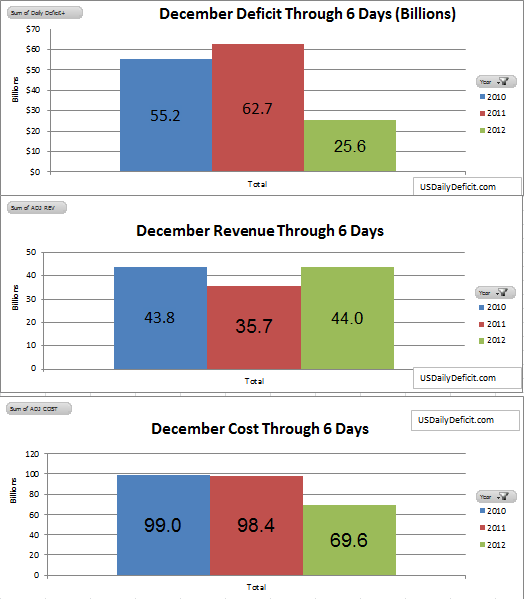

The Daily Deficit for 12/6 was $4.3B bringing the deficit through 6 days to $25.6B…$37B under last year’s deficit at this point. There are still a lot of days left, but just looking at the timing of payments this year and last, I’m going to guess at least some of this “improvement” sticks. Last year’s December deficit was $59B..I’ll throw my dart and say a 30B deficit for 12/2012. I will be paying special attention to Revenue, which was down a bit last month, to see if it could have been a timing issue, or the start of a trend?

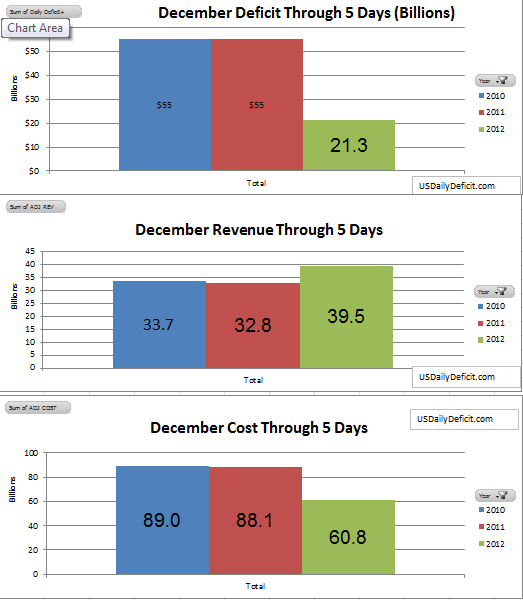

The Daily surplus for 12/5 was $2.3B, bringing the deficit through 5 days down to $21.3B.

Compared to the prior two years, we look to be overperforming, posting a deficit 34B under where we were last December through 5 days. Some of this is due to some early December payments getting pulled into 11/30…which posted a single day deficit of $38.4B. The rest I suspect is just timing. It usually takes a week or two before the monthly and daily timing issues shake out and become noise. Looking ahead, I think we’ll have a much better idea how December is going to shake out after 12/17…which I believe is when we will get a glimpse at quarterly corporate income taxes. This would have been on the 15th, but since this year the 15th is on Saturday… we’ll probably see a spike of payments 12/17. Last year, the 12/15 cash in from corporate taxes was almost $41B…I wonder how 2012 will compare?

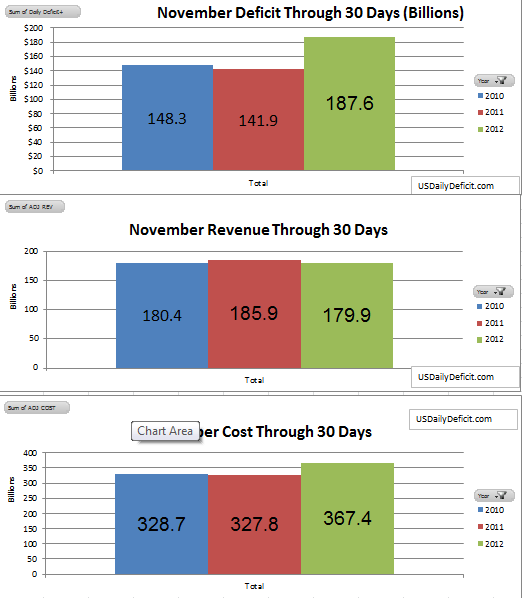

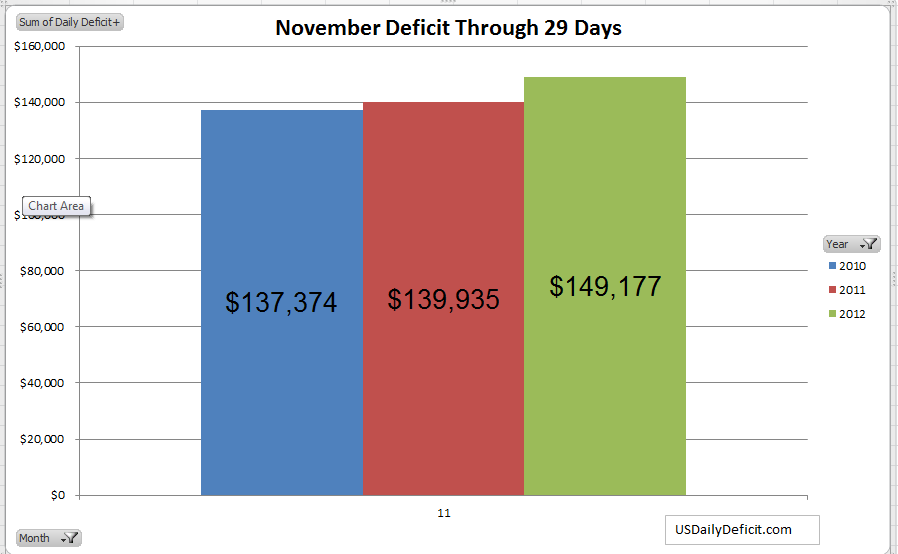

The US Daily Deficit for 11/30/2012 was $38.4B, bringing the November deficit through 29 days to $188B, $46B higher than the November 2011 deficit of $142B on slightly lower revenues and a $40B increase in cost.

The US Daily Deficit for 11/29/2012 was $6.1B, bringing the November deficit through 29 days to $149B. Assuming $25B of SSI payments go out today (11-30) we could easily end the month between $175B and $185B compared to last November’s $142B