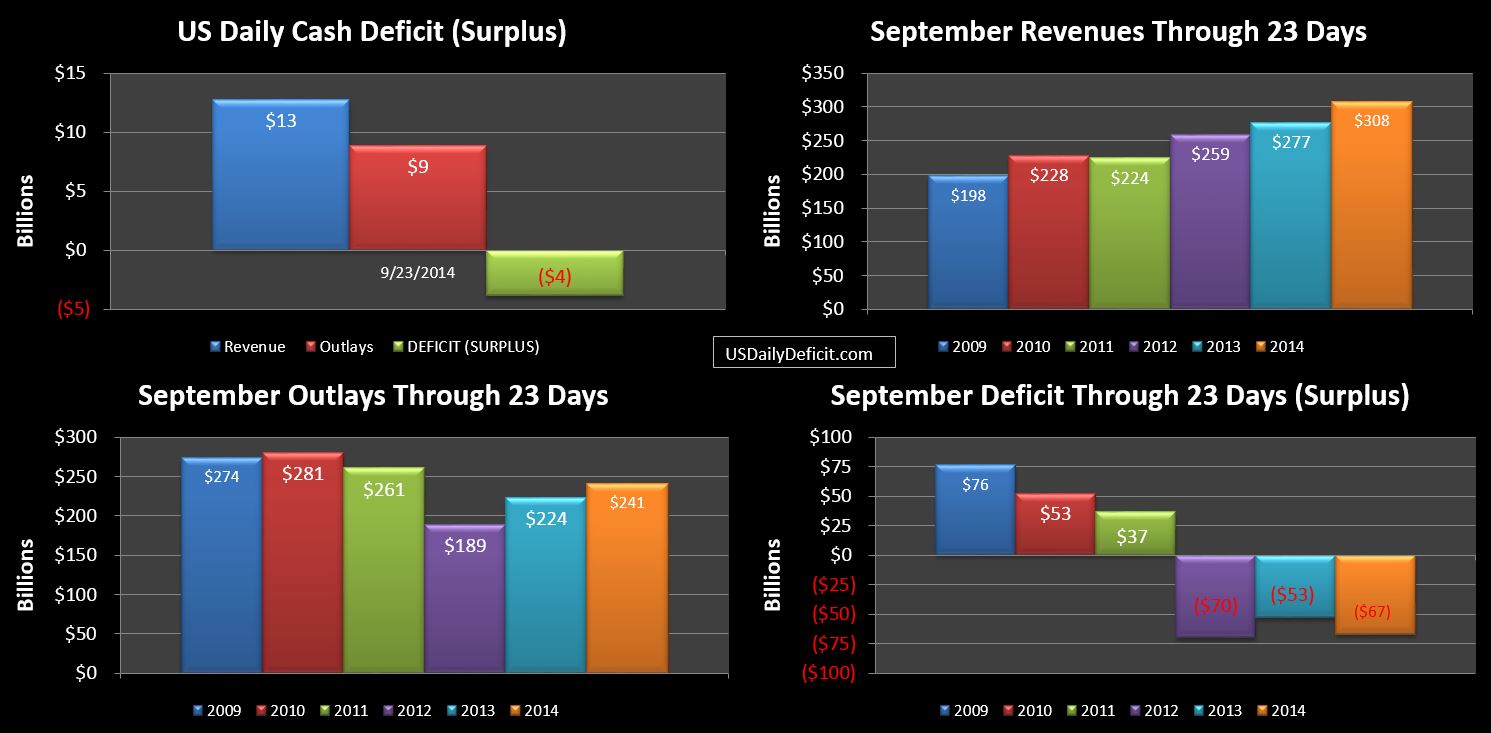

The US Daily Cash Surplus for Tuesday 9/23/2014 was $3.8B following Monday’s $17.1B surplus, pushing the September 2014 Surplus through 23 days to $67B.

Taxes not withheld continue to flow in and have picked up the pace a bit over last year bringing the YOY to +12% good for a $7B pickup so far. Total revenues sit at +11%, a $31B gain and counting. We have 5 business days remaining with the most interesting date being next Tuesday 9/30 where we should get a sizable GSE Dividend from Fannie/Freddie. The size should be interesting….last September, it was almost $15B combined. Last quarter, it was only about $10B. I don’t have a good handle of Fannie and Freddie’s seasonal variation, but another YOY miss would raise some eyebrows on what was starting to look like a reliable $50B+ annual source of cash for Uncle Sam….