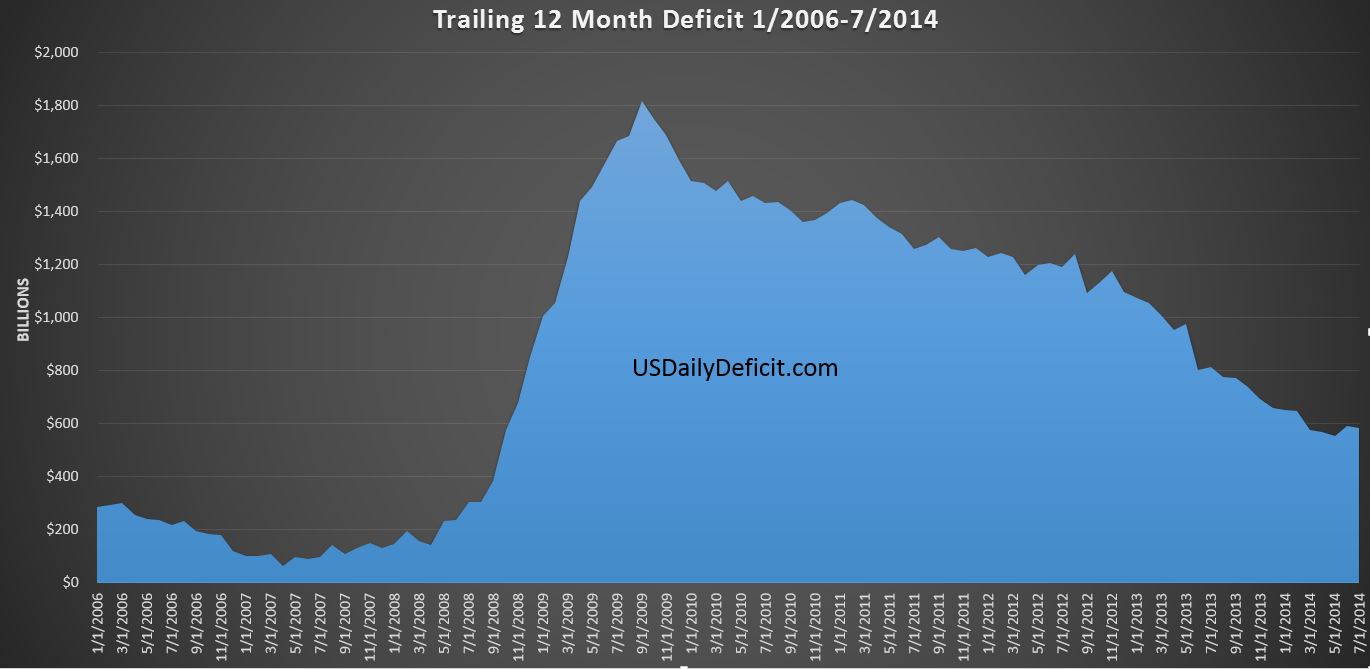

We have five days left in the month..enough time for some movement, but absent any large surprised (like maybe the $17B BoA settlement) we appear to be on track for $160-$170B deficit…just like last year. It’s still too early to say for sure….but it’s starting to look like the deficit has more or less hit a plateau at the $500-$600B level.

Above we have a chart of the TTM deficit from 2006 to present. You see it chugging along at $200B or so (the good ‘ol days) before spiking up to $1.8T….and then improving more or less for 5 years now. …until April-2014. Clearly anything can happen…but it would be a lot better to hit a plateau back around $200B….