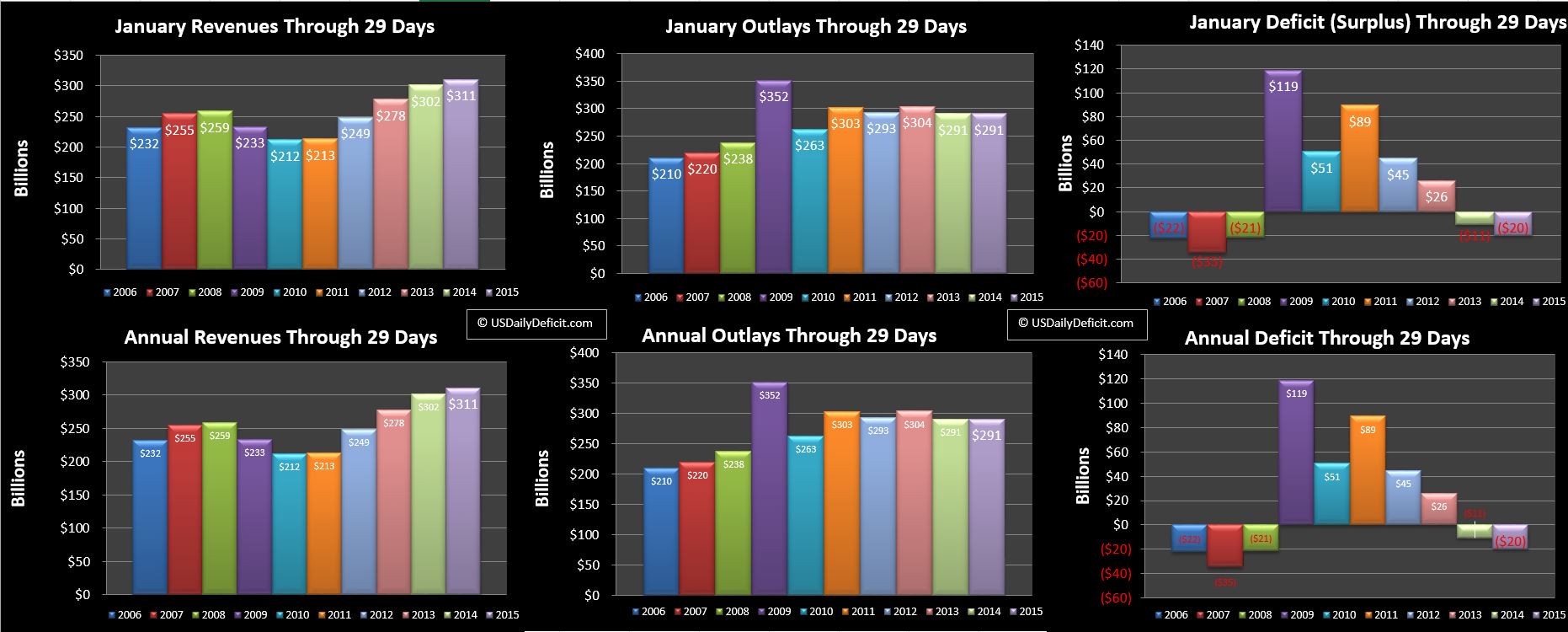

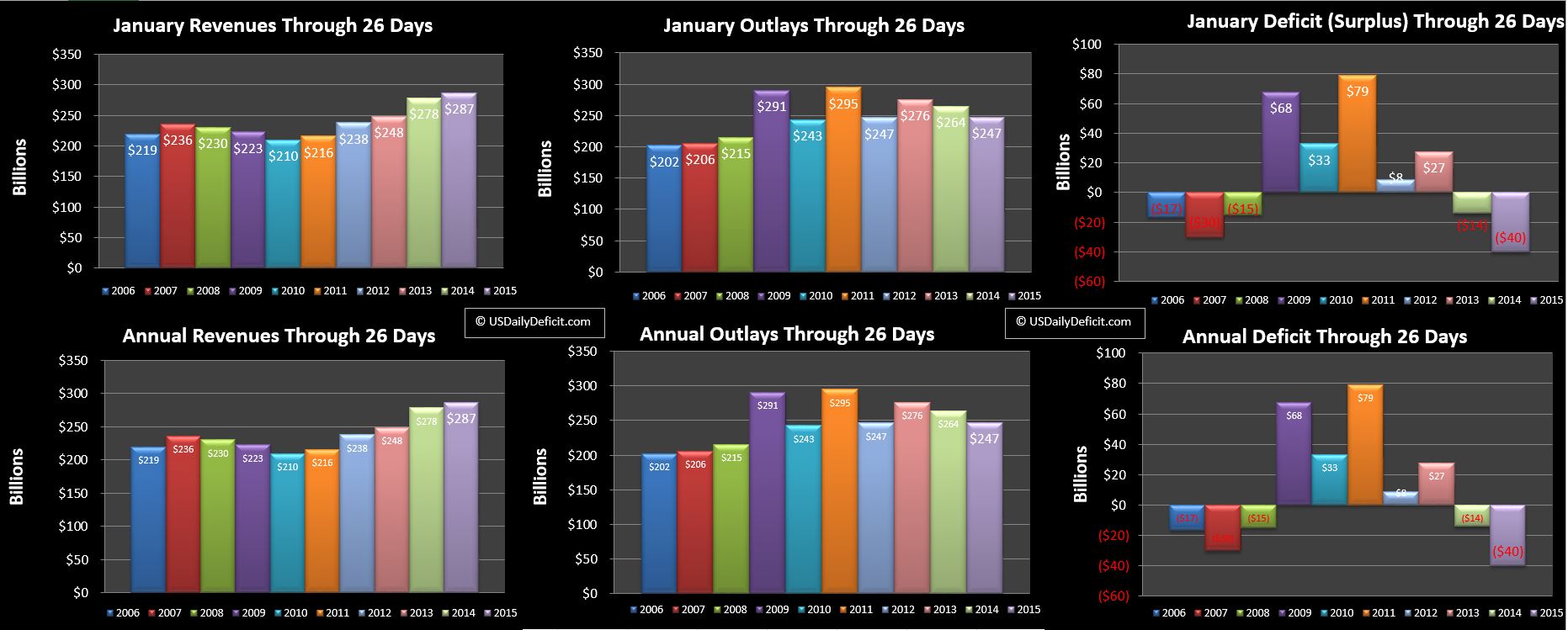

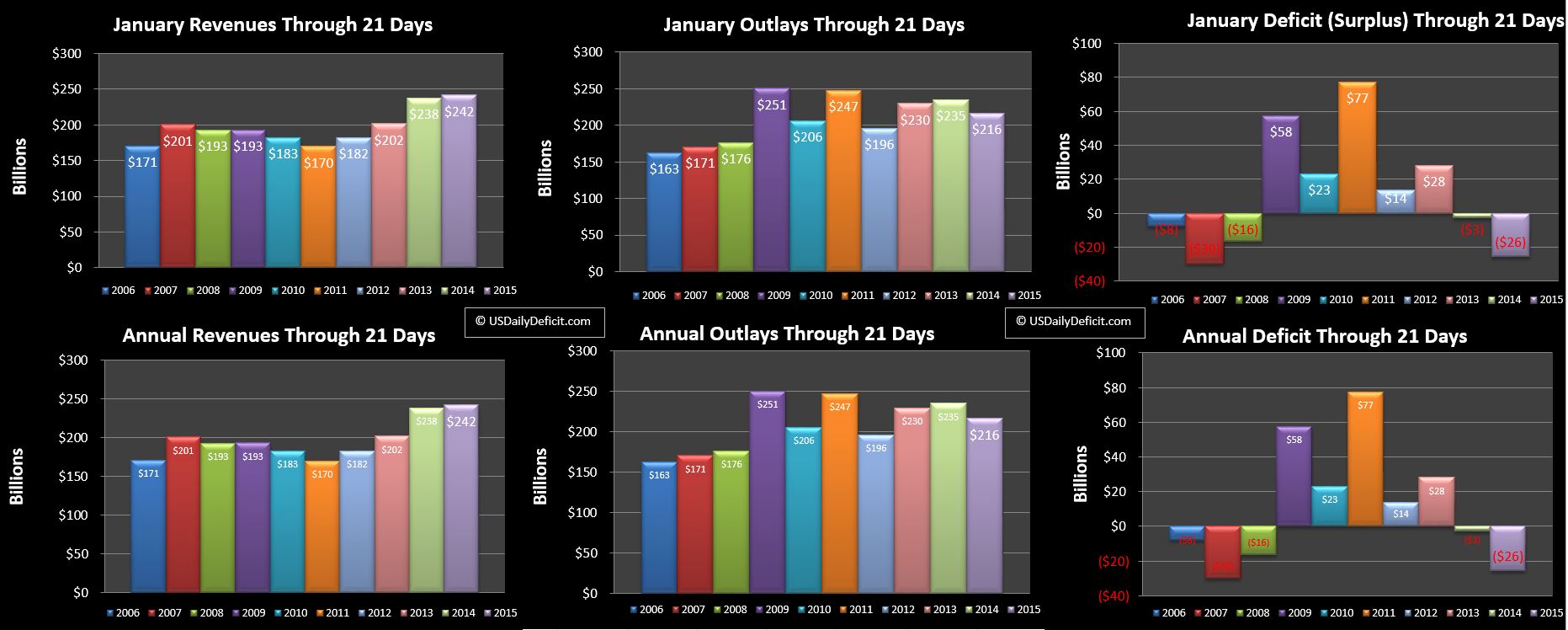

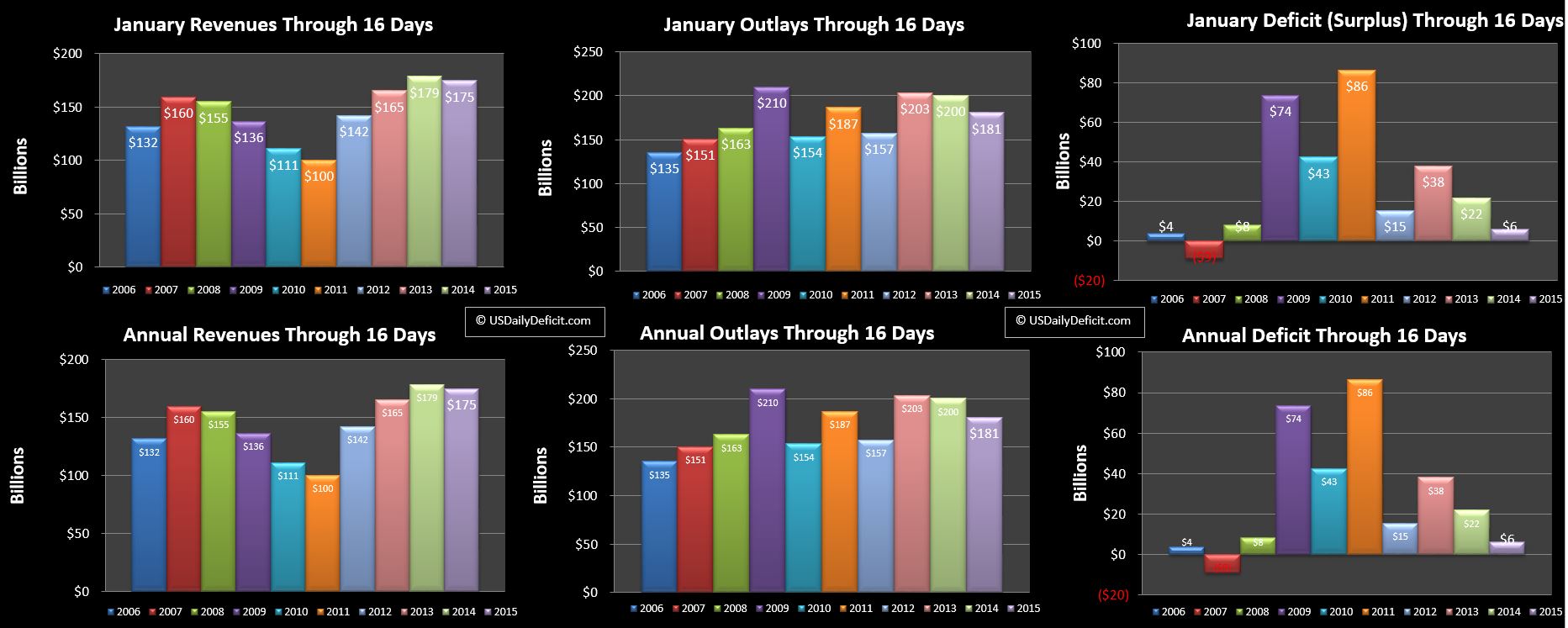

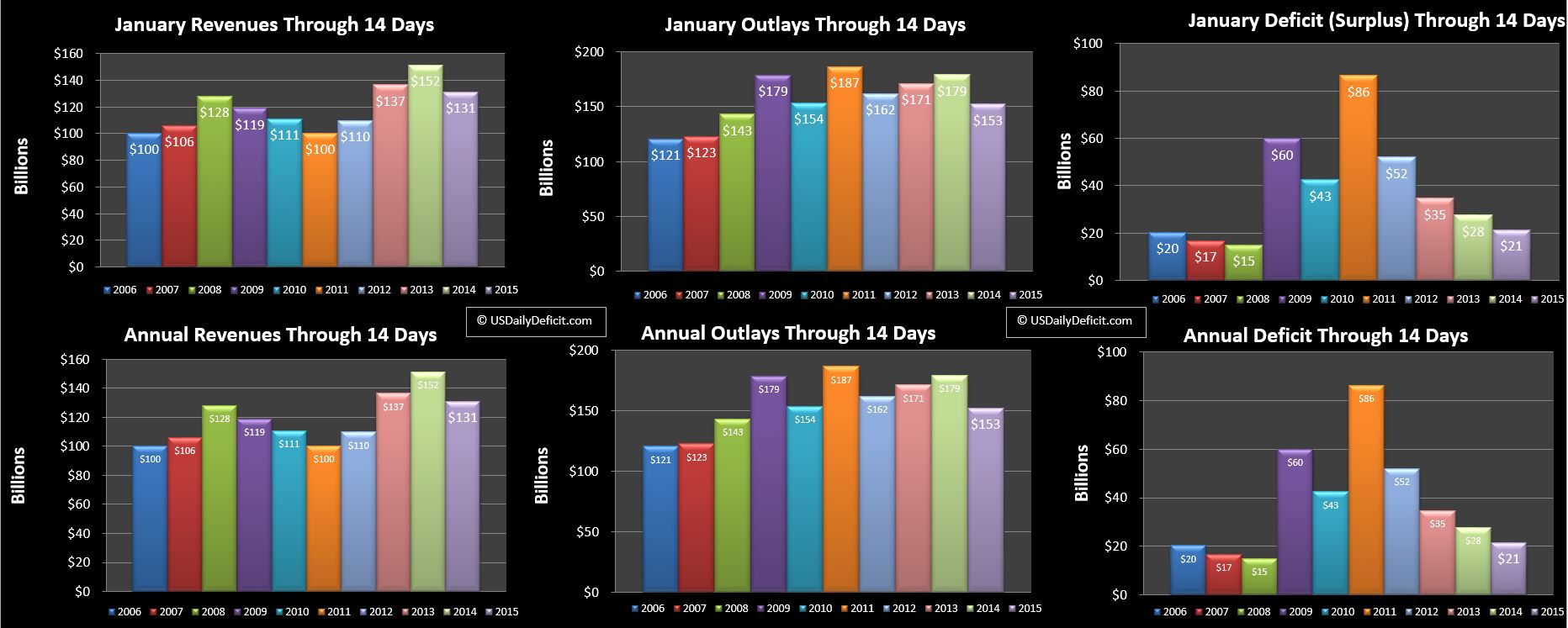

The US Daily Cash Deficit for Thursday 1/28/2014 was $4.8B bringing the January Surplus with one business day remaining to $20B.

Revenues stand at +3%. Outlays are flat overall, but there is some interesting movement. First off, Medicaid continues to grow….likely at over 15% YOY. One month isn’t a trend…..and last January probably hadn’t seen the full effect of expansion hit cash flow by then, but still interesting. Last year Medicaid spending grew $49B good for an 18% clip. Social Security…a program nearly 3 times the size as Medicaid, grew only $37B. January looks to continue that +$4B/month trend….let’s hope it slows down a bit by the second quarter because that eats up about half of revenue growth at +3% growth….

The other interesting item in outlays is unemployment payments. After averaging $2.7B a month in 2007, they zoomed upwards, peaking at $16.1B in 3/2010….and they’ve been falling just about ever since, hitting a 7+ year low in November at $2.172B…..but then jumping to $3.2B in December. I figured it was just timing….December 2013 had a $1B jump as well, though prior years didn’t. In any case, January 2014 got right back on the trend. January 2015 though…with one day left looks to match December 2014 at ~$3.2B. Hmmmm…. It’s just 2 months….and it’s only $1B, but this is one of the key indicators I’ve been observing for several years now….looking for early indications of a recession. It doesn’t mean anything at this point, but stay tuned.