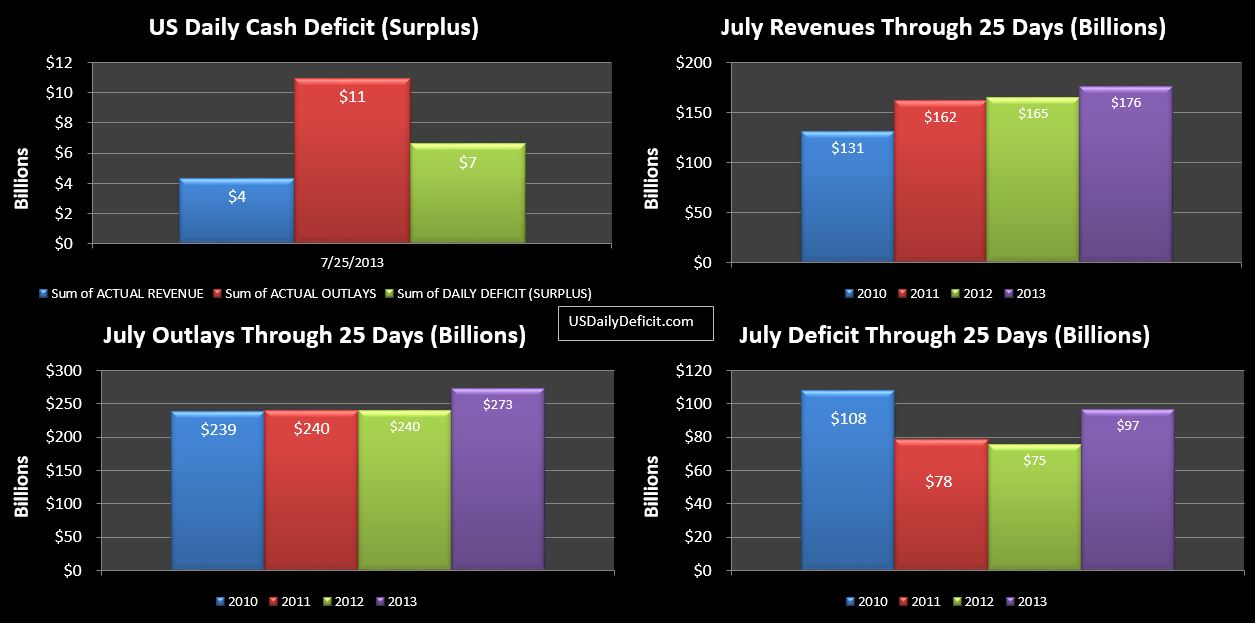

The Daily US Cash Deficit for 7/25/2013 was $6.6B bringing the July 2013 deficit through 25 days to $97B with four business days remaining. I had expected to see some $4B in revenues from the states related to unemployment but it did not come through today. When it does, it should help trim a bit off the deficit. At the beginning of the month…I estimated the ending deficit at $80B. Getting $17B of surplus over the next 4 days is probably going to be a stretch, but stranger things have happened.

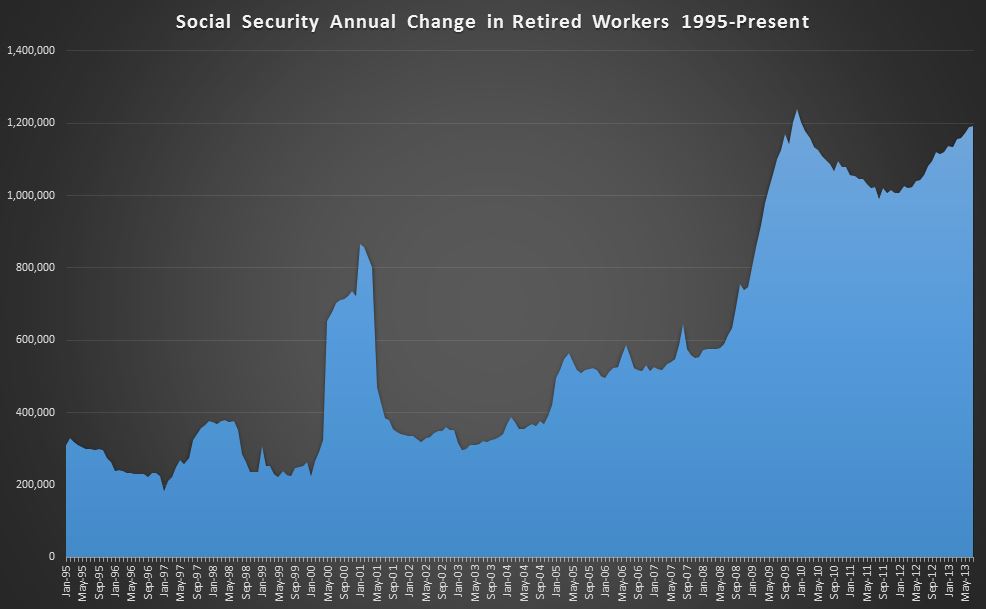

The Official July Social Security update was released this morning so I thought I’d take a look and give an update…here is my June update if you missed it.

The chart is largely unchanged. For July, we added 112k new retired workers to the population…I don’t have the data to confirm this, but generally…you are looking at about 300k new enrollees, being offset by ~200k deaths. Also note that additions seem to be driven seasonally with Jan being the highest month at +171k this year, and December being the lowest…59k in 12/2012. I don’t know if this is driven by retirement patterns or death rate patterns, I suppose it doesn’t really matter.

What we are really looking at then…is to compare July 2013 to July 2012. It turns out they are nearly identical…July 2012 had 110k of additions, so less than a 2% increase. This very may well be an anomaly…the last 4 months have averaged almost 17% YOY gains. With minimal YOY change…our TTM…charted above rises the 2k…from an annual rate of +1.190M to +1.192M

The average benefit rose $0.86 from $1269.38 to 1268.52. This sounds inconsequential, but it suggests to me that new retirees are on average coming in with higher monthly benefits, as much as $300 higher than the beneficiaries that are passing away. This could be driven largely by narrowing of the gender gap…both in labor force participation and pay. So just imagine that in a given month, a 95 year old female beneficiary passes, and a 65 year old female applies for benefits. With 30 years between them….they likely have very different work histories….and very different $ benefits. In this scenario, even though the count stays the same, the average could go up quite a bit. In the long run, we can likely expect the current $300 gender gap ($1425-male $1111-female) to close, and perhaps even reverse itself…and while this may be a good thing for society….it will add additional strain to social security. If the gap were eliminated today….monthly benefits would jump nearly$6B…$70B per year (or $700B over ten….which is how congress likes to digest it’s data)…all of course added directly to the deficit.

So bottom line, we are currently adding a net of nearly 1.2M people to the social security retirement rolls per year, a trend that should start ramping up over the next five years as we get into the meat of the boomers. This may be a slow motion trainwreck, but the end result is going to be just as ugly.

We have all seen hundreds of stories over the last 5 years or so….college students graduating with tens, or hundreds of thousands in debt, only to be unable to find a job….ultimately settling for jobs in retail, coffee shops, and restuarants.

So…what is going on? Let’s start with the myth we’ve been telling high school kids and their parents for 3 or 4 decades now. All you have to do is go to college (and graduate) and the world is your oyster. You will walk off of campus, get a good job, and go on to make millions more than you would have if you had skipped college and learned how to weld, fix cars, or be a plumber. It’s all a huge lie….taking advantage of the confusion between correlation and causation.

You see…it is completely factual that if you compare the income of college graduates to high school drop outs, college graduates will have a commanding lead. However, that income gap has absolutely nothing to do with the fact that one group went to college. The truth is…and as a society, we are far from being able to accept this, but the truth is…the college degree or not, people who make more money…do so because they are simply more talented. They were talented before they ever stepped foot on a college campus…and whether or not they ever went….it is their natural talent that will ultimately be responsible for their success….not the fact that they got the “education”…or the supposed quality of that education.

So…if this is true…that 18 year old kid with let’s just say talent in whatever field happens to be in the top 10% or so of the population(in that field)…is going to go on and be successful regardless of what “education” he gets along the way. On the other side….the kid who is not particularly talented….is unlikely to attain classically defined (aka monetary) success….regardless of what kind of educational opportunities he is given. This is perhaps the part of the myth we want to believe the most…that we can take any kid…regardless of his natural intelligence and aptitude….educate him (throw public money at him) and end up with an above average result.

So…the real problem is….parents have bought into this myth, and instead of only sending say the top 25% or so of the most academically gifted…we end up sending a full 60%. So…when these lower tier students do manage to graduate…either with a degree in history, liberal arts, or basket weaving from the University of Pheonix…it really shouldn’t surprise anyone that they end up working at McDonalds….for a 21 year old manager who wasn’t foolish enough to waste 4+ years of his life and tens of thousands of dollars on college.

So…confession time… I have a bachelors degree in accounting and an MBA, and while I have no regrets, the truth is…I learned very few real life skills in the pursuit of either degree that have been instrumental to my professional success. I learned more in my first 3 months on the job as a 21 year old accountant than I learned in all the classes combined in my undergraduate studies. My MBA…well, I learned more reading “The Economist” and The Oil And Gas Journal” in the library between classes than I did in class. You see….college is not about learning at all…it’s about credentialing.

So…say I am an employer…looking for, let’s just say an intro level accountant. Obviously…I’m going to seek out and hire somebody with a bachelors degree in accounting. However…not because I believe that the new graduate has learned much of anything…it’s for something quite different. See..I already know that any fresh accounting grad…whether they are from State U or an Ivy League…are going to be fairly clueless. But…the fact that they have a college degree does tell me something about them. It tells me first and foremost…that they probably have an above average IQ. Second, it tells me that this young individual has more than just raw intelligence…they have the ability to set, and achieve short medium and long goals. It also tells me there is a good chance they have an acceptable level of interpersonal skills to work well in a corporate environment. Now…I am fully aware that many people without degrees also have these exact same characteristics, but statistically, my odds of finding a good fit for my company are much higher if I just pick a random person out of the population of accounting graduates than picking a random person from the general population. It just makes sense for me to take advantage of the admittedly flawed credentialing process in place.

You see…It isn’t important to me what you learned in your advanced accounting class senior year….truth be told….the odds of me personally passing that exam on any given day are slim to none. What is important to me…is that you were able to demonstrate you have the ability to master a complicated subject…even if you proceeded to forget it all after your finals were complete.

So let’s take this full circle….There isn’t a doubt in my mind that the large oil and gas company that hired me out of college…could have hired me right out of high school, and taught me, within 4-5 months’s or so…how to do my first job. With good mentors, and maybe some occasional book lernin…I see no reason that I could not have proceeded on the same career path that led me to where I am today…just with a four year head start.

Obviously…they didn’t do that, and it’s not hard to understand why. Even though I may have been perfectly capable of performing at that point….they had no good way to differentiate potential high performers from the rest. SAT scores??? maybe…but that’s more of a measure of raw intelligence…a good thing, but in itself, not nescesarily indicative of the “total package”. Class rank…..perhaps a broader metric….showing not only raw intelligence, but also motivation, hard work and persistence. But…how a kid performs with mommy over their shoulder…constantly nagging, and who knows…maybe writing those essays herself….it’s still a crapshoot. Finally…perhaps most importantly, the truth is…a substantial majority of all 18 year olds…including myself at that age… regardless of their natural talents…are just straight up dumbasses, and few of them are mature enough at that age to seriously start pursuing a career.

Colleges provide the answer for both parents and corporations. For a fee….they will babysit your kids for 4-6 years. After that…for the half of them that manage to pass the not so rigorous criteria, perhaps 30% of the total population will emerge with a degree… From there, businesses can just eliminate all the liberal arts and other useless degrees, to get down to the true top 15% or so of the population they really want to hire. Is it perfect?….of course not….no system ever will be.

There will always be those individuals (probably millions) with the “right stuff” who never had the opportunity to go to college, and were therefore eliminated from potential career tracks they may have otherwise found great success. However…before we get too sad about these poor souls…don’t. I personally know a lot of very intelligent people without college degrees, and the vast majority of them have done quite well…further evidence in my mind that college, while not useless (the credential itself clearly has some value) is not quite the indicator of success.

This is already quite long…so let me just wrap it up with a summary. First, talented individuals at 18 are likely to go on to be successful…regardless of what education they do or do not get. Likewise…individuals who are not so fortunate…having an inherently lower natural talent….will likely go on to achieve lower levels of success….regardless of the whether they get an Ivy League education…or none at all. Next, college serves not as a system for learning, but rather as a system for credentialing. By age 22-23 or so… ~15% or so of the population has a degree in a useful field (engineering, math, science, medicine…and of course accounting 🙂 ) This population isn’t perfect…it likely includes a lot of people who aren’t bona fide top 15%…and conversely excludes a lot who are. But…for all it’s flaws….it is a far better tool for corporate America than random selection, and better yet…it doesn’t cost them a penny. It’s like Angie’s list for young employees…sure, there are no guarantees, but it’s better than randomly picking a contractor out of the phone book.

Colleges, over the last 30-40 years, in my opinion have taken advantage of parents and students by perpetuating the myth…that it is college itself that is responsible for the relative success of the population of college graduates, rather than their inherent natural talents. The truth is, no college could ever take a lazy kid with an 85IQ, and turn him into a successful engineer, physicist, or accountant….yet, this is what they promise parents. Just send us your kid, and say $20k per year, and your lazy stupid kid will turn out just fine. It’s all a complete lie, and the statistics prove this out. In four years….that lazy stupid kid is going to be living at home with his parents, working at McDonalds, probably without a degree at all, but almost certainly with $80k of student loan debt. The college, of course has the $80k, and absolutely no accountability.

Bottom line…the College Education system in this country is completely broken, and there is plently of blame to go around, starting with the colleges themselves, our government, corporations, and last but not least, parents and students who bought the myth hook line and sinker without ever asking any critical questions. Fixing it all..well, that’s going to take a whole new essay…maybe next time 🙂

I don’t think it shocked anyone that Detroit filed for bankruptcy yesterday, but it set off a mad scramble by the creditors….most interestingly perhaps(but not surprising)…by the city’s pension funds.

First…lets take a look at the numbers. I found a copy of the city’s last full fiscal report on their website….covering the period ending 06/30/2012. I’m guessing the 6/30/2013 may be delayed by just a bit.

Ballpark….per page 21, total revenues were $2.3B, vs. total expenses of $2.6B, for a total deficit of $300M. That’s a 13% annual deficit…which honestly doesn’t sound that huge. The US deficit…over the last 12 months ending 6/30/2013 was $800B….$3T of revenues and $3.8T of outlays….good for an annual deficit of 27%….more than double of Detroit’s.

Debt, according to the headlines at the time of the bankruptcy filing was $18B…about 8X 2012’s revenues. The US is in a little bit better shape….with $16.7T of debt on $3T of revenues, good for a 5.5X ratio. So, we still have a ways to go before we get to Detroit’s level, but it is definitely on the horizon.

Now…I don’t have the 2013 numbers, but this clearly illustrates how a relatively small annual deficit can topple a huge mountain of debt. The bottom line is…as long as people are willing to lend me money….I can keep a scheme like this going indefinitely. I can borrow to pay my bills, I can borrow to pay pensions, I can borrow to build a football stadium, and I can borrow even more to pay the interest on all the debt I already have. But…once the lenders start to think maybe you can’t pay it all back….it is almost instant death. All of a sudden…you can’t make payroll, you can’t provide police protection, and when your debt comes due….either the rates to refi are suddenly astronomical, or you just can’t refinance at all. So while maybe you could afford to pay $30M or so of interest a year on that $1B bond coming due….you certainly can’t afford to refinance at 10%, and the odds of you coming up with $1B to…god forbid…actually pay down debt are zero.

So who gets paid? There is $18B of debt, yet the city is running a deficit of $300M per year (again…year old data). And by all accounts…they are not even able to provide basic services to the city…like even fixing broken street lamps. The bondholders…well, they were foolish enough to keep lending, even though it has been obvious for a while what was going to happen. I think they should get nothing.

Now the pensioners….this is a bit more complicated. There is no money to pay…it’s a tragic situation no doubt. Some will argue that the unions negotiated outrageous pensions with their cronies in government…that’s probably true to some degree. I don’t know the answer, but if nothing else, this illustrates the enourmous unrecognized risk of defined benefit plans, whether it is from the city of Detroit, a fortune 500 company, or…the granddaddy of them all…Social Security. In all of these scenarios…you pay in or defer income for decades…perhaps half a century…for the promise that someday….decades later a) the organization will still exist period and b) the organization will still have the ability and willingness to make good on that promise.

This in itself is something I find so hard to understand about defined benefit plans. How many people in this world would you personally trust to take care of hundreds of thousands, or millions of dollars of future benefits for you? Maybe your parents, siblings, or children….maybe… Uncle Sam? No!! Congress..with an approval rating of what…15%? No!! The mayor of Detroit? No!! Any CEO of any company? Hell No!! Wake up America. The entire premise of all defined benefit programs is blatant fraud. Rather than pay you now…in cash….companies and governments offer to pay you later…in another quarter, when it will be another CEO’s problem…another Congress’s problem…another Mayor’s problem…another President’s problem. Shall I say it again…wake the hell up!! You will not be paid. You were conned…you were scammed….you bought the lies hook line and sinker, and ultimately…you must own the consequences of your poor decisions. Yes you are a victim here…yes it sucks….unfortunately…nothing can be done about it. The money is gone….spent decades ago by politicians you elected.

Ok…stepping off that soap box….We are all Detroiters (is that even the right word??) now. What happened to Detroit is what will ultimately happen to the United States Of America, and it may be sooner than any of us realize. Already….under the guise of helping a struggling economy, the Federal Reserve has resorted to manipulating interest rates to near zero and has resorted to essentially printing money and lending to itself using QE…to the tune of nearly $2T. These are already desperate measures….how long can Bernanke and Lew keep this charade going? My guess is less than 10 years….perhaps much less. As with Detroit…once we lose the ability to issue new debt and roll what you currently have…It will be nearly instant death. It would seem we have nearly run out of people to loan us money, so we have resorted to printing money and loaning it to ourselves with the Fed as a middleman. Were this game to end, and interest rates return to a normal rate…say 5% or so….I think we’d be done within a year or two.

But…as many have noted….it is nearly impossible for a sovereign nation with it’s own currency and a printing press to technically default. They are probably correct as this seems like the path of least resistance. So…in 2043 when you take that 30 year bond in for redemption….you may well get your $1000….but you’ll be lucky if it buys you a bag of potato chips. Same for today’s 38 year olds….hoping to retire in 30 years. You very well may get a social security payment deposited into your account each month, but it won’t even be enough to buy a bag of dog food…for your pet of course.